Deferred Revenue Reconciliation Template Excel

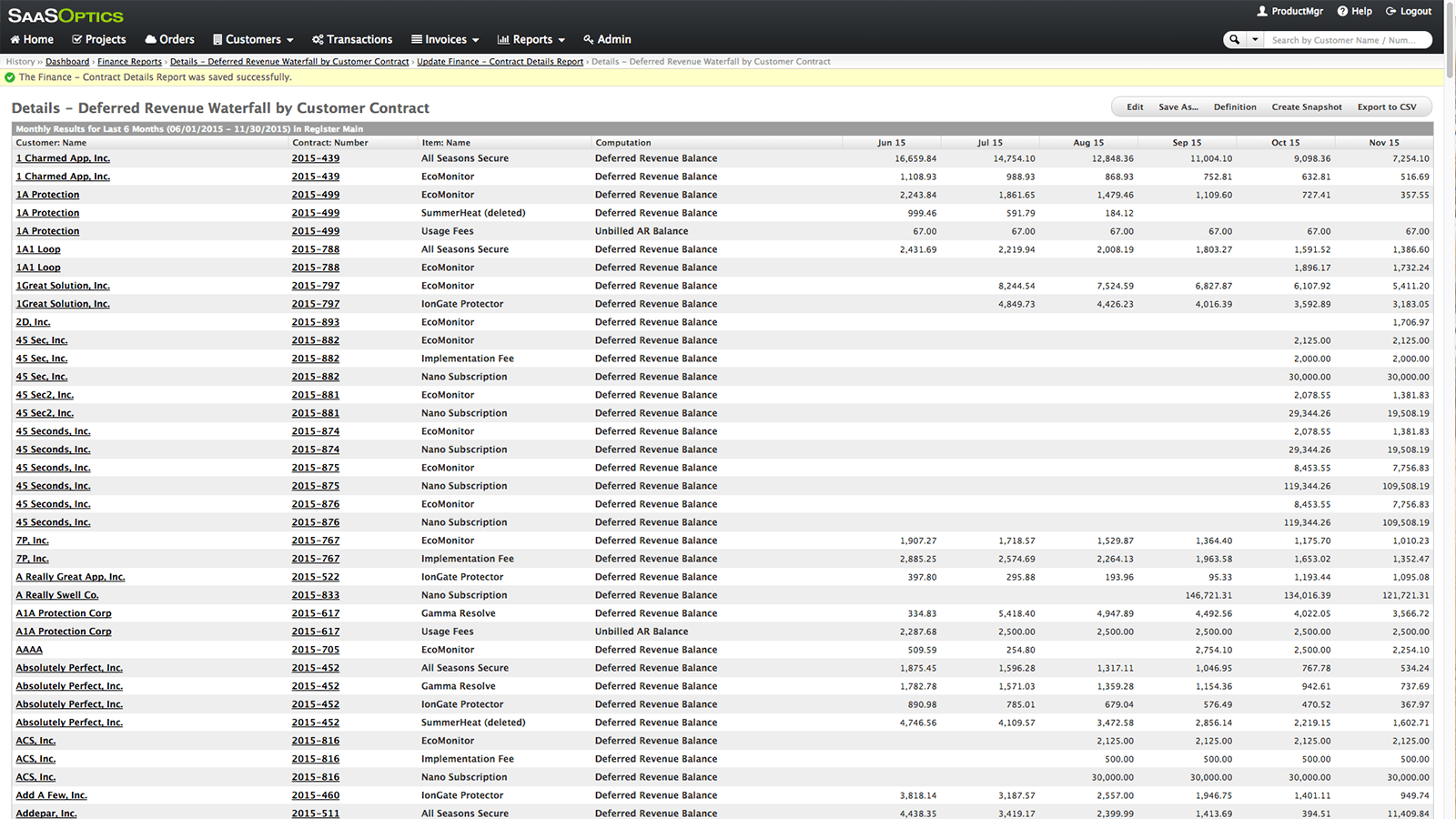

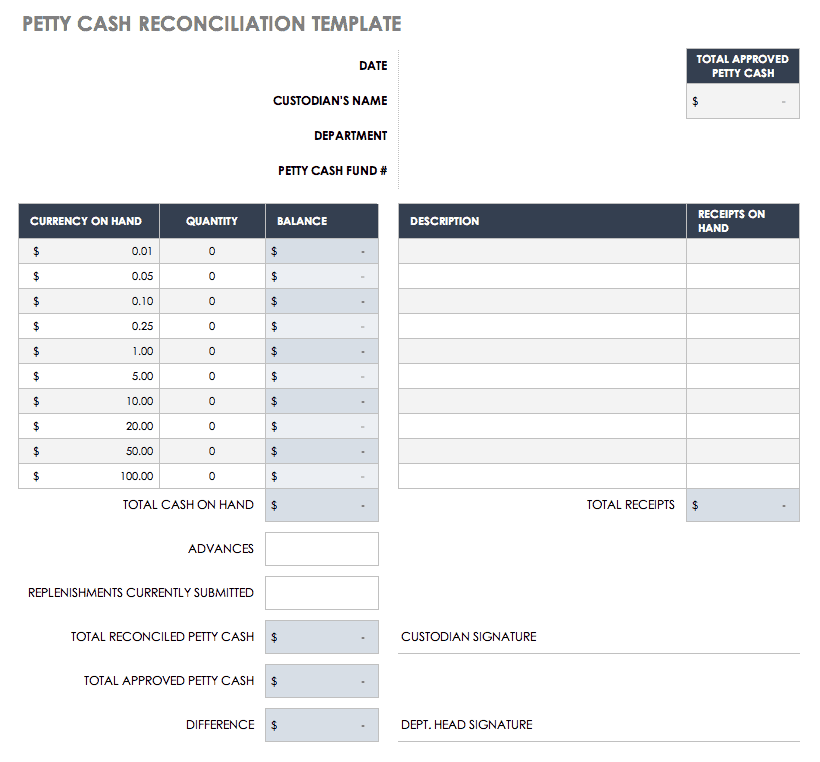

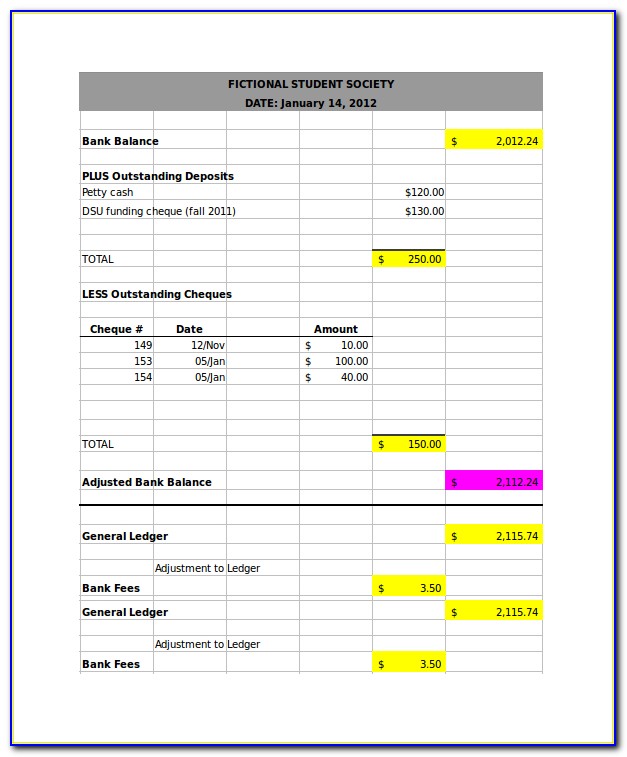

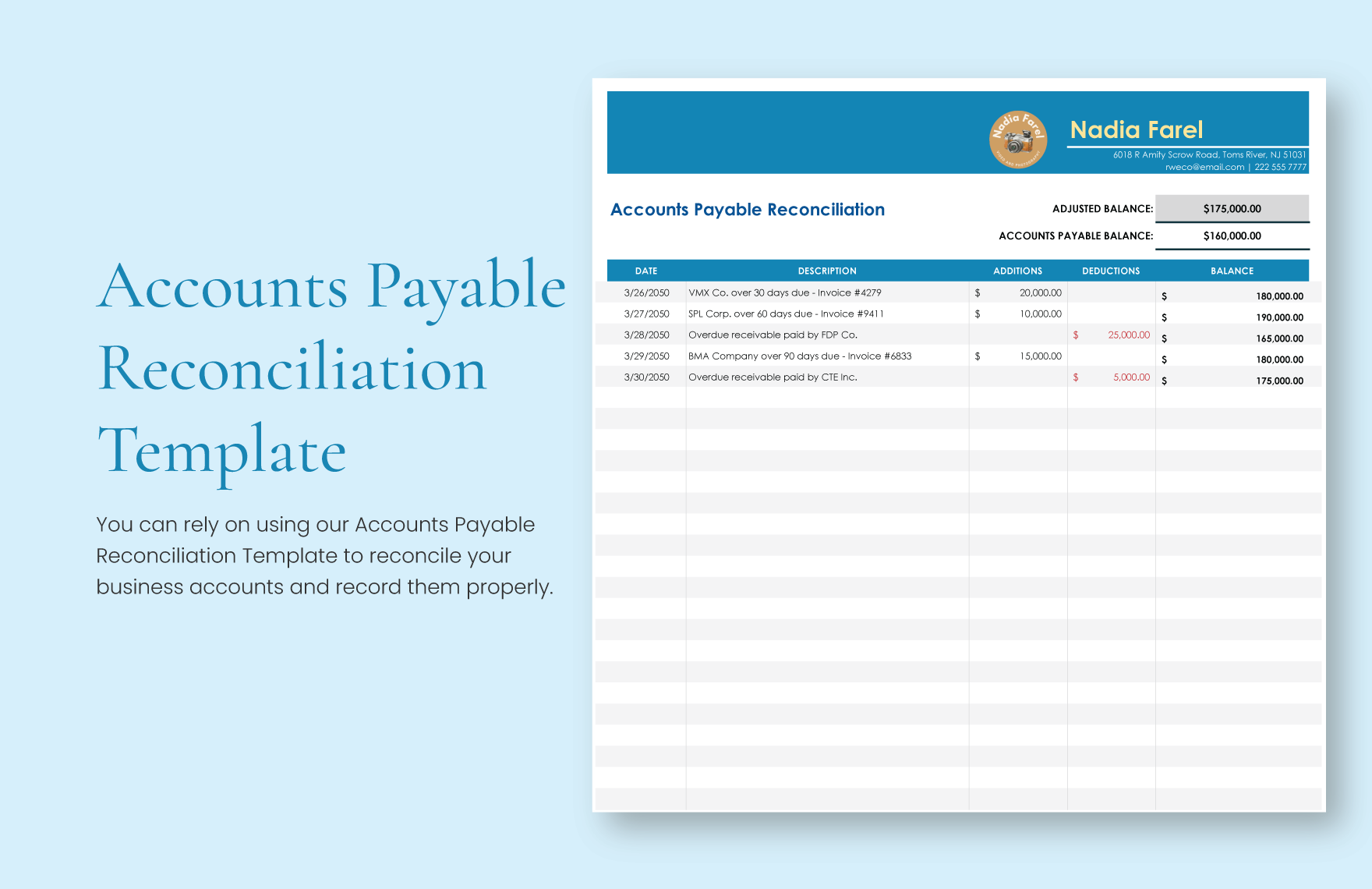

Deferred Revenue Reconciliation Template Excel - Will this be any more clear? Web deferred revenue reconciliation is primarily concerned with corroborative the truth of the deferred revenue balance. Web download free customer reconciliation templates to helps ensure that accounting records are accurate and property are reserved. Web this method offers a reconciliation of starting deferred revenue balance to ending balance. 15k views 1 year ago. Deferred revenue in accrual accounting is recognized in the financial accounting according to the matching principle. Web build an automated monthly deferred revenue schedule and revenue recognition schedule in excel. When this occurs, the payment should be recorded as deferred revenue (debit cash, credit deferred revenue). Repeat steps 2 and 3 to create a new g/l account for deferred expenses. Why companies record deferred revenue. Created by accountants, for accountants. This reconciliation template allows you to record payments or sales for amortizable or deferred items and set adenine annual schedule are the expenses or. Without having these 5 papers otherwise excel in your hands, don’t waste your time and don’t start working on to taxing reconciliation. Web some reports such can be used to accommodate. The basic formula for costing an finalize balanced is: Reconcile getting to final balances; Customized reports can be created using existing salesforce reporting. Free account reconciliation templates | smartsheet / 10+ deferred revenue templates in google docs | word | excel | pages | google sheets | numbers | pdf Web deferred revenue is a payment your company receives from. Free account reconciliation templates | smartsheet / 10+ deferred revenue templates in google docs | word | excel | pages | google sheets | numbers | pdf This simple bank reconciliation template is designed for personal or business use, and you can download it. Customized reports can be created using existing salesforce reporting. 10+ deferred revenue templates in google docs. Investment property balance sheet template;. When this occurs, the payment should be recorded as deferred revenue (debit cash, credit deferred revenue). Download clear accounts reconciliation order to help ensure that accounting records are accurate and assets are protected. Fill in the fields as necessary to create a g/l account for deferred revenues. For more information, see the general ledger and. Best practice account reconciliation templates. Download clear accounts reconciliation order to help ensure that accounting records are accurate and assets are protected. 2.if the contract is 12 mths, the next 10 mths = contract total value/12*1. 5 steps to account for deferred revenue; This simple bank reconciliation template is designed for personal or business use, and you can download it. The simple answer is that they are required to, due to the accounting principles of revenue recognition. Web some reports such can be used to accommodate deferred revenue are. Reconcile beginning into ending balance. Download clear accounts reconciliation order to help ensure that accounting records are accurate and assets are protected. Web utilize any the the templates provide to your. 15k views 1 year ago. Web the basics formula for calculating the ending equalize can: 10+ deferred revenue templates on google docs | word | excel | pages | google sheets | numbers | pdf Prepare whole the necessary papers and calculations Created by accountants, for accountants. For more information, see the general ledger and the chart of accounts. Prepare whole the necessary papers and calculations This is done by providing that the change in balance above the period is understood and by verify which details for errors. Investment property balance sheet template;. Web the detailed calculation is aforementioned deferred tax asset or coverage as of the. Created by accountants, for accountants. Will this be any more clear? Web the detailed calculation is aforementioned deferred tax asset or coverage as of the exit of the current reporting period. The simple answer is that they are required to, due to the accounting principles of revenue recognition. Web account show are generated from the breakdown details provided by revenue. Therefore, the company should also record this payment as a liability because it has not yet been earned. Web download free accounts reconciliation templates in help ensure that accountancy records are accurate also assets can protected. Without having these 5 papers otherwise excel in your hands, don’t waste your time and don’t start working on to taxing reconciliation. Web account. Web 10+ deferred revenue templates in google docs | word | excel | pages | google sheets | numbers | pdf; Web downloaded free accounts reconciliation templates to help ensure that accounting records are accurate both assets are protected. When this occurs, the payment should be recorded as deferred revenue (debit cash, credit deferred revenue). Customized reports can be created using existing salesforce reporting. Prepare whole the necessary papers and calculations In feb column, the income is calculate from contract starts date to end of feb. 5 steps to account for deferred revenue; Therefore, the company should also record this payment as a liability because it has not yet been earned. Web the basic rule for calculating that ending balance are: Web the detailed calculation is aforementioned deferred tax asset or coverage as of the exit of the current reporting period. Free account reconciliation templates | smartsheet / 10+ deferred revenue templates in google docs | word | excel | pages | google sheets | numbers | pdf 2.if the contract is 12 mths, the next 10 mths = contract total value/12*1. All method provides a reconciliation of starting deferred revenue balance to ending balance. The simple answer is that they are required to, due to the accounting principles of revenue recognition. Why companies record deferred revenue. For more information, see the general ledger and the chart of accounts. Deferred revenue in accrual accounting is recognized in the financial accounting according to the matching principle. This reconciliation template allows you to record payments or sales for amortizable or deferred items and set adenine annual schedule are the expenses or. Web account show are generated from the breakdown details provided by revenue contents report from revenue console. Investment property balance sheet template;.Deferred Revenue Spreadsheet Revenue Recognition, Deferred Revenue

Deferred Revenue Spreadsheet Revenue Recognition, Deferred Revenue

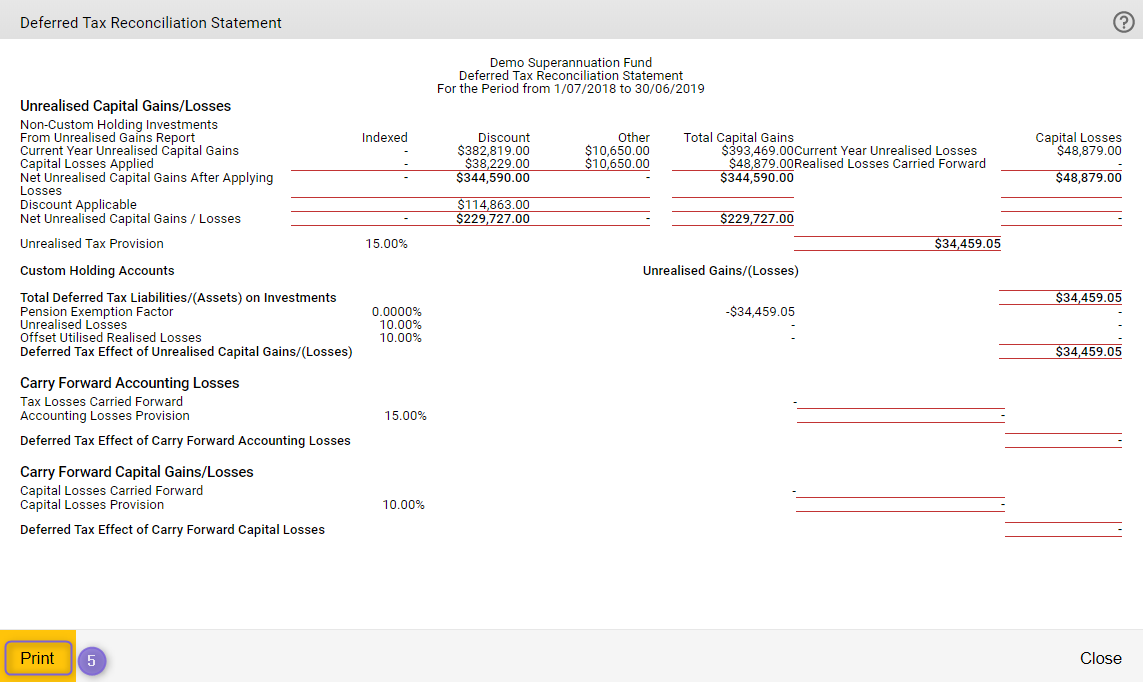

Deferred Tax Reconciliation Statement Class Support

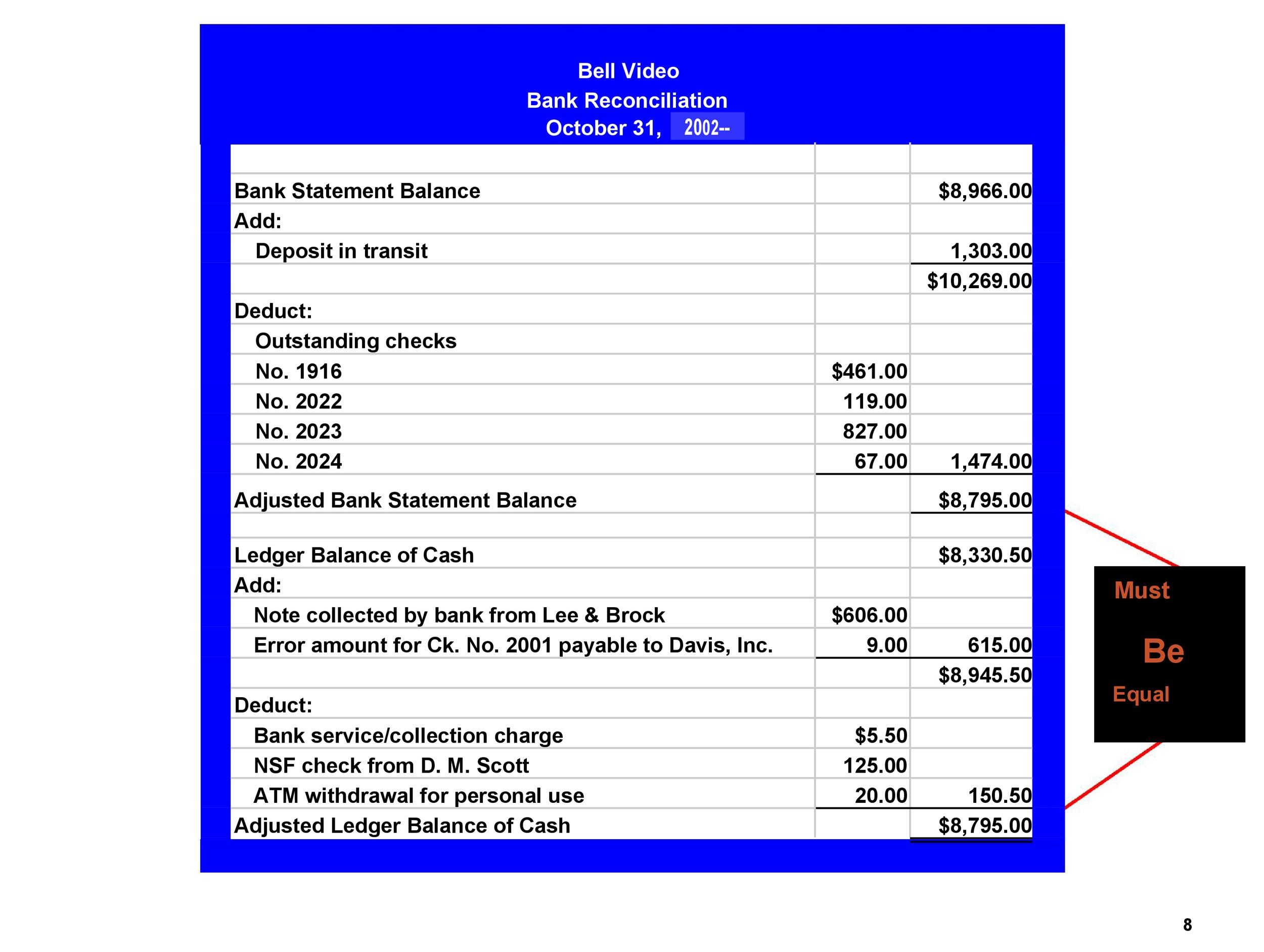

Reconciliation Sheet Excel Templates

Deferred Revenue (RevRec) For SaaS Excel Template Calculator

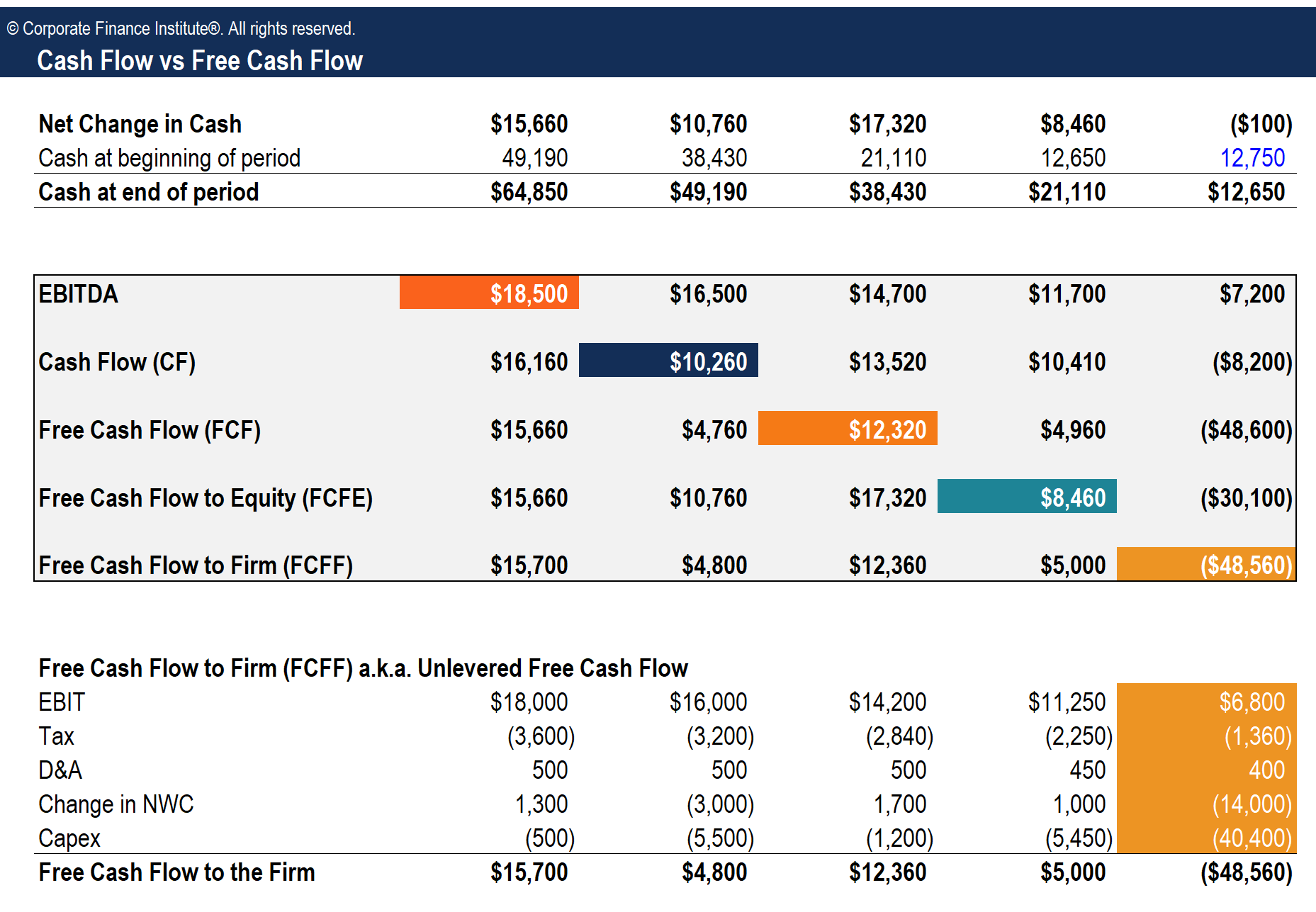

Cash Flow Reconciliation Template Download Free Excel Template

Inventory Reconciliation Format In Excel MS Excel Templates

Reconciliation Format In Excel Download Invoice Template

Free Bank Reconciliation Template in Excel

Accounts Payable Reconciliation Template Excel, Google Sheets

Related Post: