Discounted Cash Flow Excel Template Free

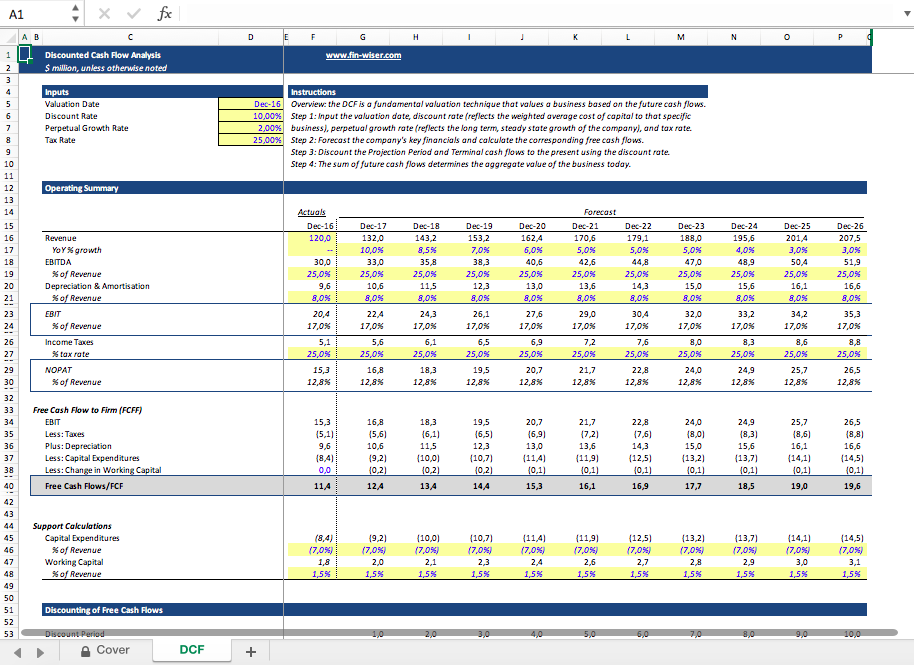

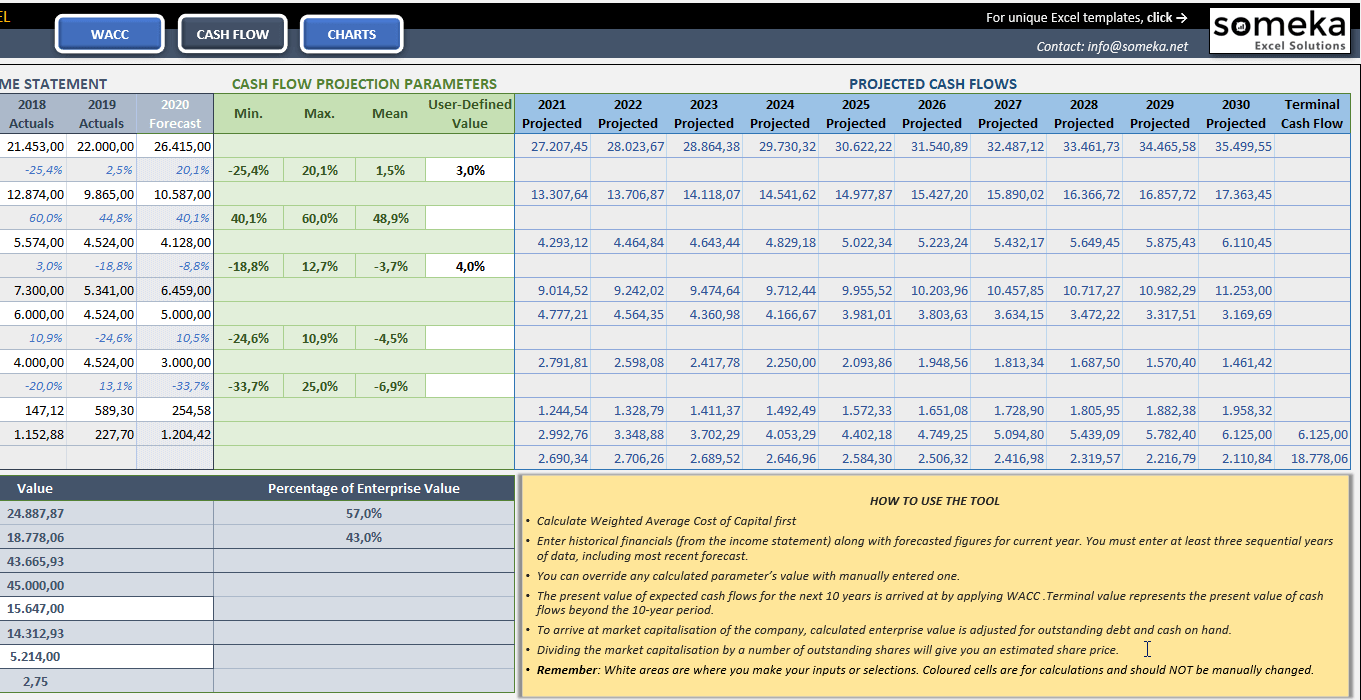

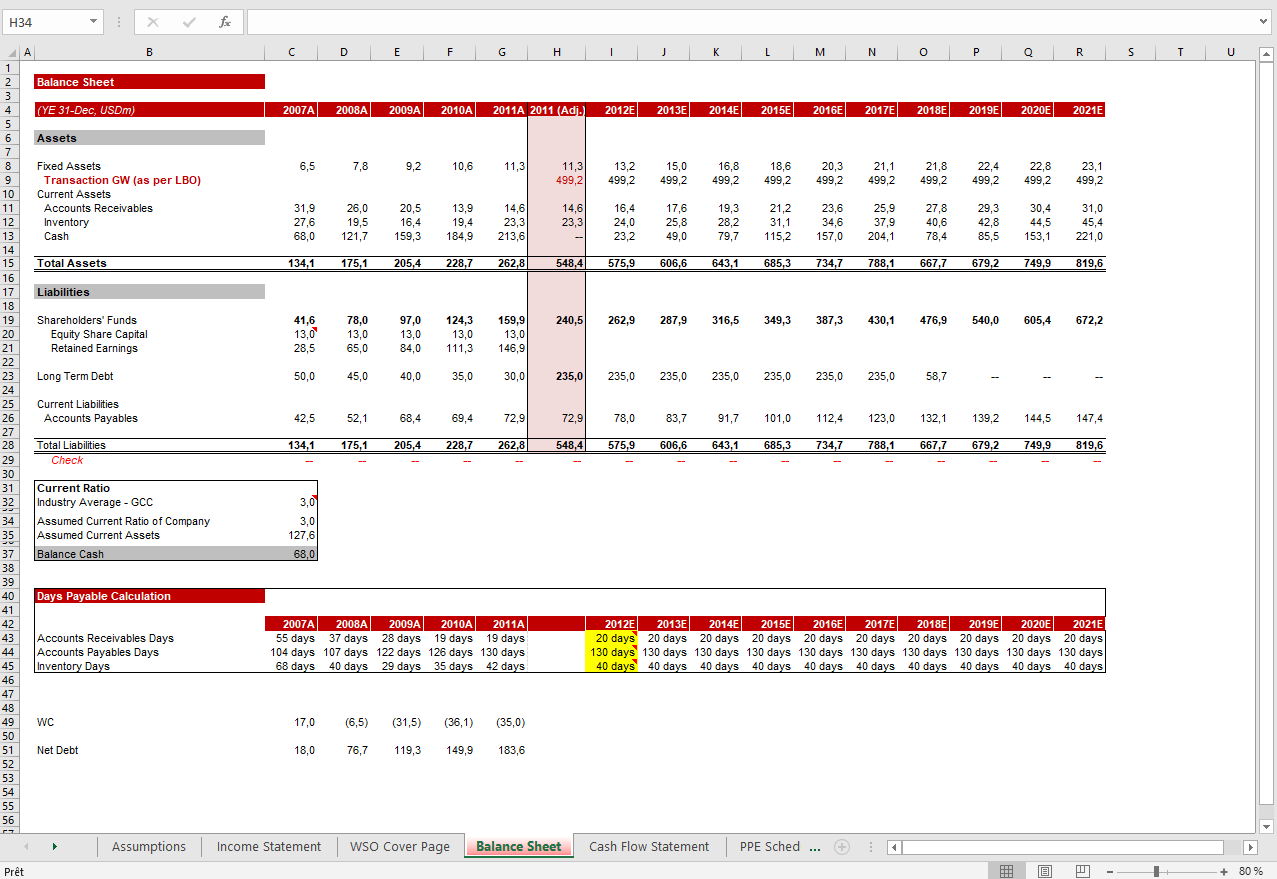

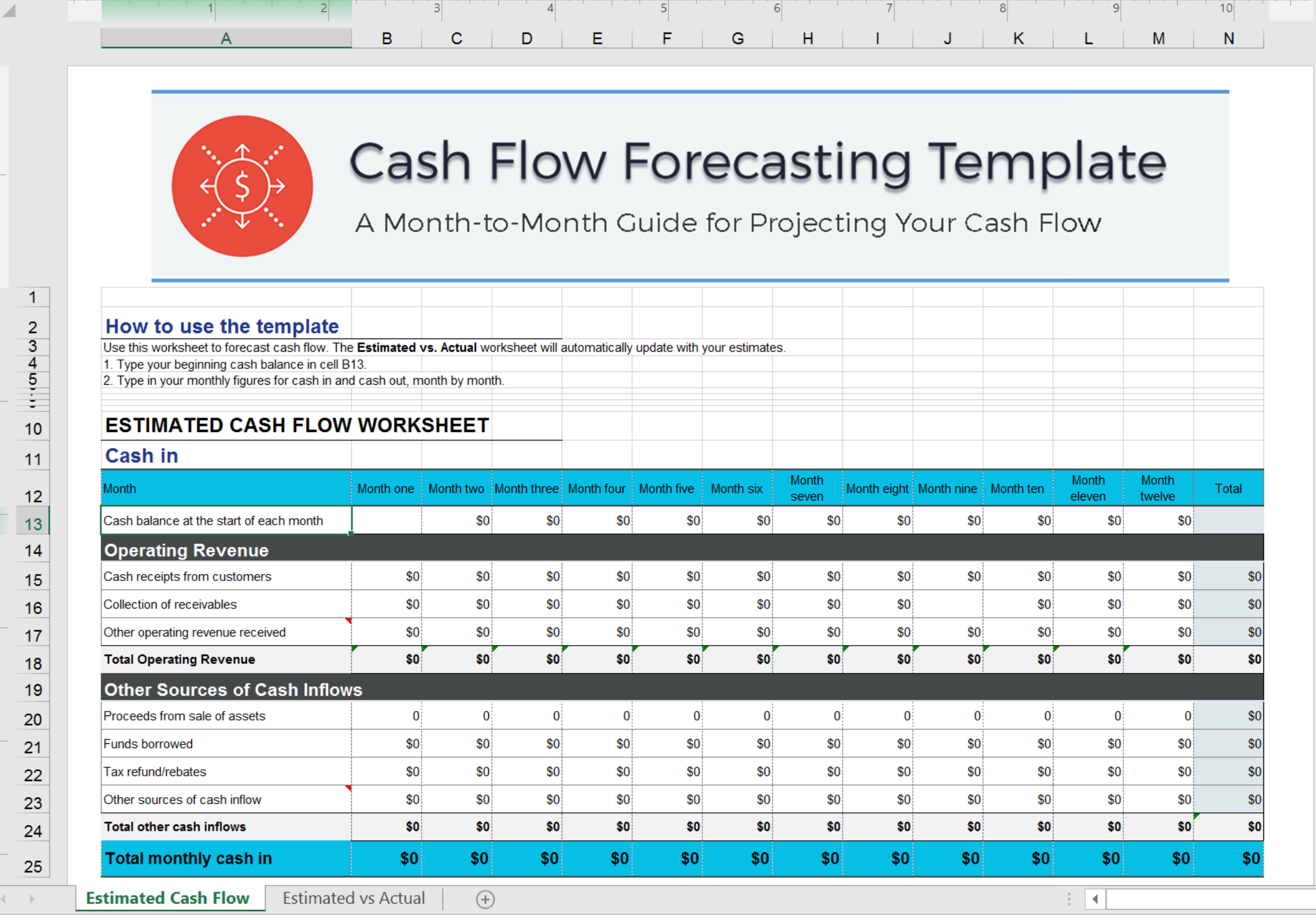

Discounted Cash Flow Excel Template Free - The full version of the stock value calculator includes an entire suite of valuation. We've gathered 10 of the best templates available online, and they're all free to download. Web discounted cash flow (dcf) excel model template. This dcf model training guide will. Then, with a few clicks, you can change assumptions and see how they affect the intrinsic value of a stock. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa, and sensitizes the analysis over a range of assumed terminal multiples and perpetuity growth rates without the use of slow excel. This ufcf calculation template provides you with insight into the tangible and intangible assets generated by your business that are available for distribution to all capital providers. Start your dcf analysis today! Web dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called the net present value (npv). Discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Web if you're looking for discounted cash flow excel templates, look no further! Web get free advanced excel exercises with solutions! Web the formula for this is: Web discounted cash flow valuation model: We've gathered 10 of the best templates available online, and they're all free to download. =npv(discount rate, series of cash flows) this formula assumes that all cash flows received are spread over equal time periods, whether years, quarters, months, or otherwise. Web very good producteasy to use. It determines the decision to buy or sell a company in the business sector. The underlying calculations are the same but many tweaks have been made to the. Web discounted cash flow is a powerful tool that can be used to value a company. Web download this template for free. Web this free discounted cash flows spreadsheet is based off fwallstreet and is an enhanced version of the original spreadsheet available from fwallstreet.com. * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, *. Sum the discounted cash flows to get the net present value (npv). Present value factor = 1 / ( (1 + discount rate) ^ number of years). Web download this template for free. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa, and sensitizes the analysis over a range of assumed terminal multiples and. Microsoft excel has made our work easier with the discounted cash flow formula. Web download sample discounted cash flow excel template — excel. Web download this template for free. Web discounted cash flow valuation model: Advantages of discounted cash flow valuation. Nonprofit cash flow projection template; Web simple cash flow template; What is discounted cash flow valuation? The model is completely flexible, so that when you put in the inputs data the model calculates. Web get free advanced excel exercises with solutions! Our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. We've gathered 10 of the best templates available online, and they're all free to download. The dcf formula allows you to determine the value of a company today, based on how much money. Web discounted cash flow valuation model: In this post, we'll discuss what discounted cash flow is and why it's important, then we'll showcase each of the 10 templates. Web simple cash flow template; Dcfs are widely used in both academia and in practice. Web very good producteasy to use. In this post, we'll discuss what discounted cash flow is and why it's important, then we'll showcase each of the 10 templates. We've gathered 10 of the best templates available online, and they're all free to download. Nonprofit cash flow projection template; Dcfs are widely used in both academia and in practice. Web this free discounted cash flows spreadsheet is. =npv(discount rate, series of cash flows) this formula assumes that all cash flows received are spread over equal time periods, whether years, quarters, months, or otherwise. Web discounted cash flow is a powerful tool that can be used to value a company. We've gathered 10 of the best templates available online, and they're all free to download. Web ms excel. This ufcf calculation template provides you with insight into the tangible and intangible assets generated by your business that are available for distribution to all capital providers. Dcfs are widely used in both academia and in practice. It determines the decision to buy or sell a company in the business sector. The term discounted cash flow is a very common one in the field of finance and accounting. Web discounted cash flow is a powerful tool that can be used to value a company. Present value factor = 1 / ( (1 + discount rate) ^ number of years). How to use the template. The underlying calculations are the same but many tweaks have been made to the formula and variables. Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a current, present value. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. =npv(discount rate, series of cash flows) this formula assumes that all cash flows received are spread over equal time periods, whether years, quarters, months, or otherwise. Unlevered free cash flow calculation template. * dashboard, * income statement, * cash flow, * balance sheet, * wacc calculation, * dcf calculation, * liquidity. Microsoft excel has made our work easier with the discounted cash flow formula. Web discounted cash flow valuation model: Web export this template to excel with just one click. The model is completely flexible, so that when you put in the inputs data the model calculates. Web if you're looking for discounted cash flow excel templates, look no further! Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Start your dcf analysis today!Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

discounted cash flow excel template —

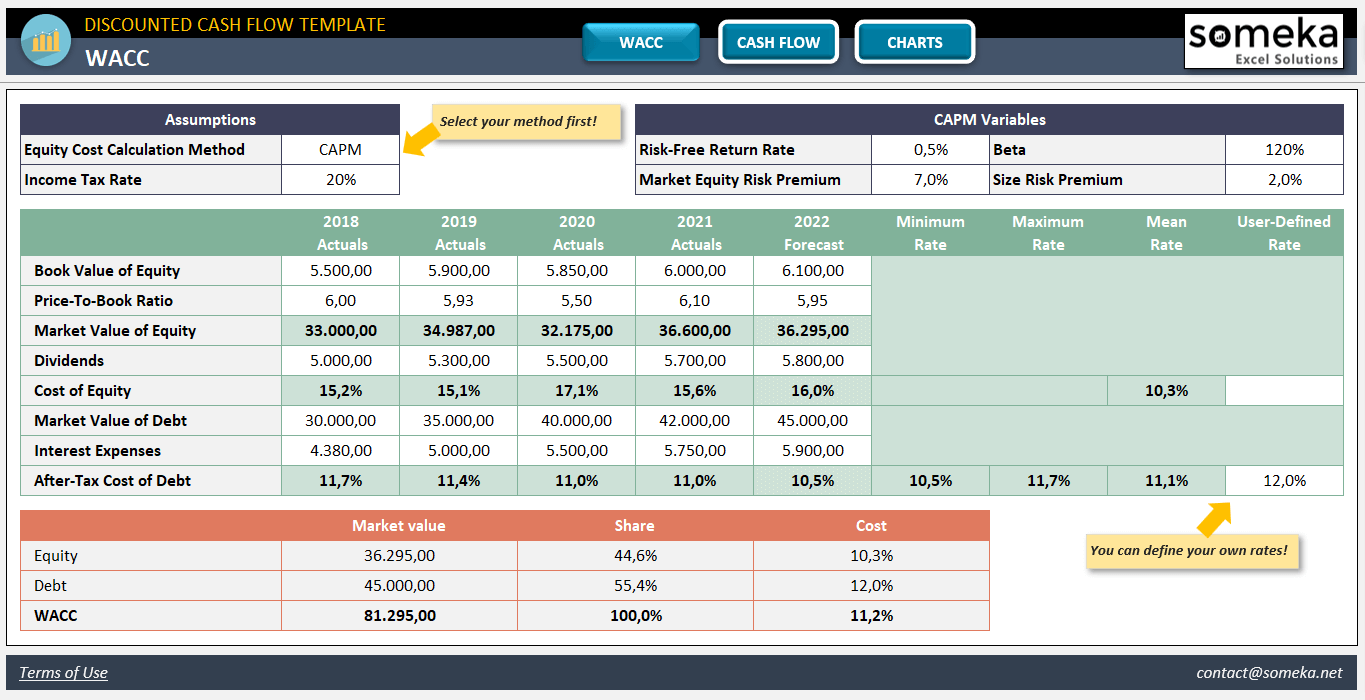

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Cash Flow Excel Template Download from Xlteq

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Discounted Cash Flow (DCF) Excel Model Template Eloquens

7 Cash Flow Analysis Template Excel Excel Templates

Cash Flow Excel Template Forecast Your Cash Flow

Discounted Cash Flow Excel Template DCF Valuation Template

Free Discounted Cash Flow Templates Smartsheet

Related Post: