Excel Debt Snowball Template

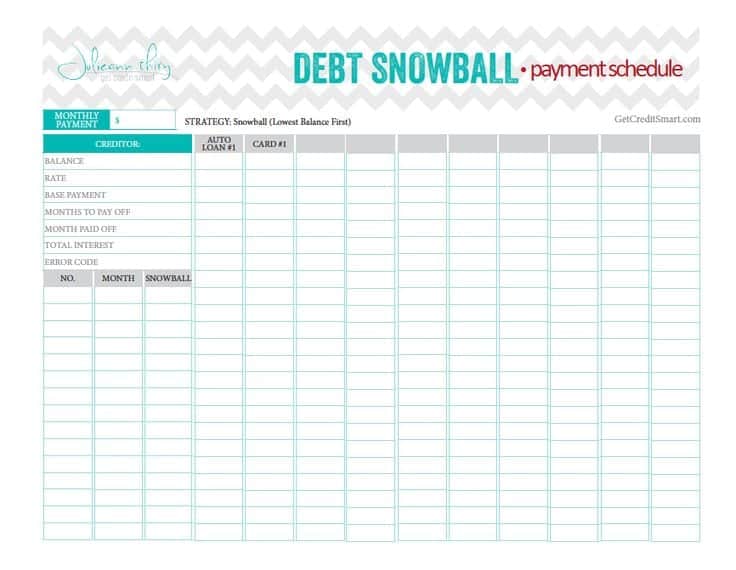

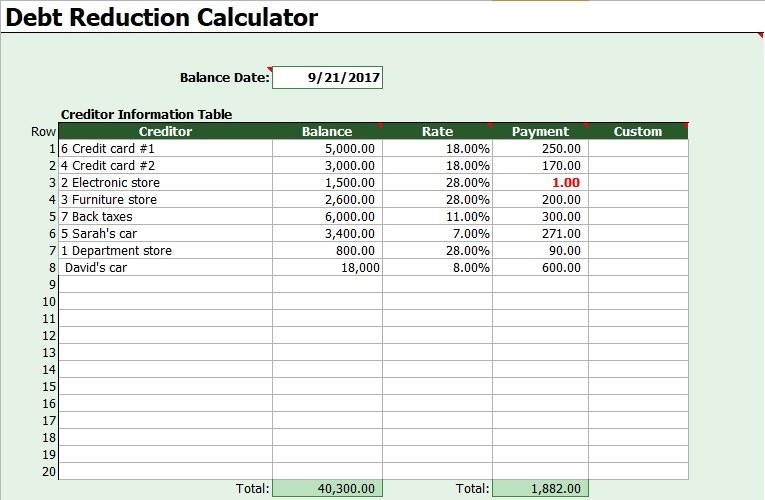

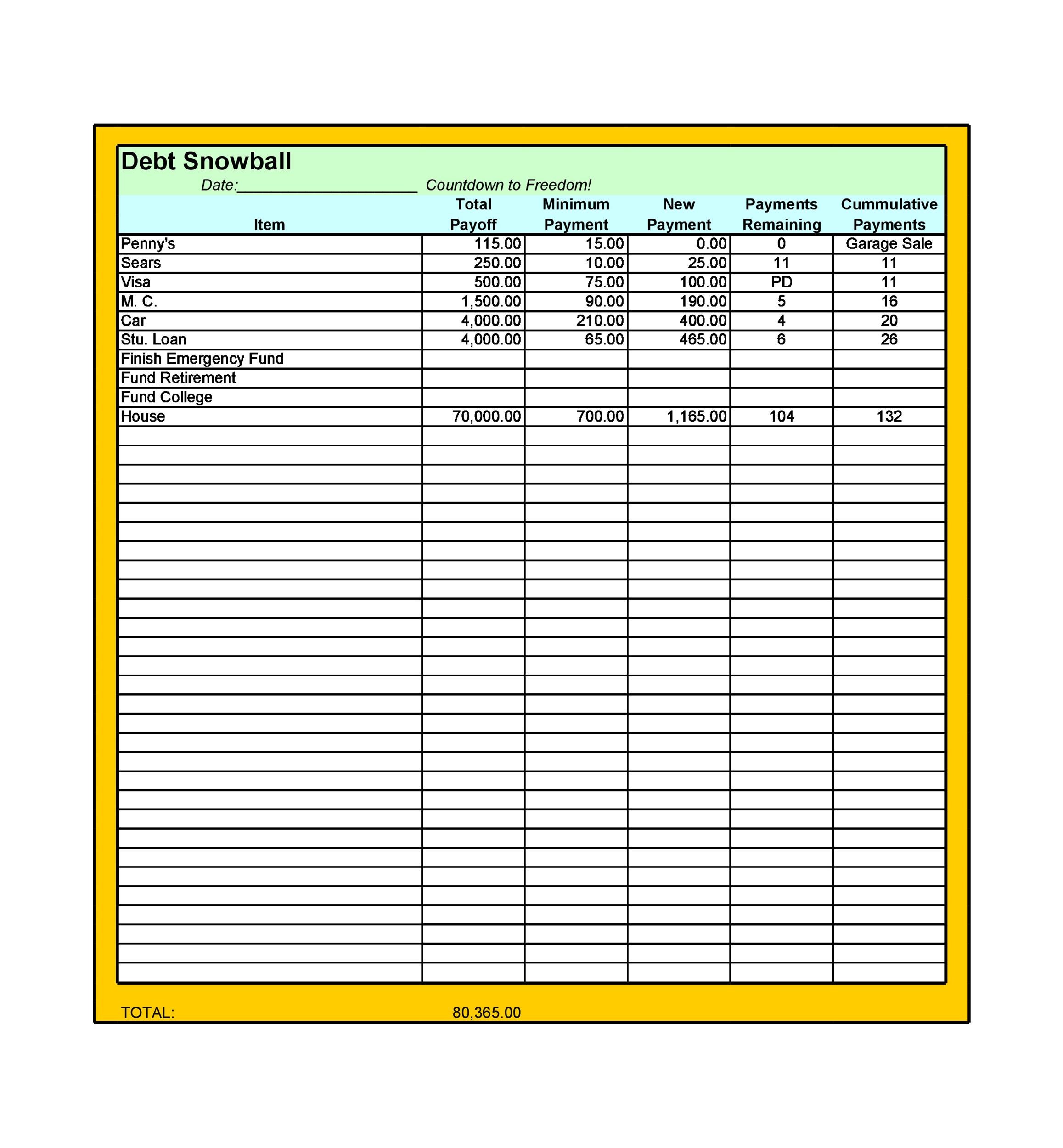

Excel Debt Snowball Template - You can use these forms to list down all your debts and add them to come up with the total. Managing debt is a normal part of the modern financial journey. Use snowball, avalanche, or whatever payoff strategy works best for you. List your debts from smallest to largest balance (ignore interest rate) list your minimum payment amounts for each debt. Once the smallest debt is. Open a blank page in google sheets or excel. Get the perfection hangover debt snowball spreadsheet. Add a column for months. Web track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. The easy budget blog shares tips on money management, debt payoff, frugal living, and more. The easy budget blog shares tips on money management, debt payoff, frugal living, and more. By brynne conroy october 11, 2023. Add a column for months. Continue to pay only the minimum on your larger debts, and put all extra money toward the smallest debt. Web last updated june 30, 2023 google sheets has always been helpful when you need. One of these forms is known as the debt snowball spreadsheet. Add a column for months. Managing debt is a normal part of the modern financial journey. Use it to automaticaly create a debt repayment plan using the debt snowball methods. Life and my finances/business insider though your debts might feel overwhelming, the spreadsheet breaks them down into a simple. Get it for free here. Web a debt snowball spreadsheet will assist you in keeping track of the small payments you make to complete your debt. Continue to pay only the minimum on your larger debts, and put all extra money toward the smallest debt. Web the debt snowball follows these exact steps to help you pay off your debt:. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. Web $ minimum payment $ account name (optional) add debt your household income this includes any income you make each month after taxes (your paycheck, your side hustle—it all counts). Web free snowball debt spreadsheet templates. Monthly. Web snowball debt payoff spreadsheet will allow you to easily calculate and determine exactly how much you need to pay on which debt and when. Continue to pay only the minimum on your larger debts, and put all extra money toward the smallest debt. Both of these will make it easier to set up your debt snowball in excel or. Web track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. Or buy the debt free playbook for $47. Web free snowball debt spreadsheet templates. Organize income, expenses, and debts with ease. Life and my finances/business insider though your debts might feel overwhelming, the spreadsheet breaks them down into a simple payment. Continue to pay only the minimum on your larger debts, and put all extra money toward the smallest debt. Simplify your budgeting and take charge today! Get it for free here. If you’re ready to make a debt snowball spreadsheet, get your free debt snowball spreadsheet template download here. Merilee and her husband paid off $71,000 in debt in just. Organize income, expenses, and debts with ease. Use snowball, avalanche, or whatever payoff strategy works best for you. If you’re ready to make a debt snowball spreadsheet, get your free debt snowball spreadsheet template download here. Web a debt snowball spreadsheet will assist you in keeping track of the small payments you make to complete your debt. Managing debt is. Use snowball, avalanche, or whatever payoff strategy works best for you. Web $ minimum payment $ account name (optional) add debt your household income this includes any income you make each month after taxes (your paycheck, your side hustle—it all counts). Merilee and her husband paid off $71,000 in debt in just over two years using their debt snowball. Web. Then you can plan out how much you’ll set aside per month for your debts. List your debts across the top with your balance, interest, and minimum payment amounts. Get the perfection hangover debt snowball spreadsheet. One of these forms is known as the debt snowball spreadsheet. Web however, the spreadsheet is set up to use the debt snowball. Web $ minimum payment $ account name (optional) add debt your household income this includes any income you make each month after taxes (your paycheck, your side hustle—it all counts). Web debt snowball templates provide a structured and organized approach to debt repayment. Web debt snowball calculator template excel is a debt lessening procedure, whereby one who owes on more than one record pays off the records beginning with the littlest adjusts in the first place, while paying the base installment on bigger obligations. Continue to pay only the minimum on your larger debts, and put all extra money toward the smallest debt. List your debts from smallest to largest balance (ignore interest rate) list your minimum payment amounts for each debt. Add a column for months. Web make extra payments whenever you can to pay off debt faster. Web the snowball budget template is your key to financial control. One of these forms is known as the debt snowball spreadsheet. Use it to automaticaly create a debt repayment plan using the debt snowball methods. Web click here to download sall's free debt snowball tool. Keep in mind that you only have one snowball payment, however, it grows as each debt is paid off. Simplify your budgeting and take charge today! Life and my finances/business insider though your debts might feel overwhelming, the spreadsheet breaks them down into a simple payment. List your debts across the top with your balance, interest, and minimum payment amounts. Merilee and her husband paid off $71,000 in debt in just over two years using their debt snowball. The focus is on savings, but it is based on the debt reduction calculator, so it lets you include debt payoff in addition to your savings goals. I just was making some updates to our budgeting templates page where we have a bunch of free excel and google doc spreadsheets available. Web the debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Features of debt snowball excel template.9+ Debt Snowball Excel Templates Excel Templates

Dave Ramsey Debt Snowball Worksheets —

Debt Snowball Tracker Digital Excel Payoff Spreadsheet Etsy

Easy to use Digital Debt Snowball Excel Template Etsy

Debt Snowball Calculator Template Excel Excel TMP

38 Debt Snowball Spreadsheets, Forms & Calculators

Dave Ramsey Inspired Debt Snowball Spreadsheet Excel Etsy

Snowball Debt Payoff Spreadsheet ExcelTemplate

38 Debt Snowball Spreadsheets, Forms & Calculators

5 Debt Snowball Excel Templates Excel xlts

Related Post: