Asc 842 Calculation Template

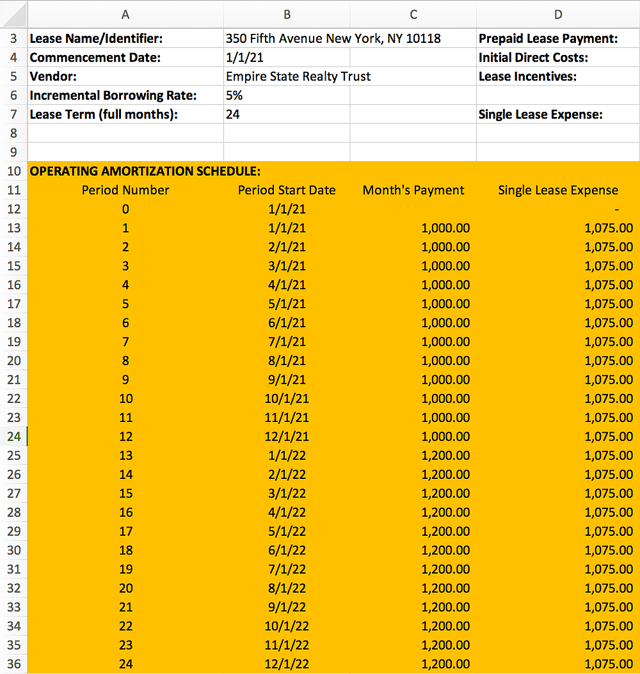

Asc 842 Calculation Template - Web where to start asc 842 is the new leasing standard, superseding asc 840. Generate clear dynamic statements and get your reports, the way you like them. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. Ad our software is backed by decades of lease accounting experience and trusted by experts. Web determine if your leases are classified as finance or operating leases under asc 842. Determine the lease term under asc 840 step 2: Web as noted above, the first step in calculating the lease liability, is to determine the term of the lease. Bdo's professional practice publication (blueprint) guides professionals through the application of fasb’s accounting standards codification topic 842, leases (“asc 842” or “leases guidance”). Web download the blueprint series. Schedule a free demo to learn more. The deadline for private companies to implement accounting standards. Turn lease accounting compliance into lease dominance. Determine the total lease payments under gaap step 3:. Bdo's professional practice publication (blueprint) guides professionals through the application of fasb’s accounting standards codification topic 842, leases (“asc 842” or “leases guidance”). Web with everything we’ve provided, we hope you have a better understanding. Time is of the essence. Ensure you can address them. Generate clear dynamic statements and get your reports, the way you like them. Web download the blueprint series. Asc 842 brought changes to lease accounting standards. Web determine if your leases are classified as finance or operating leases under asc 842. Asc 842 brought changes to lease accounting standards. Determine the total lease payments under gaap step 3:. January 1, 2021 lease end date: Schedule a free demo to learn more. Web the rate component of the present value calculation is also called the discount rate, and your company has a few options to choose from as it applies asc 842. Ensure you can address them. For a comprehensive discussion of the. The deadline for private companies to implement accounting standards. Time is of the essence. Generate clear dynamic statements and get your reports, the way you like them. Ad download the free asc 842 lease classification template to ensure you are in the know! Web learn more about lease accounting. Web details on the example lease agreement step 1: For a comprehensive discussion of the. Web lease inputs the lease agreement we’re going to calculate is based on the following details: Embedded lease test use this free tool to determine if your contract contains a lease. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with. For. Embedded lease test use this free tool to determine if your contract contains a lease. Web the rate component of the present value calculation is also called the discount rate, and your company has a few options to choose from as it applies asc 842. Asc 842 effective dates effective date for public companies effective date for private companies. Time. Web the fasb’s new standard on leases, asc 842, is already effective for public companies and is replacing today’s leases guidance for other companies in 2021. Asc 842 brought changes to lease accounting standards. The deadline for private companies to implement accounting standards. The new standard is effective from 1 january 2019 for public companies and 15 december 2021. The. January 1, 2021 lease end date: Asc 842 brought changes to lease accounting standards. The term is the total amount of the time between the. Ensure you can address them. Asc 842 effective dates effective date for public companies effective date for private companies. The new standard is effective from 1 january 2019 for public companies and 15 december 2021. January 1, 2021 lease end date: Web lease inputs the lease agreement we’re going to calculate is based on the following details: Web where to start asc 842 is the new leasing standard, superseding asc 840. Turn lease accounting compliance into lease dominance. Ensure you can address them. Summarizing key aspects of asc 842, the blueprint helps all companies, public or private, understand and comply. Asc 842 effective dates effective date for public companies effective date for private companies. Determine the total lease payments under gaap step 3:. Web where to start asc 842 is the new leasing standard, superseding asc 840. Web the rate component of the present value calculation is also called the discount rate, and your company has a few options to choose from as it applies asc 842. Web lease inputs the lease agreement we’re going to calculate is based on the following details: Bdo's professional practice publication (blueprint) guides professionals through the application of fasb’s accounting standards codification topic 842, leases (“asc 842” or “leases guidance”). Asc 842 brought changes to lease accounting standards. The deadline for private companies to implement accounting standards. Ad download the free asc 842 lease classification template to ensure you are in the know! Web the fasb’s new standard on leases, asc 842, is already effective for public companies and is replacing today’s leases guidance for other companies in 2021. Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. The new standard is effective from 1 january 2019 for public companies and 15 december 2021. Web details on the example lease agreement step 1: Ad our software is backed by decades of lease accounting experience and trusted by experts. Web download the blueprint series. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Turn lease accounting compliance into lease dominance. Web as noted above, the first step in calculating the lease liability, is to determine the term of the lease.ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Sensational Asc 842 Excel Template Dashboard Download Free

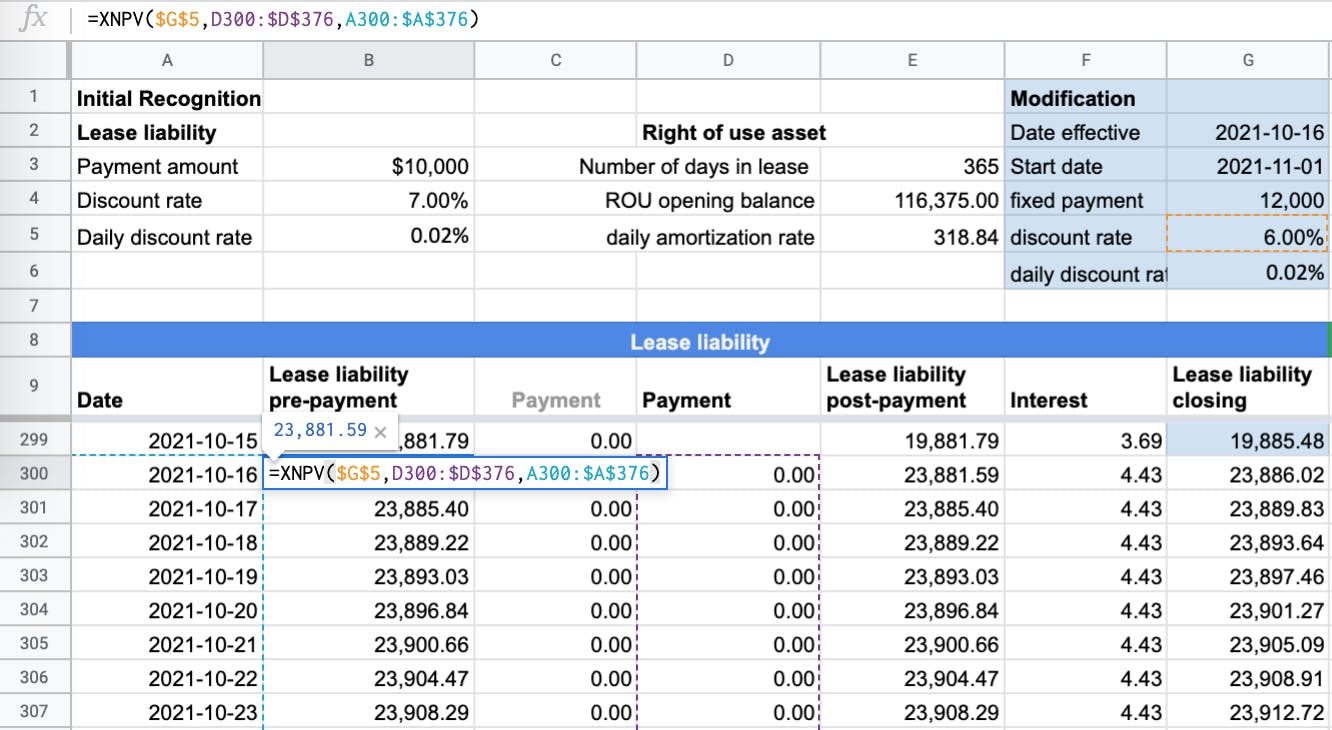

How to Calculate a Finance Lease under ASC 842

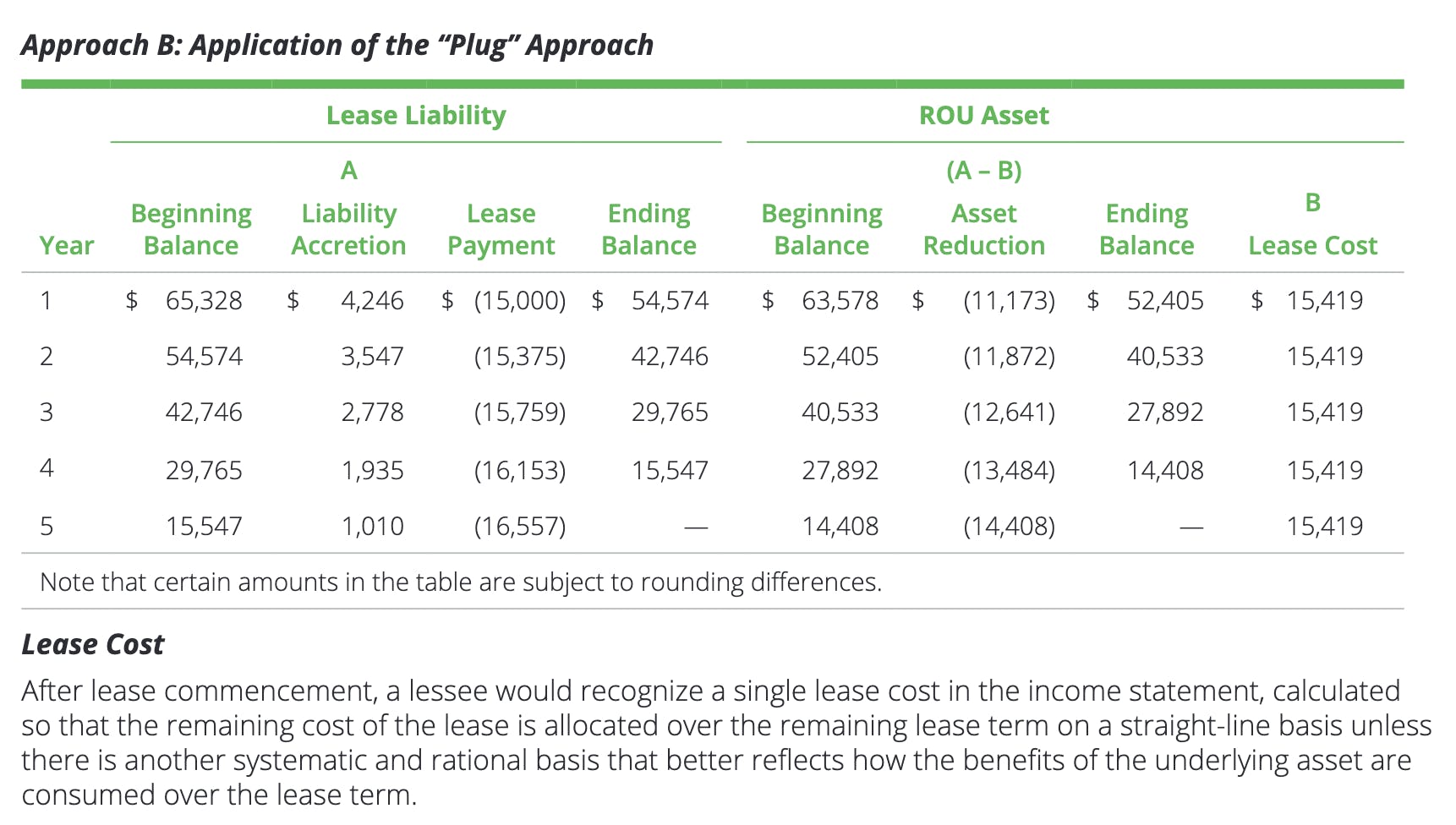

ASC 842 Guide

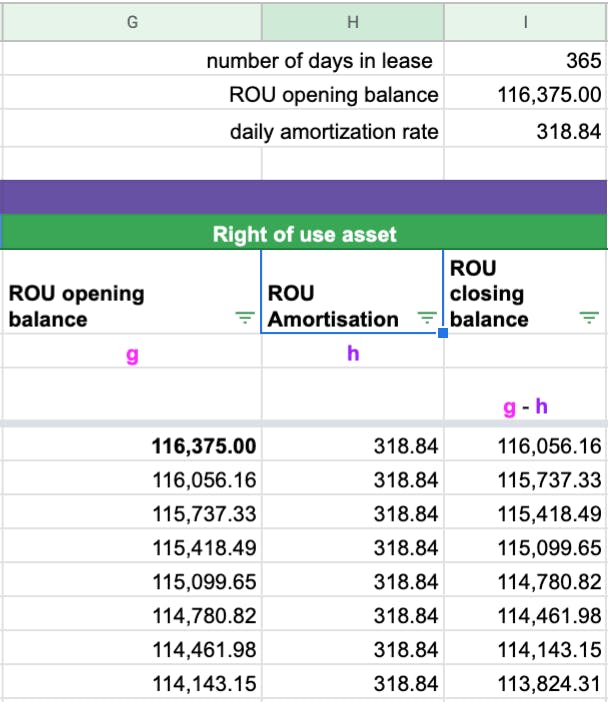

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

ASC 842 Excel Template Download

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

How to Reconcile Non GAAP Lease Accounting with ASC 842 for an

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

How to Calculate a Finance Lease under ASC 842

Related Post: