Illinois Secured Promissory Note Template

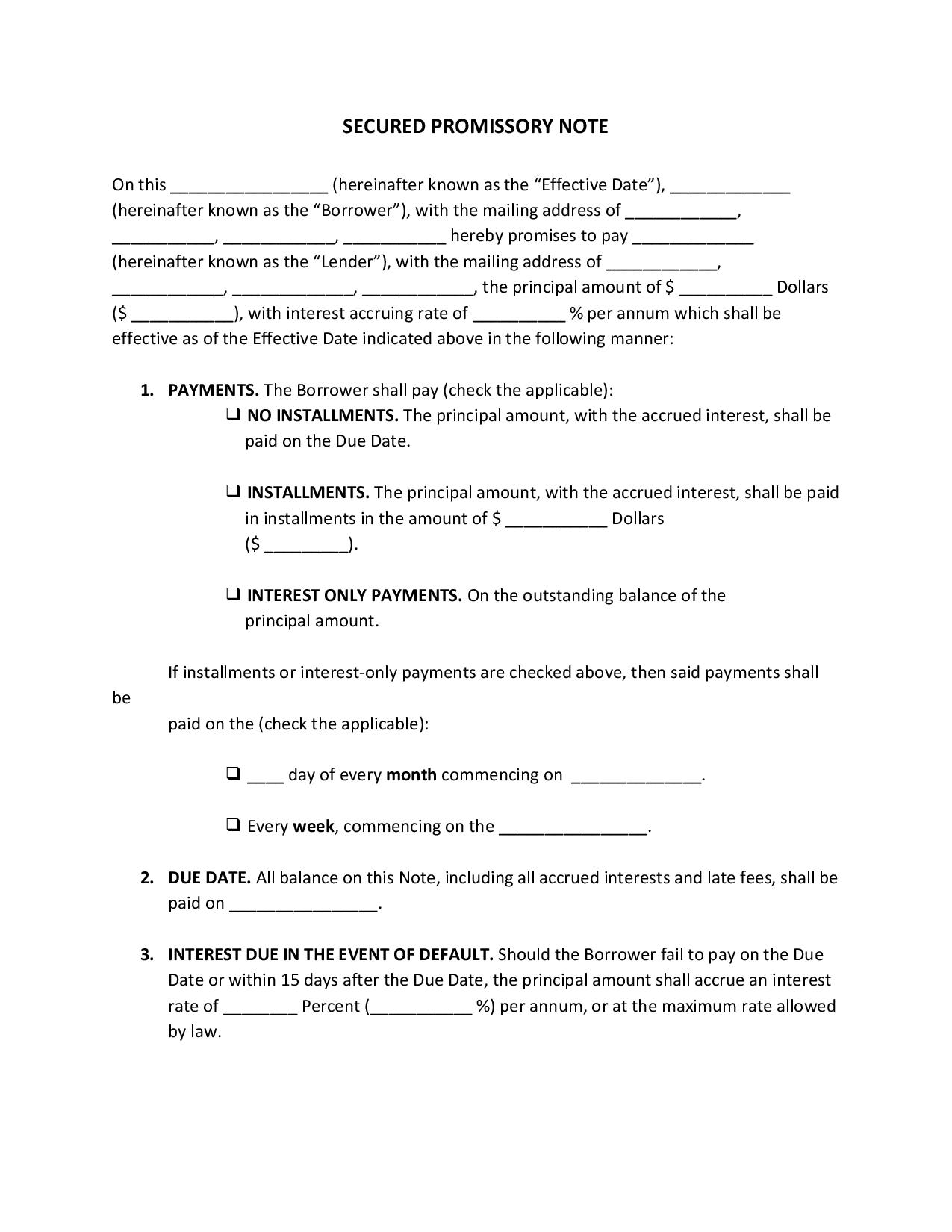

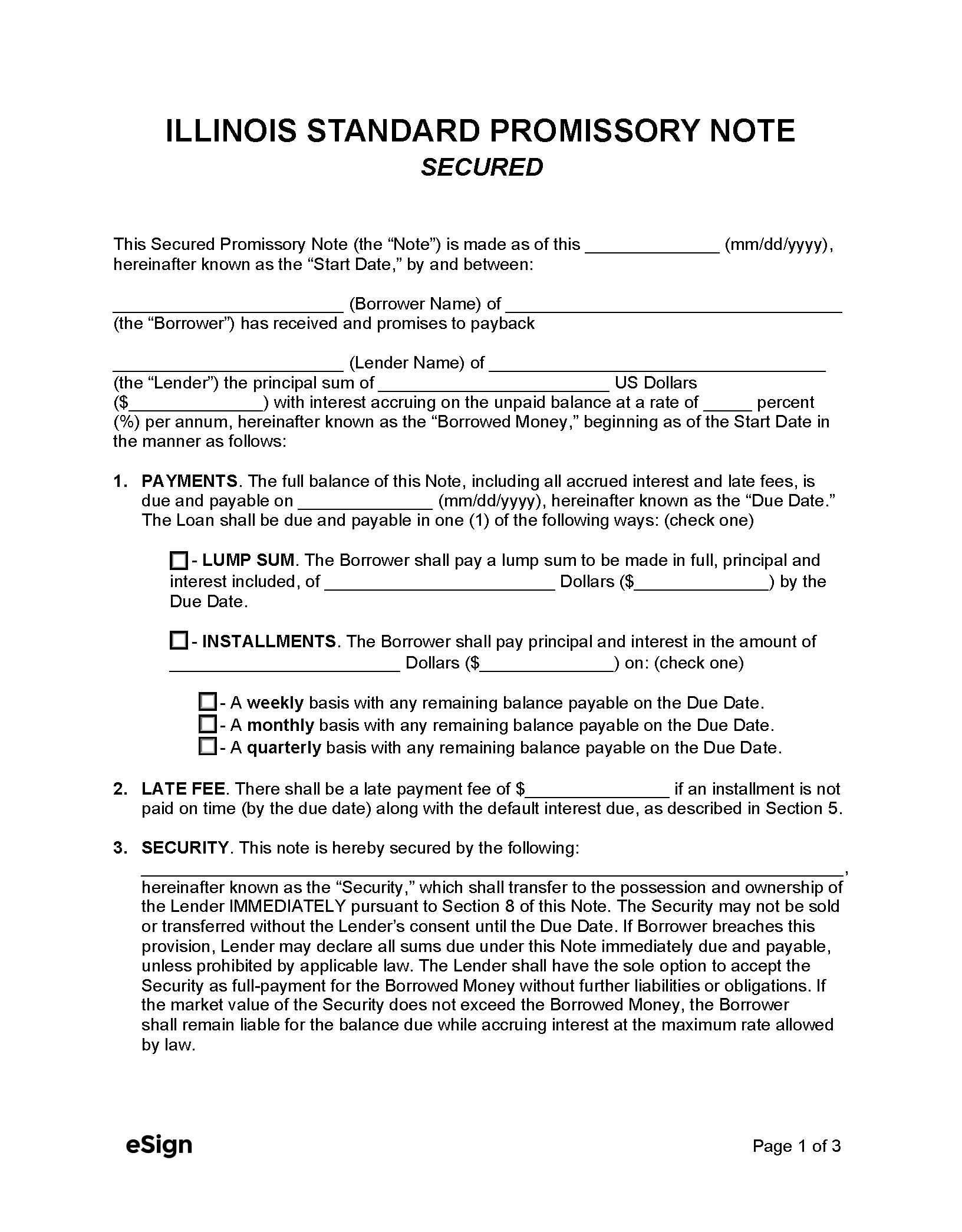

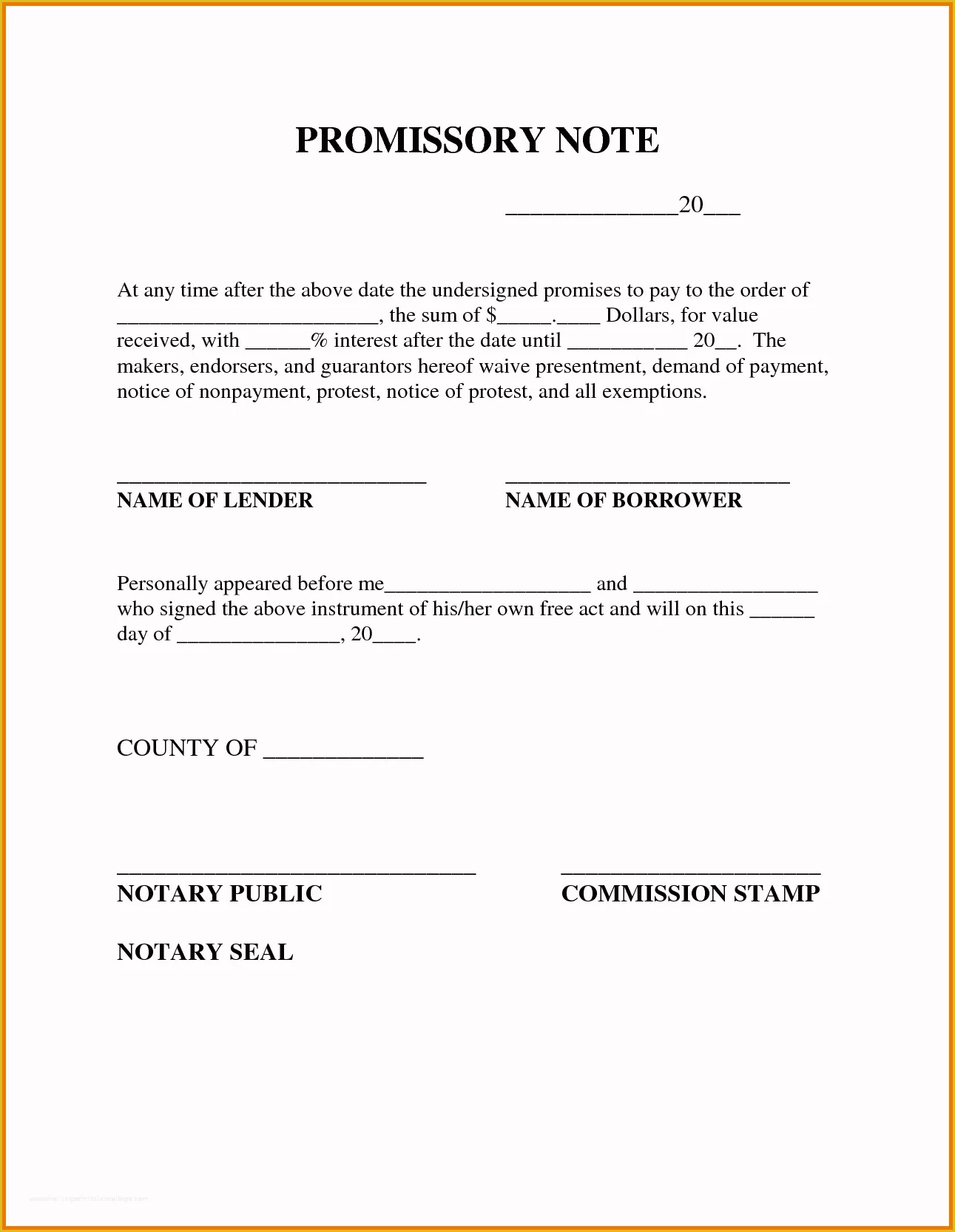

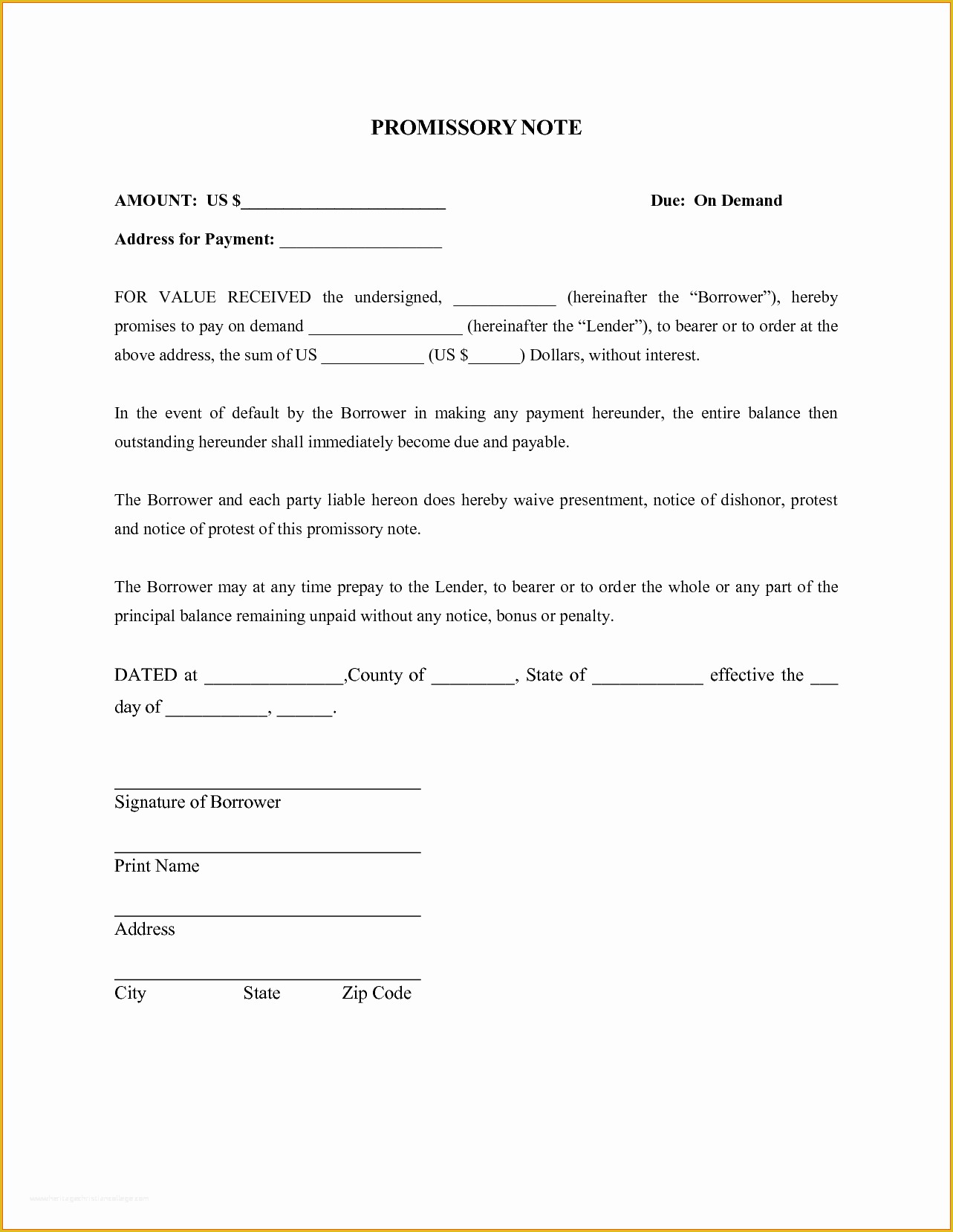

Illinois Secured Promissory Note Template - The same goes for debt agreements, where money has been exchanged between a lender and a borrower. Lenders have a higher risk when using unsecured loans/notes, therefore they are typically only issued to. It includes information such as the amount of the loan, the interest rate, the repayment schedule, and any collateral that is being used to secure the loan. [borrower's name] with a mailing address of [mailing address] (“borrower”), and lender: ________________________ (borrower name) of ___________________________________ (the “borrower”) has received and promises. The illinois secured promissory note template is available for download in ms word or.pdf format. [lender's name] with a mailing address of [mailing address] (“lender”). Common types of secured promissory notes include a car loan or mortgage. You need a promissory note illinois form to denote the transaction. Web the illinois standard secured promissory note template is a legal document that outlines the terms of a loan between a lender and a borrower. This secured promissory note (the “note”) is made as of [mm/dd/yyyy], hereinafter known as the “start date,” by and between: It’ll ensure legal compliance and protection for the lender and borrower in the state of illinois. Lenders have a higher risk when using unsecured loans/notes, therefore they are typically only issued to. An illinois secured promissory note is a document. The illinois unsecured promissory note template is a legal document that is available in.pdf or word format. This illinois secured standard promissory note (“note”) made on _______________, 20____ is by and between: This helps to ensure the borrower makes timely and consistent payments to the lender. You need a promissory note illinois form to denote the transaction. An illinois promissory. It includes information such as the amount of the loan, the interest rate, the repayment schedule, and any collateral that is being used to secure the loan. An illinois secured promissory note is a document that records a promise to pay back a loan secured by collateral. Web illinois secured promissory note template. In a secured lending arrangement, the borrower. Areas of the document that will need to be agreed upon consist of payment types, interest rates, items to be used as security, and many. Web the illinois standard secured promissory note template is a legal document that outlines the terms of a loan between a lender and a borrower. Web a secured promissory note allows the lender to secure. Web the illinois promissory notation templates are designed to be used as a starting spot when drafting a secured or unsecured promissory note. It’ll ensure legal compliance and protection for the lender and borrower in the state of illinois. Web the illinois standard secured promissory note template is a legal document that outlines the terms of a loan between a. An illinois promissory note is a written promise to repay a loan. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. The difference between a secured and unsecured remarks, is that unsecured notes do not do current pledged by the borrower more deposit. The difference between a secured. Web illinois standard promissory note. The illinois promissory note templates are designed to be used as a starting point when drafting a secured or unsecured promissory note. The same goes for debt agreements, where money has been exchanged between a lender and a borrower. Web secured promissory note the parties. _______________, with a mailing address of ______________________________, (“borrower”), and lender: It’ll ensure legal compliance and protection for the lender and borrower in the state of illinois. The most common form of a secured promissory note is a car loan or a mortgage. Common types of secured promissory notes include a car loan or mortgage. Web create my document what is an illinois promissory note? A promissory note may be secured. Web use this free promissory note template for illinois when formalizing a loan agreement. The illinois secured promissory note template is available for download in ms word or.pdf format. In a secured lending arrangement, the borrower pledges a specific asset to the lender that serves as an assurance for loan repayment. The same goes for debt agreements, where money has. Common types of secured promissory notes include a car loan or mortgage. [lender's name] with a mailing address of [mailing address] (“lender”). The difference between a secured and unsecured remarks, is that unsecured notes do not do current pledged by the borrower more deposit. The same goes for debt agreements, where money has been exchanged between a lender and a. If the borrower defaults on the loan, and fails to cure the default, the lender may legally take possession of. The difference between a secured and unsecured note, is that unsecured notes do not have assets pledged by the borrower as collateral. An illinois secured promissory note binds two parties to a contract requiring a borrower (of a monetary balance) to reimburse a lender the loaned amount of money plus interest over time. It’ll ensure legal compliance and protection for the lender and borrower in the state of illinois. It includes information such as the amount of the loan, the interest rate, the repayment schedule, and any collateral that is being used to secure the loan. A promissory note may be secured or unsecured. The illinois promissory note templates are designed to be used as a starting point when drafting a secured or unsecured promissory note. [borrower name] (borrower name) of [borrower address] (the “borrower”) has received and promises to payback In a secured lending arrangement, the borrower pledges a specific asset to the lender that serves as an assurance for loan repayment. Web illinois secured promissory note template. An illinois promissory note is a written promise to repay a loan. Web updated april 08, 2022 an illinois unsecured promissory note is utilized by two parties consisting of a lender and a borrower and adds structure and legality to the agreement. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate. ________________________ (borrower name) of ___________________________________ (the “borrower”) has received and promises. If a borrower defaults on a secured promissory note, the lender. Web secured promissory note the parties this illinois secured promissory note (“note”) made on [date], is by and between: Web create my document what is an illinois promissory note? _______________, with a mailing address of ______________________________, (“borrower”), and lender: The template is free to customize to fit your requirements and reduce the risk of disputes. Web use this free promissory note template for illinois when formalizing a loan agreement.FREE Promissory Note Forms

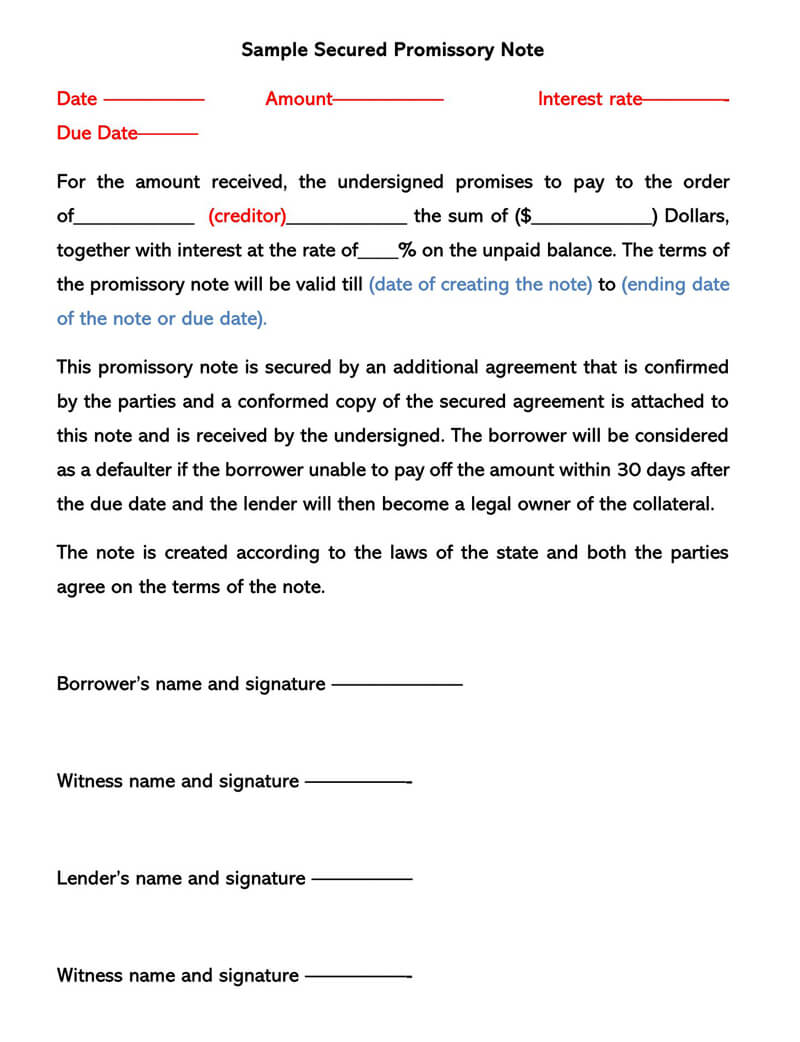

Free Secured Promissory Note Template

Free Illinois Secured Promissory Note Template PDF Word

Free Promissory Note Template Illinois Printable Templates

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Illinois Promissory Note Template

free secured promissory note templates by state basic promissory note template illinois doc

Secured Promissory Note Templates (Free) [Word, PDF, ODT]

Secured Promissory Note Template

Free Illinois Secured Promissory Note Template Word PDF eForms

Related Post:

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-06.jpg?w=395)

![Secured Promissory Note Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/03/Standard-Secured-Promissory-Note-Templates.Legal_.jpg)