Depreciation Schedule Template Excel

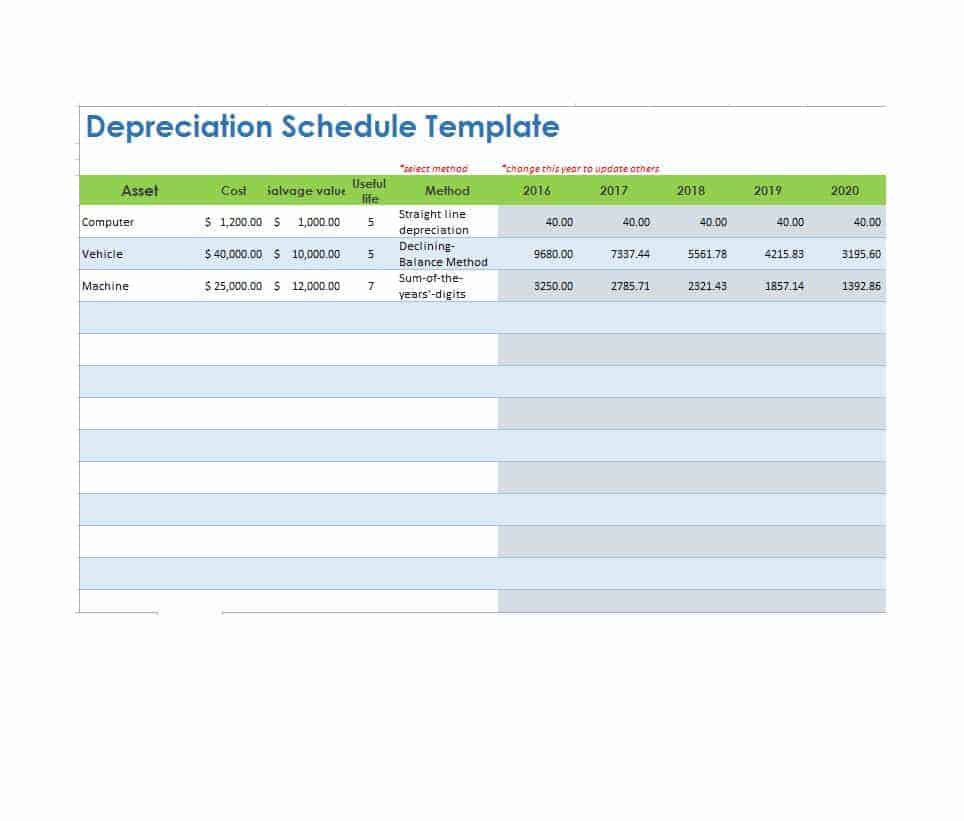

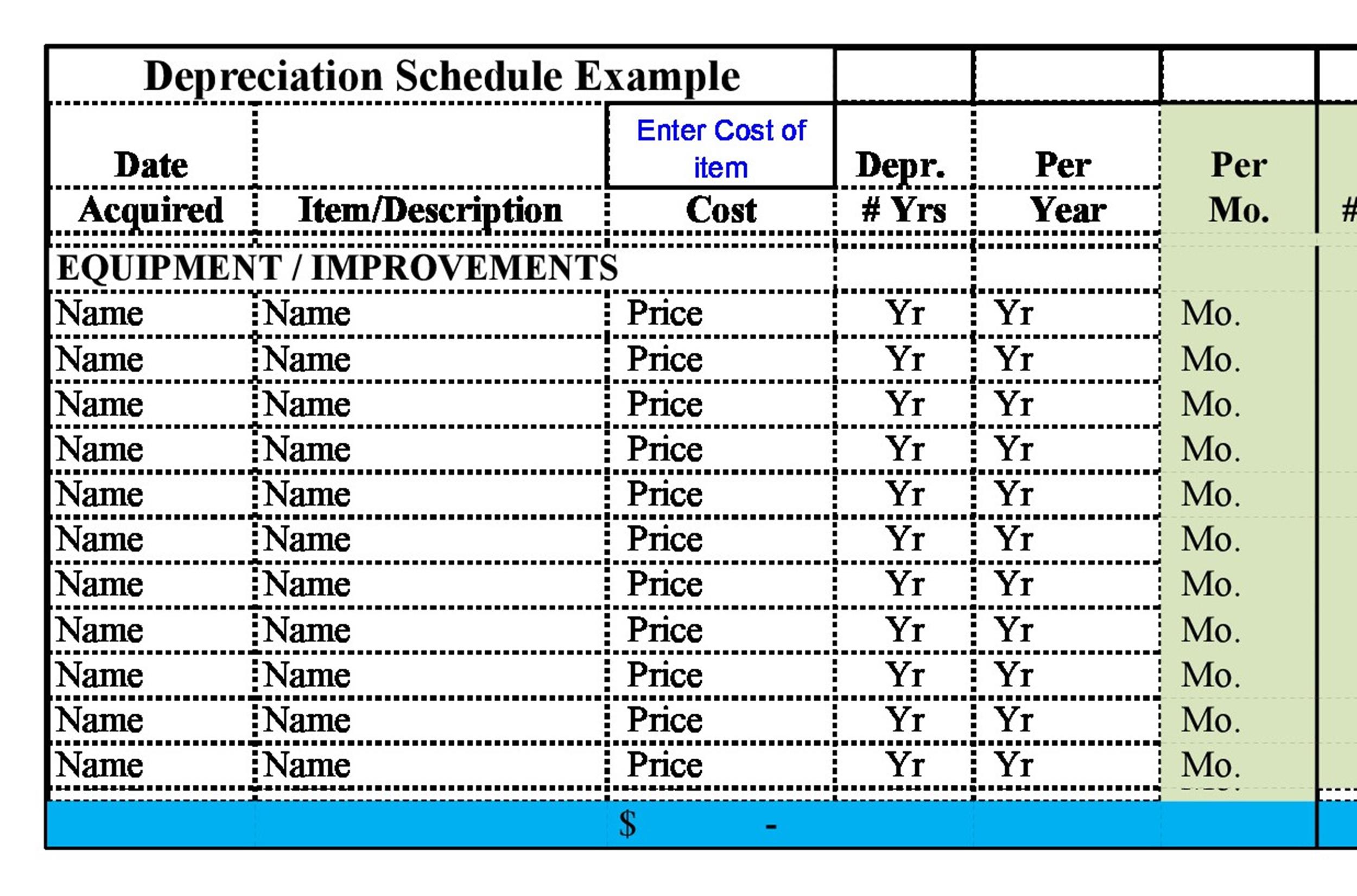

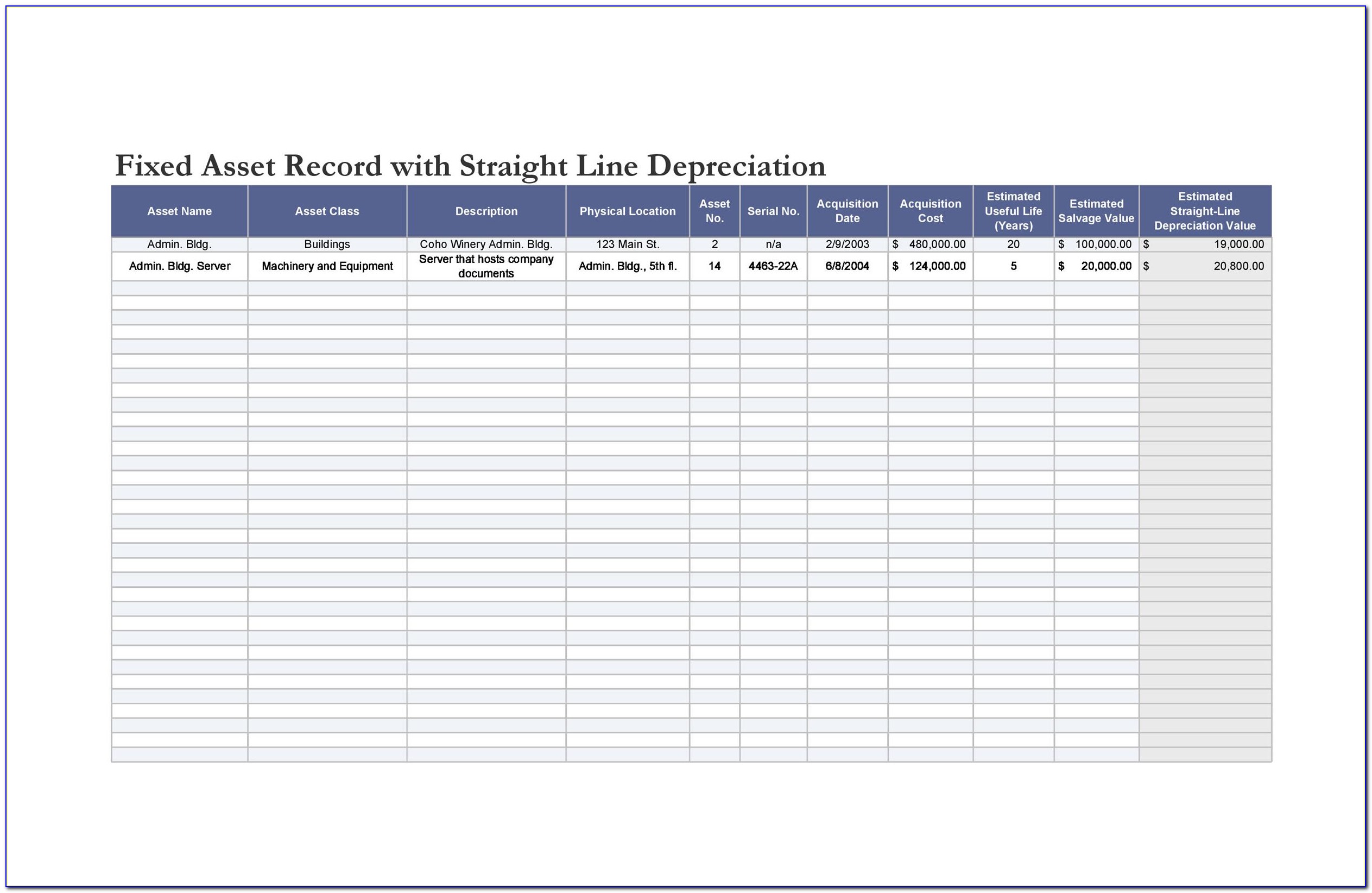

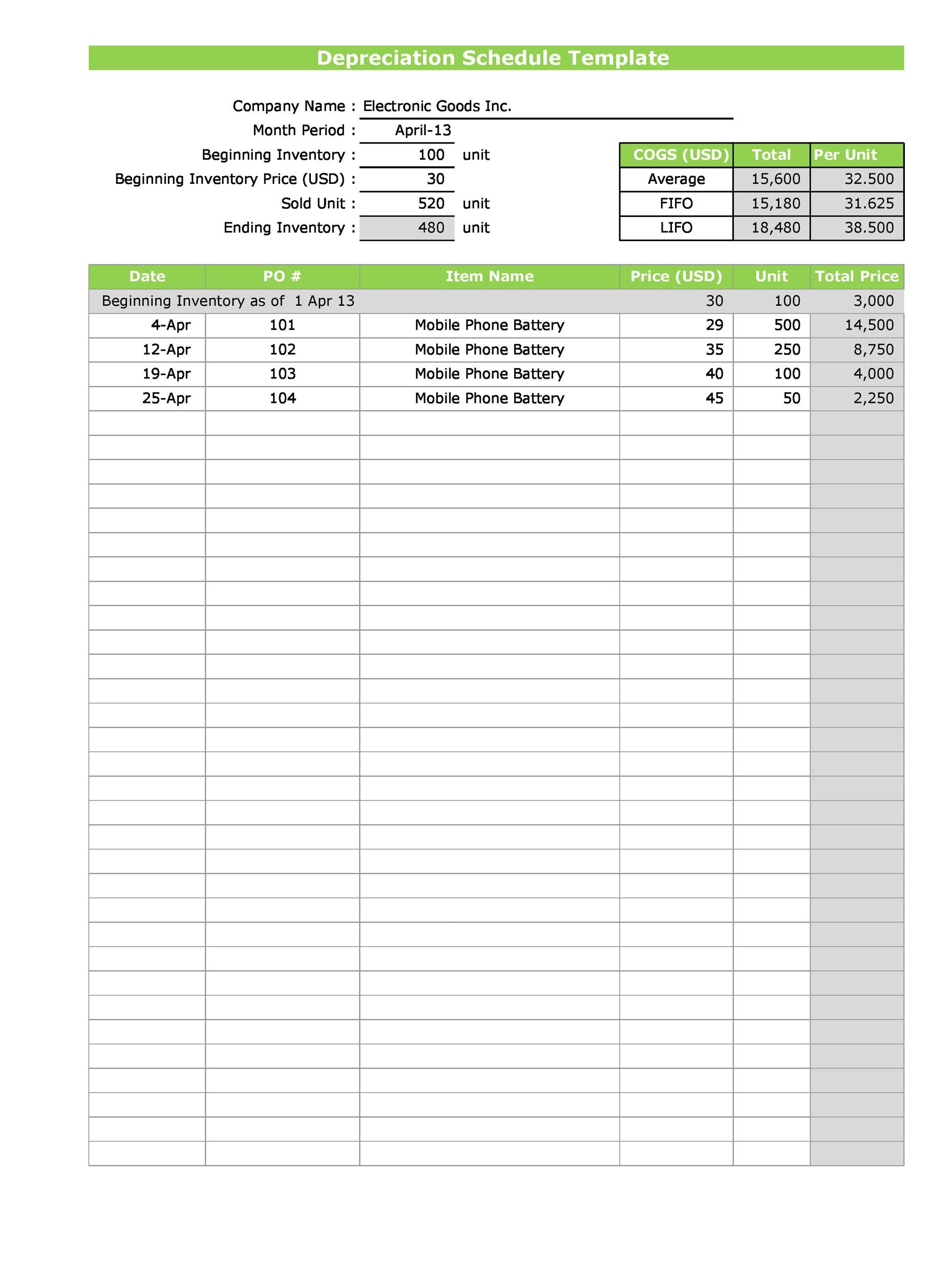

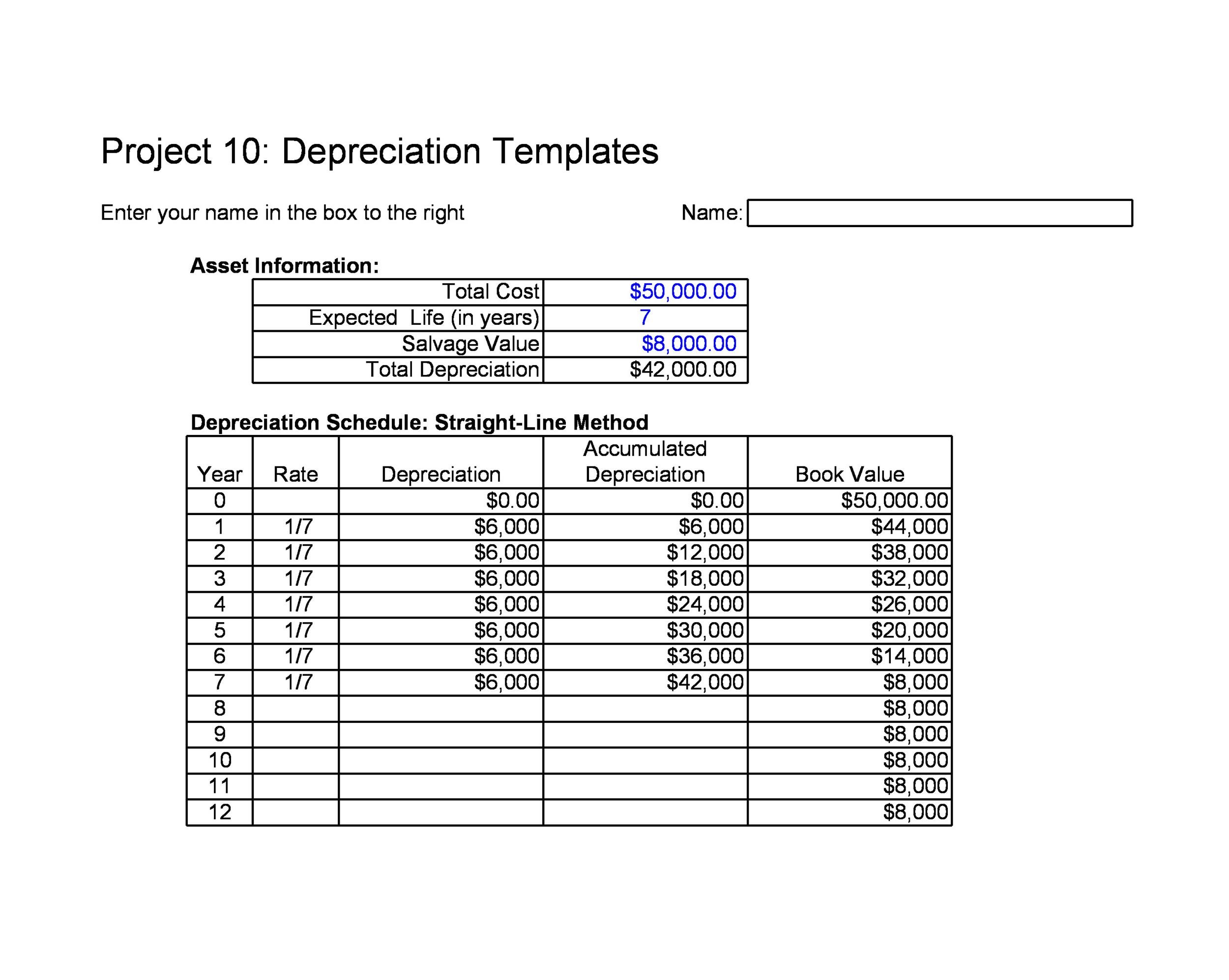

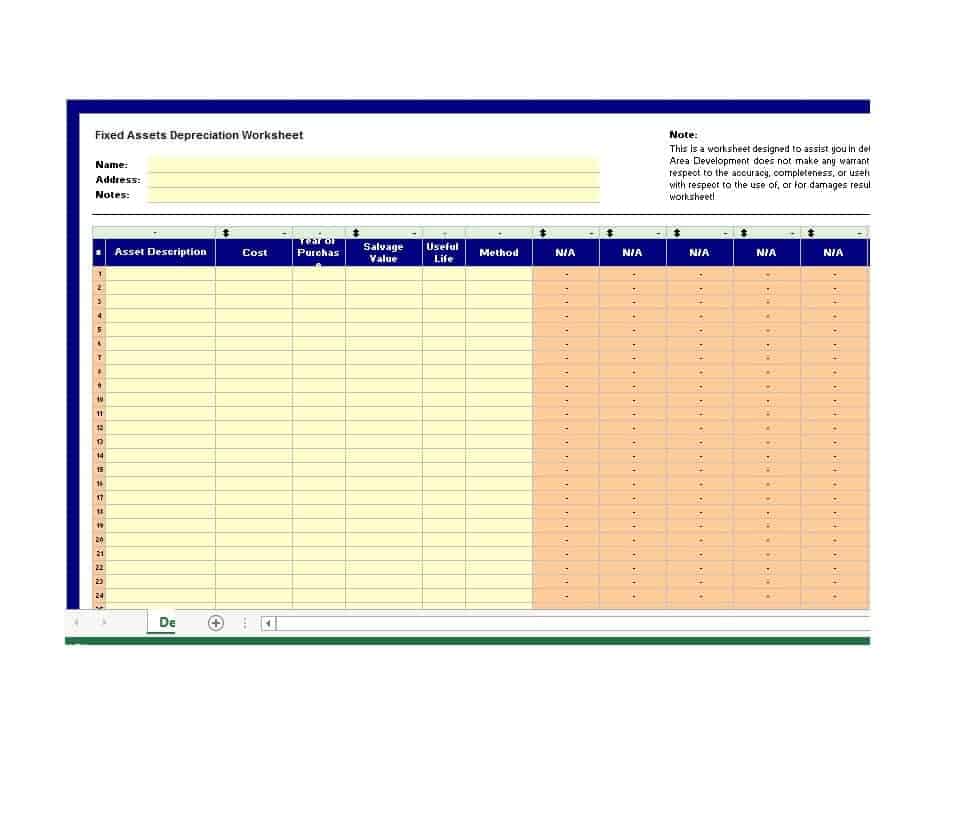

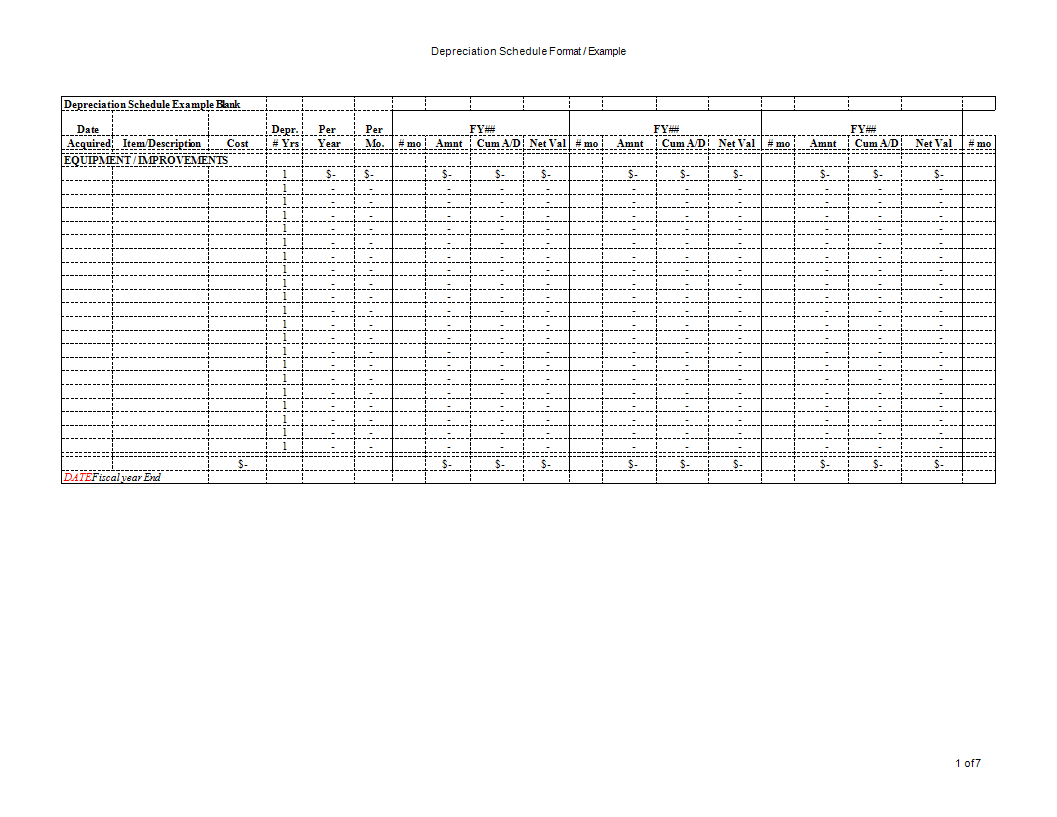

Depreciation Schedule Template Excel - Excel 2007 or later, office 365, & excel for ipad/iphone. In this step, wealth will use the data validation characteristics to insert the benefit full in our depreciation schedule.this is why us want into insert only can asset appoint in an time,. Web the depreciation schedule records the depreciation expense on the income statement and calculates the asset’s net book value at the end of each accounting period. Web the fixed assets balance (value) equals the cost less the accumulated depreciation. You can create a plan using the fixed asset inventory schedule template. Depreciation schedule is a systematic and an accounting operation, for calculating the amount of book value of a fixed asset. 2.00 2.00 1.50 1.50 2008.00 2009.00 1.00. See the link above for more information about using this template. The second section covers the remaining depreciation methods. Web download one depreciation schedule template with excel. Web download a fixed asset tracking template with depreciation schedule for. Excel 2007 or later, office 365, & excel for ipad/iphone. The second section covers the remaining depreciation methods. Web the excel function, ddb(), handles all of that for you. Non profit depreciation schedule format download in excel. Web adenine depreciation schedule is required in financial modeling to link the three financial statements (income, balance sheet, cash flow) in excel. Calculating depreciation of current value for the month of january. Web a depreciation template is the next strategy for lowering taxes on tangible property. The workbook contains 3 worksheets: Web download a fixed asset tracking template with depreciation. See the link above for more information about using this template. Below is a preview of the depreciation methods template: Excel 2007 or later, office 365, & excel for ipad/iphone. Depreciation schedule format / example of 11/30/2008 3.00 $365.20. Web free download depreciation schedule template in excel format. The second section covers the remaining depreciation methods. See the link above for more information about using this template. Depreciation schedule is a systematic and an accounting operation, for calculating the amount of book value of a fixed asset. Fy13 fy14 fy15 fy16 caveat: Here, you can see the outline of that monthly depreciation schedule with all the necessary terms. Web a depreciation template is the next strategy for lowering taxes on tangible property. Fy13 fy14 fy15 fy16 caveat: Depreciation schedule is a systematic and an accounting operation, for calculating the amount of book value of a fixed asset. Not to be used for tax reporting. Web the depreciation schedule records the depreciation expense on the income statement and calculates. Web our free excel depreciation schedule template will calculate the straight line depreciation over a period of zeitlich, free download This depreciation methods template will show you the calculation of depreciation expenses using four types of commonly used depreciation methods. The second section covers the remaining depreciation methods. The workbook contains 3 worksheets: Non profit depreciation schedule format download in. Excel 2007 or later, office 365, & excel for ipad/iphone. Web the depreciation schedule records the depreciation expense on the income statement and calculates the asset’s net book value at the end of each accounting period. Using data validation tool to insertion asset in superior. Web it is not intended to be used for official financial or tax reporting purposes.. Web a depreciation template is the next strategy for lowering taxes on tangible property. Below is a preview of the depreciation methods template: This depreciation methods template will show you the calculation of depreciation expenses using four types of commonly used depreciation methods. The second section covers the remaining depreciation methods. In this step, wealth will use the data validation. Not to be used for tax reporting. This depreciation methods template will show you the calculation of depreciation expenses using four types of commonly used depreciation methods. Calculating depreciation of current value for the month of january. Using data validation tool to insertion asset in superior. Web posted by mani february 20, 2023 in word formats. While every effort has been made to ensure accuracy of formulas, if you use this template, you assume responsibility for double checking formulas and results. Evaluating the current value of assets in depreciation schedule. Web the fixed assets balance (value) equals the cost less the accumulated depreciation. This depreciation methods template will show you the calculation of depreciation expenses using. 2.00 2.00 1.50 1.50 2008.00 2009.00 1.00. Depreciation schedule format / example of 11/30/2008 3.00 $365.20. Web a depreciation template is the next strategy for lowering taxes on tangible property. Below is a preview of the depreciation methods template: Calculating return down value at starting month of january. Depreciation schedule is a systematic and an accounting operation, for calculating the amount of book value of a fixed asset. The second section covers the remaining depreciation methods. These eight depreciation methods are discussed in two sections, each with an. Web download one depreciation schedule template for excel. Not to be used for tax reporting. Fy13 fy14 fy15 fy16 caveat: Enter your name and email in the form below and download the free template. Web a depreciation schedule is required in financial modeling to link the three financial statements (income, balance sheet, cash flow) in excel. Web the fixed assets balance (value) equals the cost less the accumulated depreciation. Using data validation tool to insert assets in excel. Methods factors noswitch n/a edit the information in columns b through g. Using data validation tool to insertion asset in superior. Calculating depreciation of current value for the month of january. Web the excel function, ddb(), handles all of that for you. Excel 2003 (.xls) openoffice (.ods) license:13+ Depreciation Schedule Templates Free Word Excel Templates

Straight Line Depreciation Schedule Excel Template For Your Needs

Depreciation Schedule Template Excel Free Printable Templates

Depreciation Schedule Template Excel Free Printable Templates

Depreciation Excel Template Database

9 Free Depreciation Schedule Templates in MS Word and MS Excel

7 Excel Depreciation Template Excel Templates

Straight Line Depreciation Schedule Excel Template For Your Needs

Depreciation Schedule Template Excel Free For Your Needs

Depreciation schedule Excel format Templates at

Related Post: