Irs Mandated Wisp Template

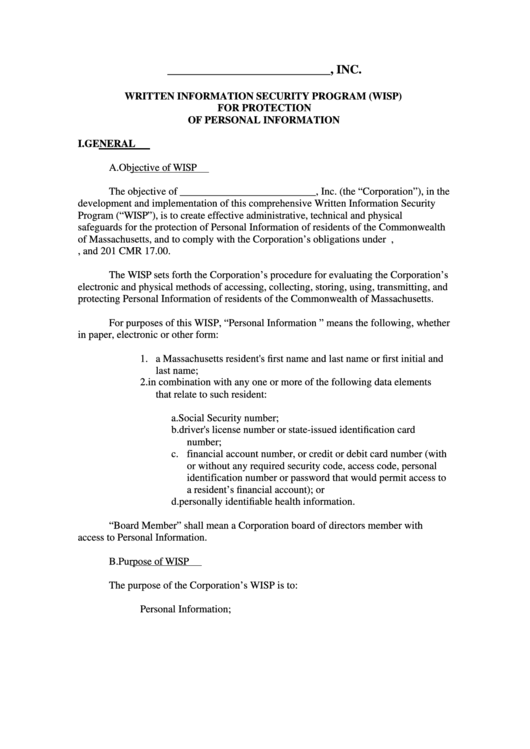

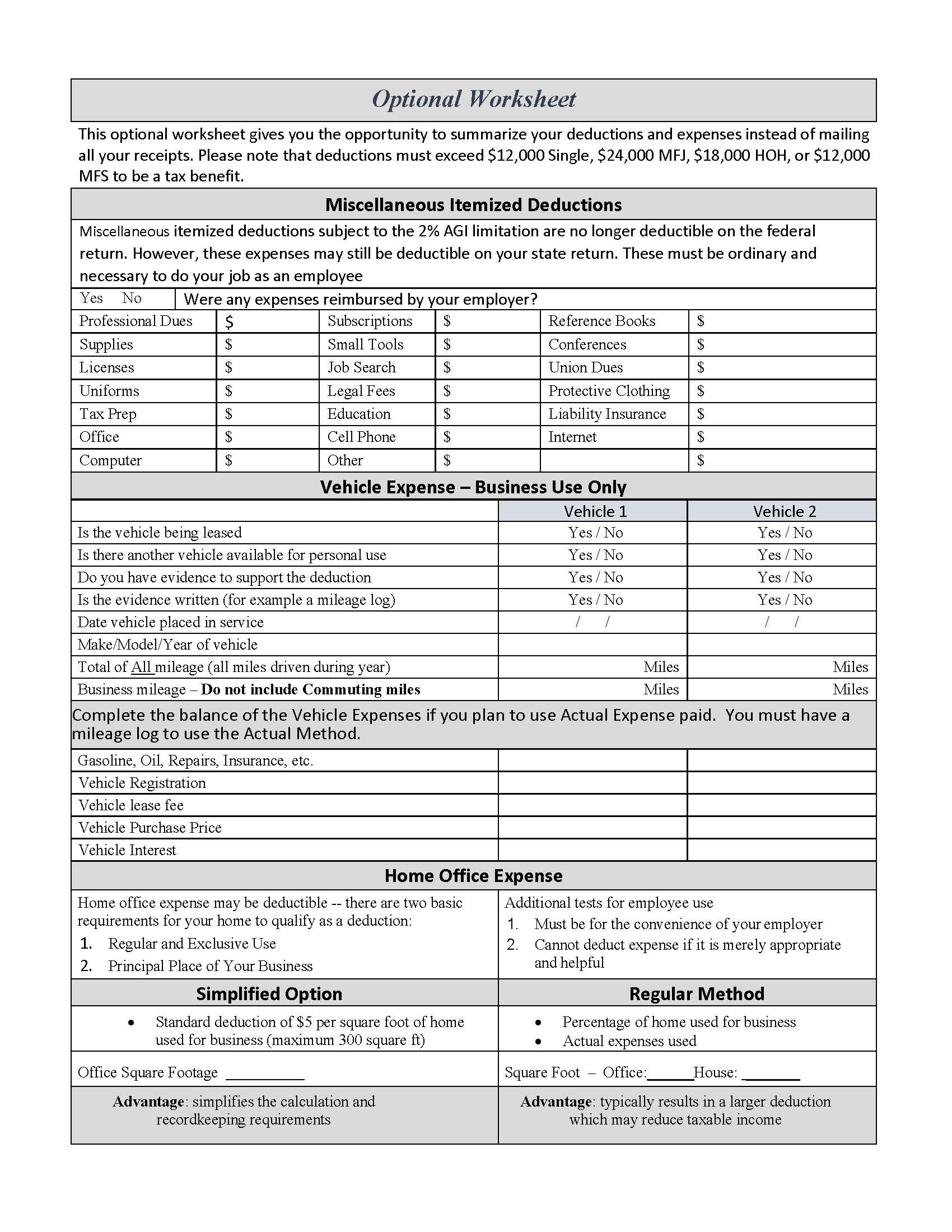

Irs Mandated Wisp Template - Ad download our free template today! Web the requirements for written information security plans (wisp) came out in august of this year following the “irs security summit.”. Identify, protect, detect, respond and recover. Expert discussion on the irs’s wisp template and the importance of a data security plan by: In 2022 the irs security summit declare that all tax preparers need to use an irs wisp template for. Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web the wisp, available on irs.gov and in publication 5708 pdf, begins with the basics. On august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers must have a written. On august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers must have a written. You will need to use an editor such as microsoft word or equivalent to open and edit the file. Web the irs is forcing all tax pros to have a wisp. Key components in your firm’s written information security. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax. Web tax and accounting professionals have a new resource for implementing or improving their written. Web the national association of tax professionals (natp) is the largest association dedicated to equipping tax professionals with the resources, connections and. Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. Web irs publications 4557 and 5293 provide guidance in creating a. Free to use and modify to fit your needs. Identify, protect, detect, respond and recover. You will need to use an editor such as microsoft word or equivalent to open and edit the file. National association of tax professionals october 11, 2022. Web its focus is on five principles: This document is for general distribution and is available to all employees. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. It walks users through getting started on a plan, including understanding security. Proven framework w/ dependable results. Expert discussion on the irs’s wisp template and the importance of a. Web the wisp, available on irs.gov and in publication 5708 pdf, begins with the basics. Download our free written information security plan template for accountants. Web thomson reuters tax & accounting. Web the template is free to use and to modify as it applies to your company. The sample plan is available on irs.gov. National association of tax professionals october 11, 2022. Web the special plan, called a written information security plan or wisp, is outlined in publication 5708, creating a written information security plan for your tax. Ad compliance with sec, finra, irs, aicpa and more. It walks users through getting started on a plan, including understanding security. Written information security plan (wisp). It walks users through getting started on a plan, including understanding security. Web the national association of tax professionals (natp) is the largest association dedicated to equipping tax professionals with the resources, connections and. This document is for general distribution and is available to all employees. Key components in your firm’s written information security plan while primarily targeted at companies. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Free to use and modify to fit your needs. Written information security plan (wisp) for. Web a wisp is a written information security plan that is required for certain businesses, such as tax professionals. The irs currently offers a 29. All tax and accounting firms should do the following:. Proven framework w/ dependable results. The sample plan is available on irs.gov. In 2022 the irs security summit declare that all tax preparers need to use an irs wisp template for. Expert discussion on the irs’s wisp template and the importance of a data security plan by: A security plan should be appropriate to the company’s size, scope of activities, complexity and the sensitivity of the customer. Web the wisp, available on irs.gov and in publication 5708 pdf, begins with the basics. Download our free written information security plan template for accountants. Expert discussion on the irs’s wisp template and the importance of a data security plan by: Written information security plan (wisp) for. Web sample template written information security plan (wisp) added detail for consideration when creating your wisp define the wisp objectives, purpose, and scope identify. Web in conjunction with the security summit, irs has now released a sample security plan designed to help tax pros, especially those with smaller practices, protect their data and. Proven framework w/ dependable results. Web irs publications 4557 and 5293 provide guidance in creating a wisp that is scaled to the firm’s operations. Identify, protect, detect, respond and recover. Web the national association of tax professionals (natp) is the largest association dedicated to equipping tax professionals with the resources, connections and. Web practitioner requirement to develop a written information security plan. In 2022 the irs security summit declare that all tax preparers need to use an irs wisp template for. The irs currently offers a 29. Web its focus is on five principles: Web washington — the irs, state tax agencies and the nation’s tax industry today reminded all “professional tax preparers” that federal law requires them to create a. On august 9th, 2022 the irs and security summit have issued new requirements that all tax preparers must have a written. It walks users through getting started on a plan, including understanding security. All tax and accounting firms should do the following:. Web our free information security plan template, which you can download for free by filling out the form, covers topics that range from:Wisp Template For Tax Professionals Printable Templates

Irs Wisp Template

Written Information Security Plan (WISP) Tech 4 Accountants

Wisp Template For Tax Professionals Printable Templates

Letter To Irs Business Name Change Leweter pertaining to Deed Poll

Irs Wisp Template

Wisp Template For Tax Professionals Printable Templates

Irs Wisp Template

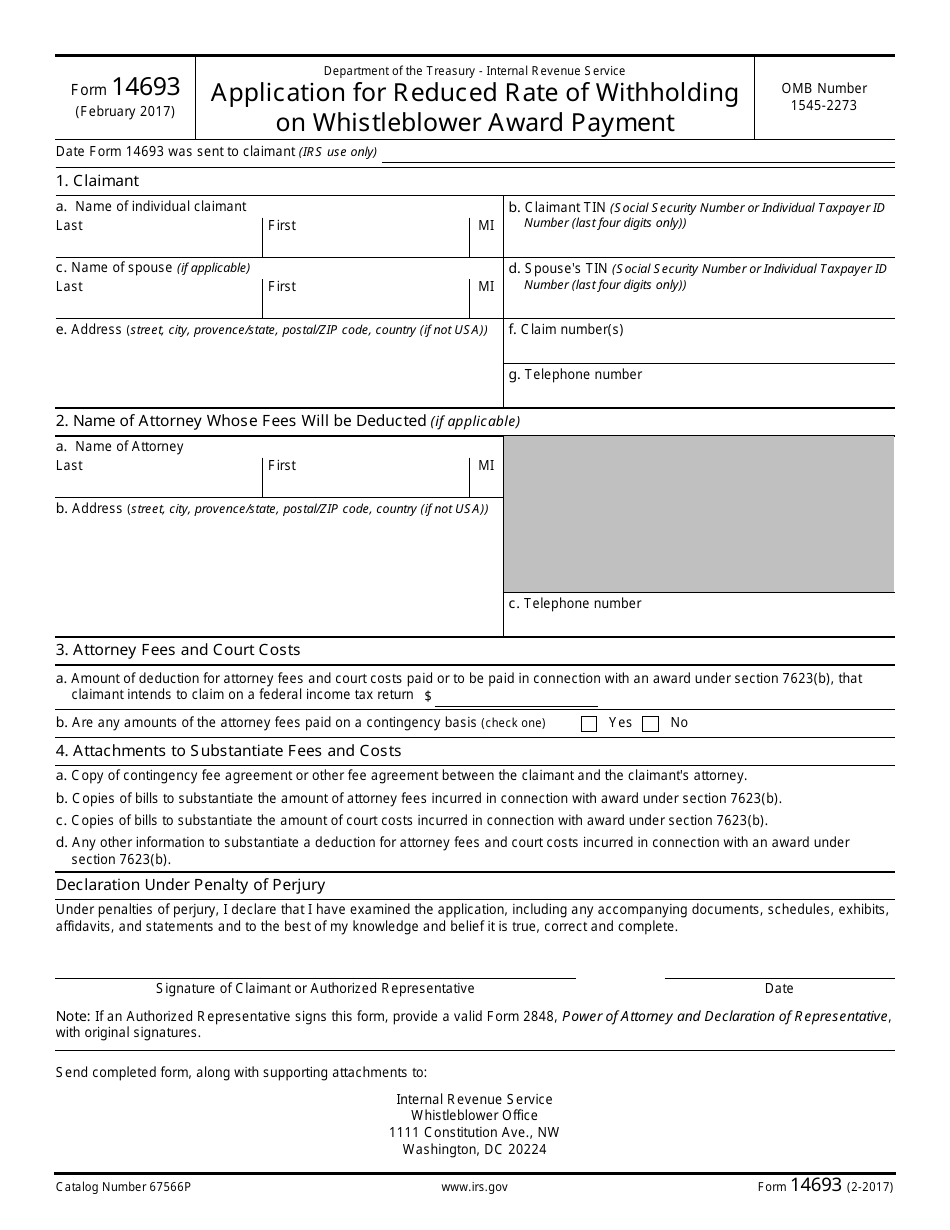

IRS Form 14693 Download Fillable PDF or Fill Online Application for

Wisp Template For Tax Professionals Printable Templates

Related Post: