Asc 842 Operating Lease Excel Template

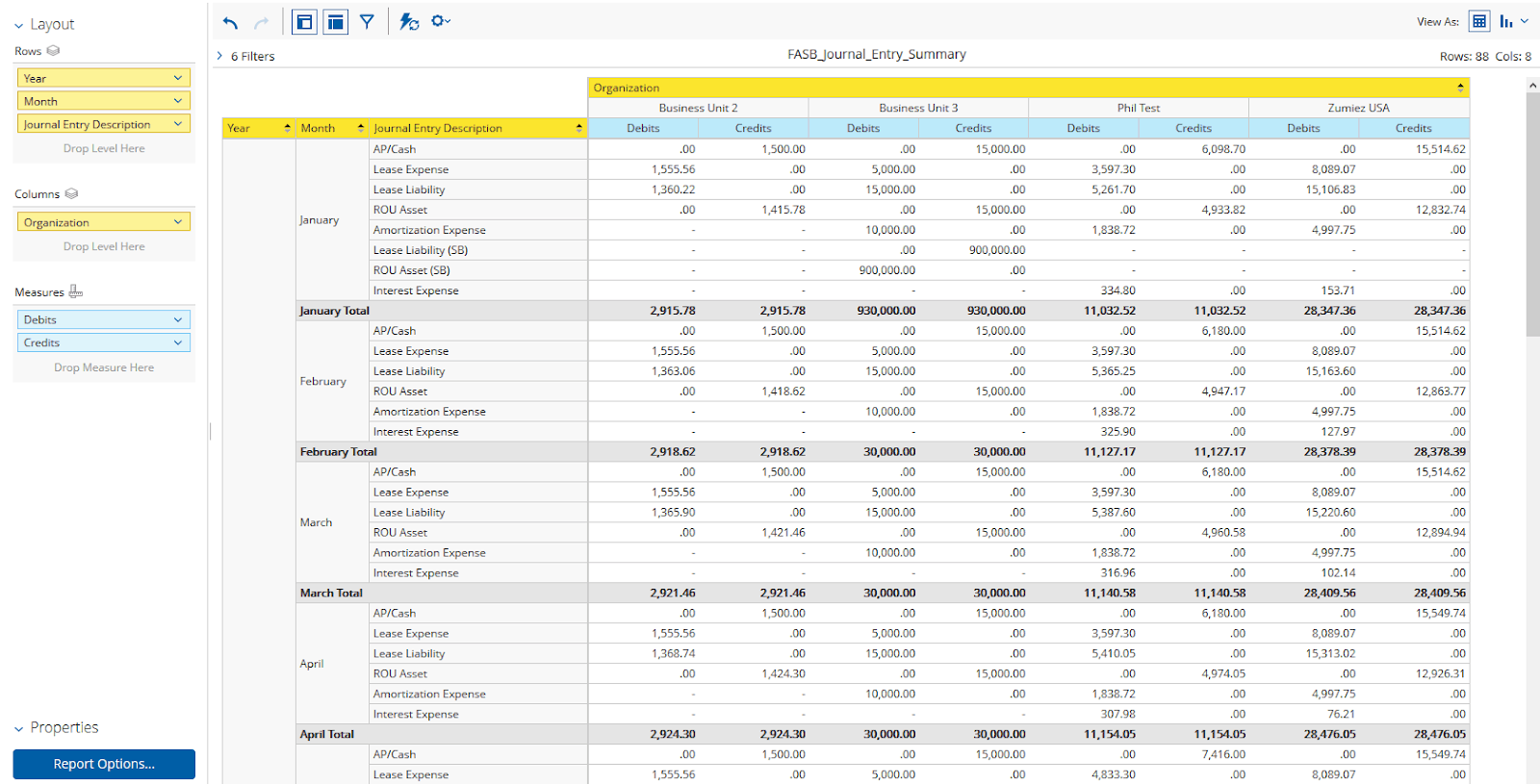

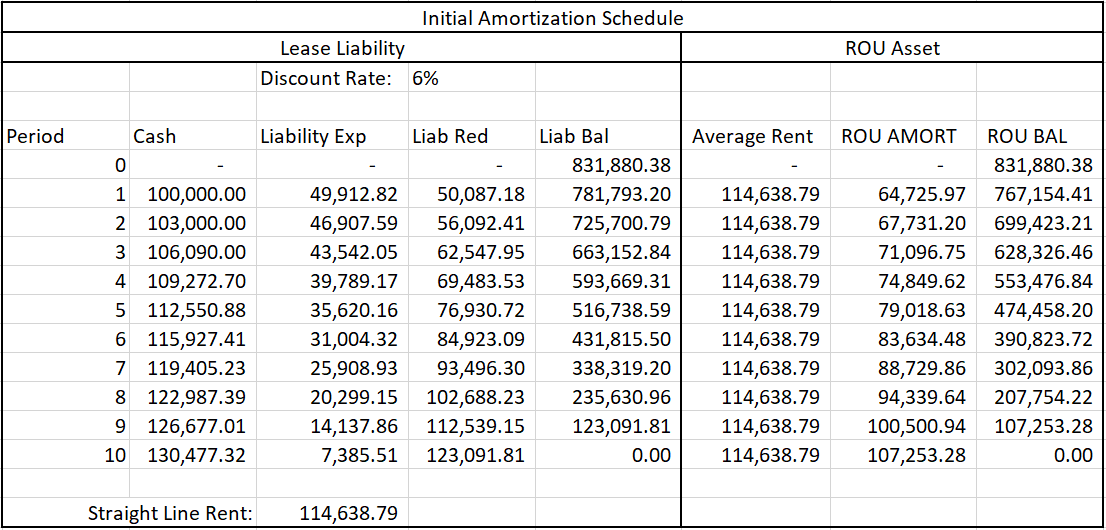

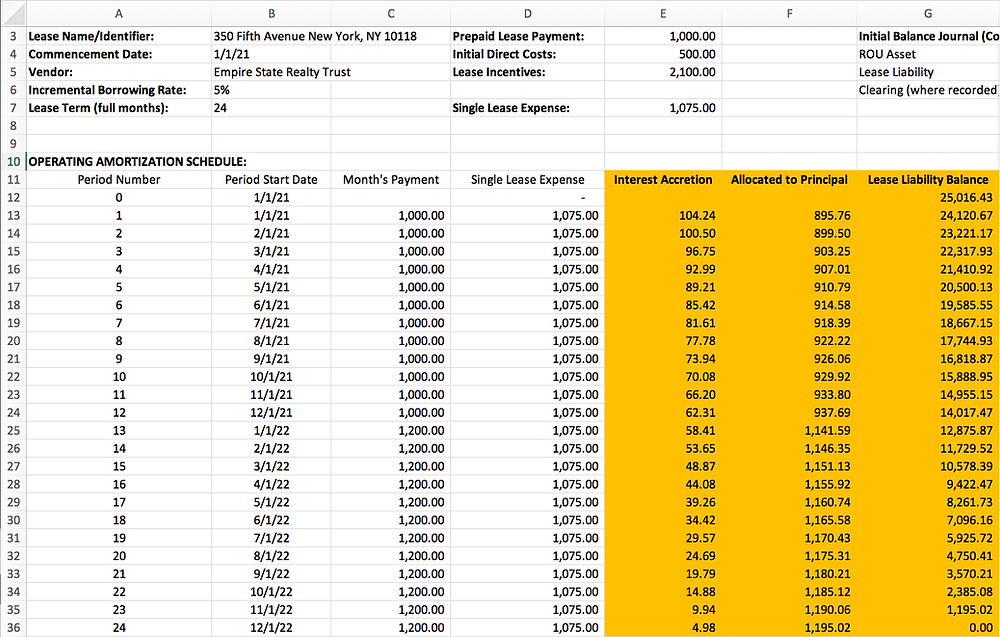

Asc 842 Operating Lease Excel Template - Ensure you can address them. Automate the new lease accounting requirements with leasecrunch accounting software Lease accounting examples like this one make it easy to understand the accounting. Effective date for public companies. Debit of $112,000 under the rou asset. What is a lease under asc 842? Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Ensure you can address them. Ad asc 842 brought changes to lease accounting standards. Effective date for private companies. Web if you enter the number “0”, this will adjust the present value calculation to assume lease payments are made at the end of each period, or in arrears; Web larson lease accounting template asc 842. Debit of $112,000 under the rou asset. At the end of the 2020 fiscal year, the financial accounting standards. Download the free asc 842. Web utilizing excel based solutions to calculate and appropriately record a lease reassessment / modification. Ensure you can address them. Web larson lease accounting template asc 842. Effective date for public companies. Web fasb asc 842 is applicable to any entity that enters into a lease and applies to all leases and subleases of property, plant, and equipment; Preparing the journal entries, presentation, and disclosure. Web utilizing excel based solutions to calculate and appropriately record a lease reassessment / modification. Web under the new lease accounting standard asc 842, the lease is either an operating lease or a finance lease. Click the link to download a template for asc 842. Ensure you can address them. At the end of the 2020 fiscal year, the financial accounting standards. Ad asc 842 brought changes to lease accounting standards. Lease accounting examples like this one make it easy to understand the accounting. Automate the new lease accounting requirements with leasecrunch accounting software The basic 842lease.com spreadsheet is designed to be very simple and user. Click here to see other lease accounting examples. Click the link to download a template for asc 842. Web in turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: Ensure you can address them. Web utilizing excel based solutions to calculate and appropriately record a lease reassessment / modification. Preparing the journal entries, presentation, and disclosure. Click here to see other lease accounting examples. Ad streamline operations of your organizations w/ lease software. Effective date for private companies. Web on february 25, 2016, the fasb issued accounting standards update no. The basic 842lease.com spreadsheet is designed to be very simple and user. Web calculate your monthly lease liabilities and rou assets in compliance with asc 842. Easily find the lease software you're looking for w/ our comparison grid. Debit of $112,000 under the rou asset. Lease accounting is like a tale of two cities, with companies that have. Ad streamline operations of your organizations w/ lease software. Ad keep clients compliant with asc 842, gasb & ifrs 16 with leasecrunch accounting software. Ensure you can address them. Ad asc 842 brought changes to lease accounting standards. Web with everything we’ve provided, we hope you have a better understanding of the new standards for lessees, are far less nervous. Preparing the journal entries, presentation, and disclosure. Effective date for public companies. A roadmap to adoption and implementation. Click here to see other lease accounting examples. What is a lease under asc 842? Automate the new lease accounting requirements with leasecrunch accounting software Web in turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: A finance lease supersedes a capital lease under asc 840. Click here to see other lease accounting examples. Ad keep clients compliant with asc 842, gasb & ifrs 16 with. Web in turn, your new asc 842 journal entries to recognize the commencement of this lease will be as follows: At the end of the 2020 fiscal year, the financial accounting standards. Lease accounting examples like this one make it easy to understand the accounting. Automate the new lease accounting requirements with leasecrunch accounting software Whether financing or operating, you can easily make an operating lease schedule that meets the requirements under asc 842. Last updated on february 9, 2023 by morgan beard. Ensure you can address them. Ad asc 842 brought changes to lease accounting standards. Web under the new lease accounting standard asc 842, the lease is either an operating lease or a finance lease. The basic 842lease.com spreadsheet is designed to be very simple and user. Web if you enter the number “0”, this will adjust the present value calculation to assume lease payments are made at the end of each period, or in arrears; Web utilizing excel based solutions to calculate and appropriately record a lease reassessment / modification. Lease accounting is like a tale of two cities, with companies that have. Web calculate your monthly lease liabilities and rou assets in compliance with asc 842. Web asc 842 operating lease example. Web by lauren covell october 13, 2022. Effective date for private companies. Ad streamline operations of your organizations w/ lease software. Debit of $112,000 under the rou asset. A finance lease supersedes a capital lease under asc 840.ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

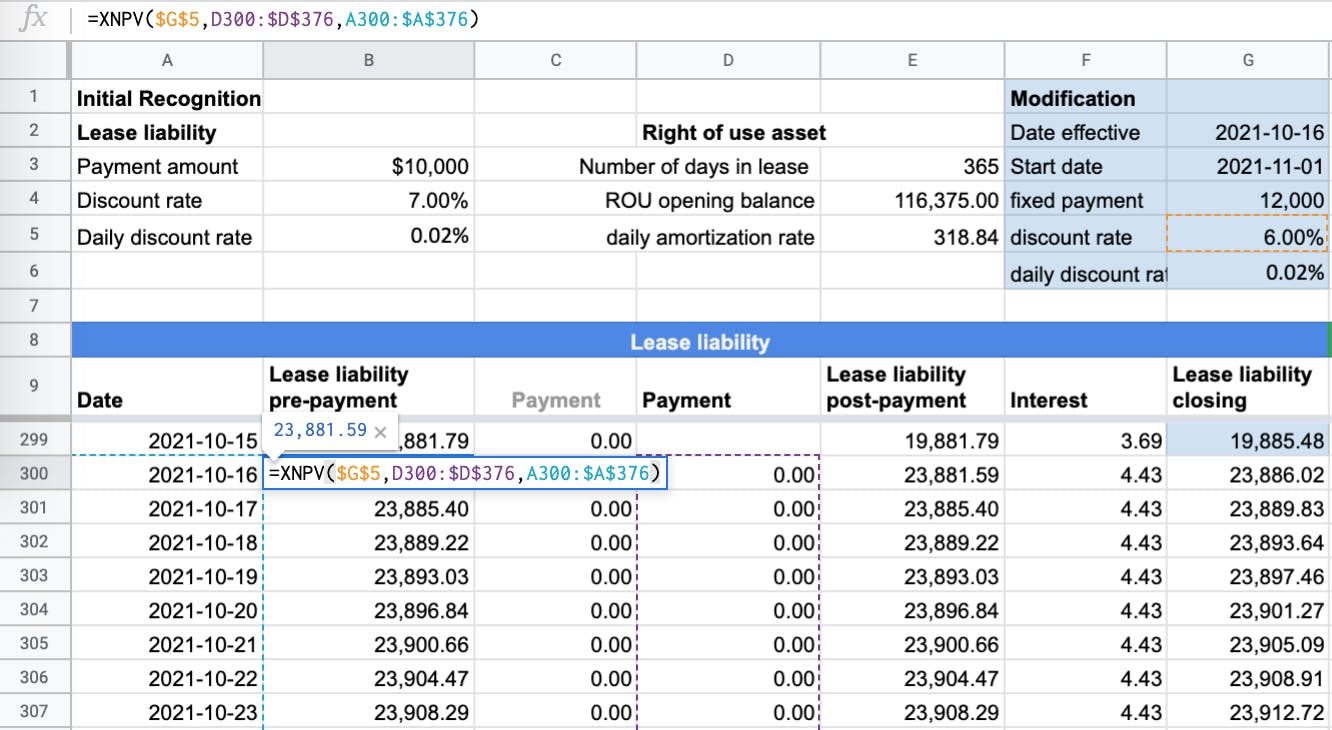

Lease Modification Accounting under ASC 842 Operating Lease to

ASC 842 Guide

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Sensational Asc 842 Excel Template Dashboard Download Free

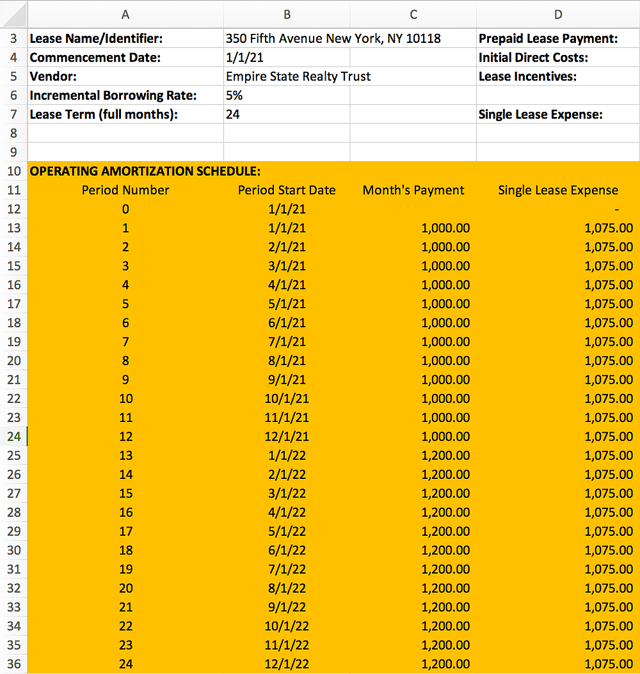

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

How to Calculate a Finance Lease under ASC 842

Related Post: