Asc 842 Lease Excel Template Free

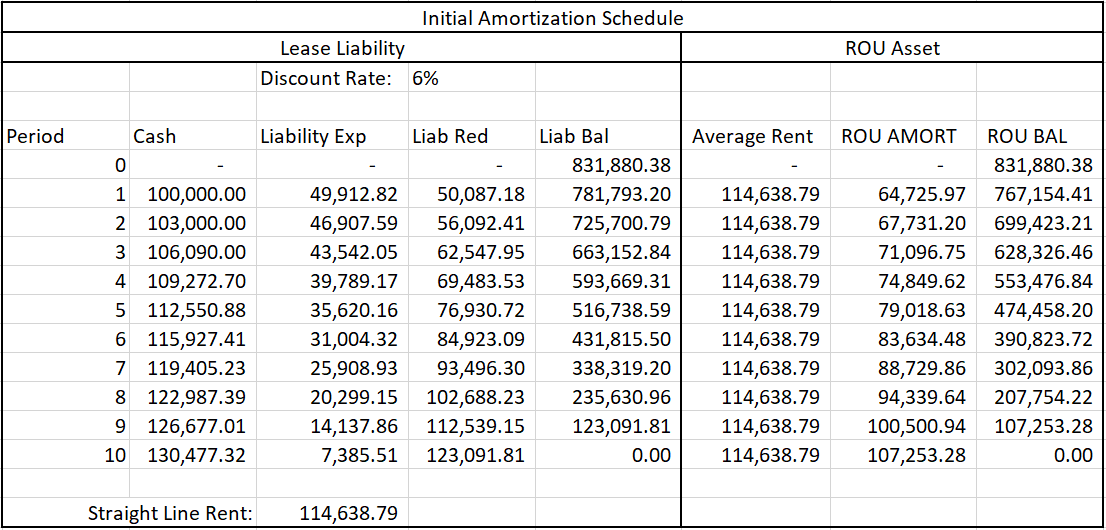

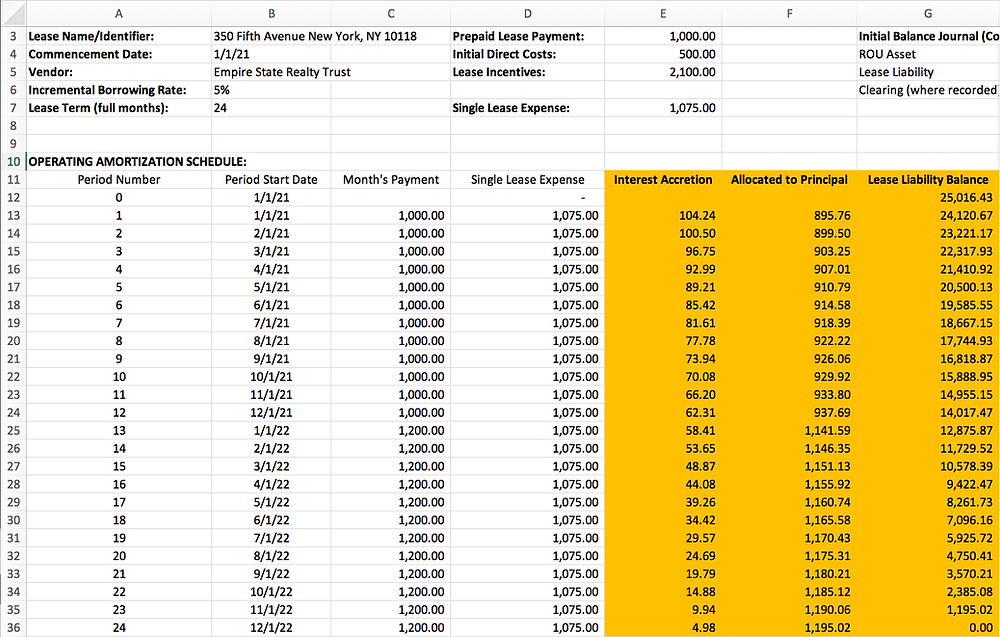

Asc 842 Lease Excel Template Free - Web asc 842 led to changes in the accounting of lease contracts and is a challenge for many companies. Calculate your monthly lease liabilities and rou assets in compliance with asc 842. And as always, your financial friends at embark are here to help guide the way. Web since the goal of asc 842 is transparency, upon adoption, leases now need to be included on the balance sheet and reoccurring journal entries will be required. What is a lease under asc 842? Operating lease accounting under asc 842 and. Using spreadsheets to comply with fasb's asc 842 and ifrs 16 is complex and difficult to manage, but if you only have a few leases, it is possible. Web download this asc 842 lease accounting spreadsheet template as we walk you through how you cannot easily make certain operating lease date that meets the application available asc 842, whether financing or operating. Web download the free asc 842 lease classification template from embark today! With this lease amortization schedule you will be able to : Your company is also required to use this rate if it’s available. Web under asc 842, an operating lease you now recognize: Web use this free tool to determine if your leases are classified as finance or operating leases under asc 842. The asc 842 lease classification template for lessees is now available for download. Web how to calculate your. Under asc 842, operating leases and financial leases have different amortization calculations. Web here's that excel template again: Asc 840 accounting would be better described as the deficit or surplus of your total cash payments in comparison to your lease expense over a. Trusted by thousands of public and. Web since the goal of asc 842 is transparency, upon adoption,. The present value of all known future lease payments. Web how to calculate your lease amortization. Which is amortized over the useful life of the asset. If you're unsure, refer to our initial recognition guidance. Asc 840 accounting would be better described as the deficit or surplus of your total cash payments in comparison to your lease expense over a. Web download the free asc 842 lease classification template from embark today! What is a lease under asc 842? If you're unsure, refer to our initial recognition guidance. Web this excel file shows the basic steps for calculating and posting lessee contracts according to the asc 842 standard. Web this solution will suffice for entities with around a dozen or. Web larson lease accounting template asc 842. With these inputs, we'll calculate the monthly lease liability amortization schedule. And as always, your financial friends at embark are here to help guide the way. What does our lease classification template cover? With this lease amortization schedule you will be able to : For accountants, accounting managers, controllers, auditors, and finance executives. With these inputs, we'll calculate the monthly lease liability amortization schedule. Click the link to download a template for asc 842. Interest rate implicit in the lease under ifrs 16. Web use this free tool to determine if your leases are classified as finance or operating leases under asc 842. Under asc 842, operating leases and financial leases have different amortization calculations. Then the spreadsheet proposes a lease type. Or, try it for free. Period, cash, expense, liability reduction, and liability balance, as shown below: Asc 842 transition blueprint & workbook; Download the free asc 842 amortization schedule template for operating and financing leases under asc 842. Use this free tool to create an inventory of your leases. Interest rate implicit in the lease under ifrs 16. The asc 842 lease classification template for lessees is now available for download. Web asc 842 led to changes in the accounting of lease. Under asc 842, operating leases and financial leases have different amortization calculations. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous about them now, and proceed with confidence. Web download this asc 842 lease accounting spreadsheet template as we walk you through how you cannot easily make. Web under asc 842, an operating lease you now recognize: Web download the free asc 842 lease classification template from embark today! The implicit rate at the date of lease inception is specified as the preferred discount rate in the standard. With these inputs, we'll calculate the monthly lease liability amortization schedule. Each row will include the date of the. Your excel worksheet needs to include a way to calculate these journal entries on a monthly, or at minimum, quarterly basis. Using spreadsheets to comply with fasb's asc 842 and ifrs 16 is complex and difficult to manage, but if you only have a few leases, it is possible. Web here's that excel template again: Under asc 842, operating leases and financial leases have different amortization calculations. For accountants, accounting managers, controllers, auditors, and finance executives. Web discount rate implicit in the lease under asc 842. If you're unsure, refer to our initial recognition guidance. The lessee's right to use the leased asset. Interest rate implicit in the lease under ifrs 16. Web this lease accounting software for excel captures all the relevant data you will need to comply with the new asc 842 lease accounting standards. In my opinion, asc 840 was a little misleading when looking at assets and obligations on a balance sheet. Fill out the form below to get our template. Download the free asc 842 amortization schedule template for operating and financing leases under asc 842. Each row will include the date of the payment and the payment amount for the life of the lease. Period, cash, expense, liability reduction, and liability balance, as shown below: Web under asc 842, an operating lease you now recognize: Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Click the link to download a template for asc 842. Calculate your monthly lease liabilities and rou assets in compliance with asc 842. Web use this free tool to determine if your leases are classified as finance or operating leases under asc 842.5 Steps To ASC 842 Lease Compliance EZLease

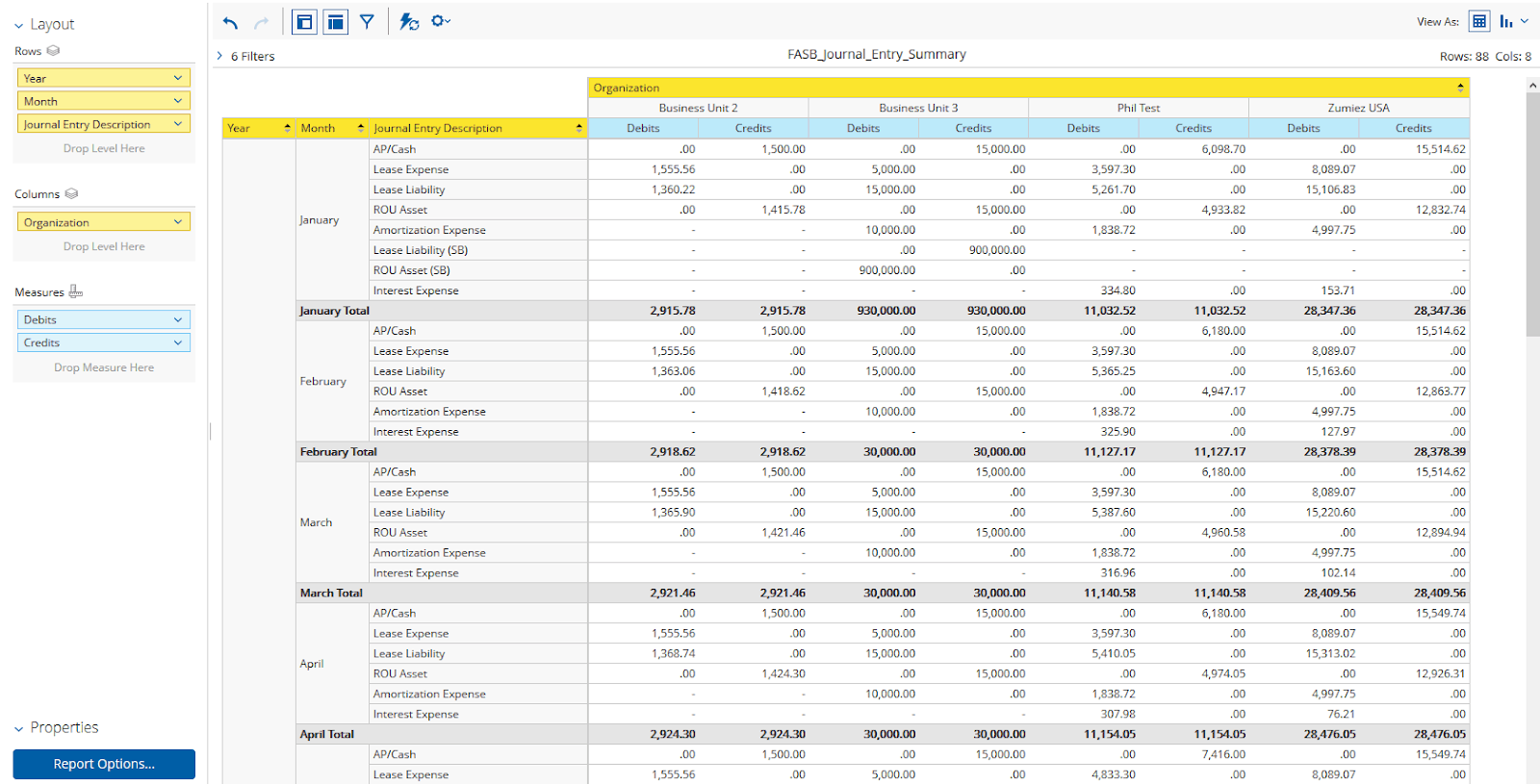

How to Calculate the Journal Entries for an Operating Lease under ASC 842

ASC 842 Excel Template Download

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

Lease Modification Accounting under ASC 842 Operating Lease to

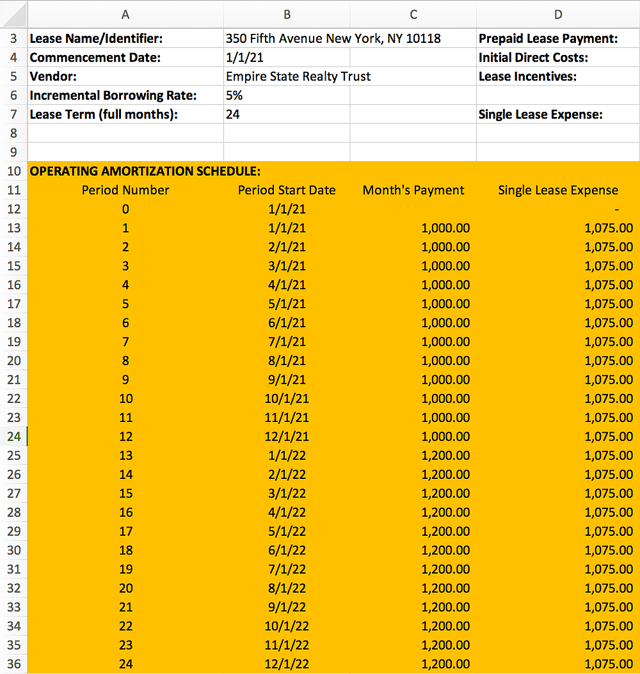

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Sensational Asc 842 Excel Template Dashboard Download Free

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Related Post: