M&A Integration Plan Template

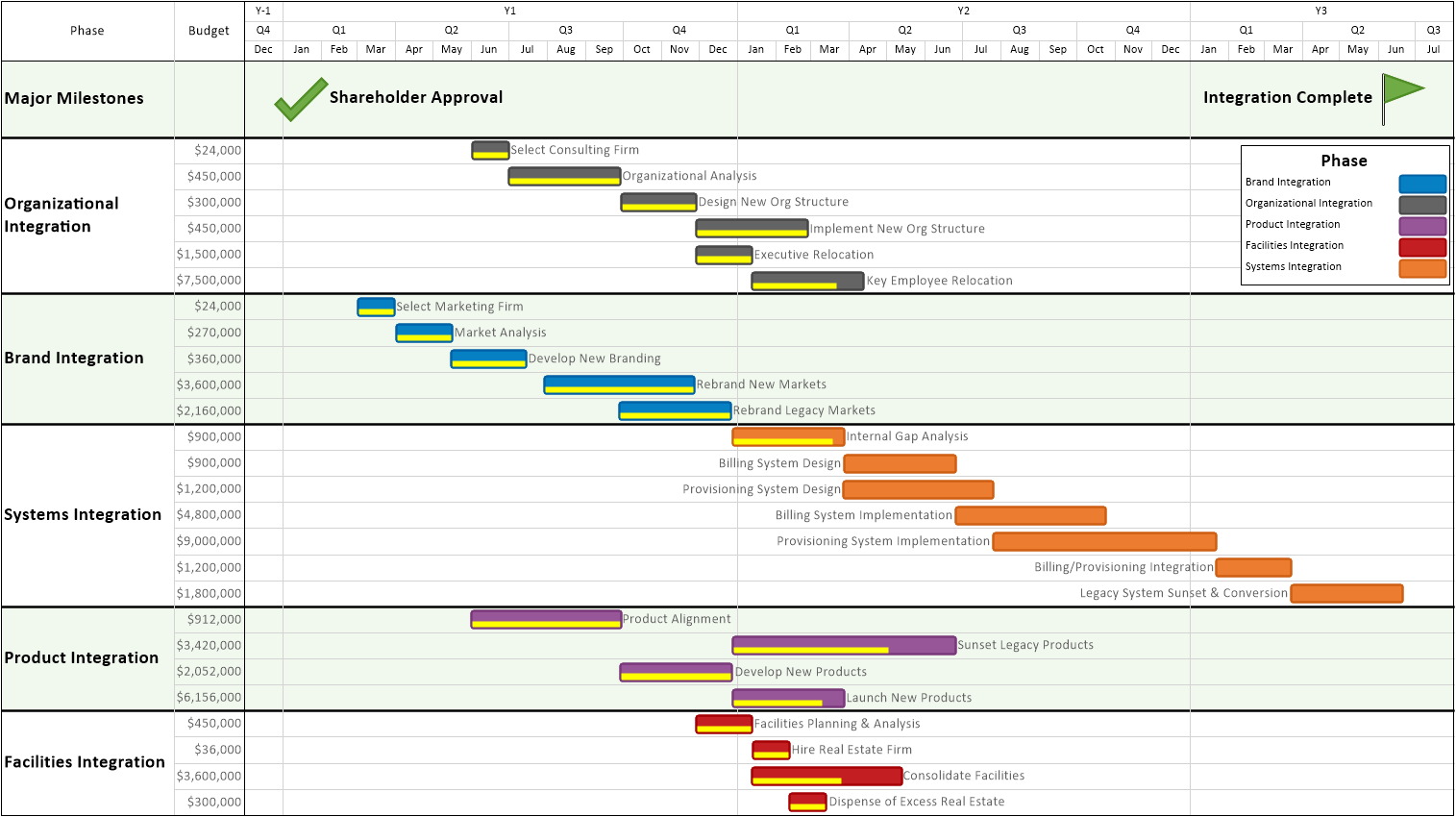

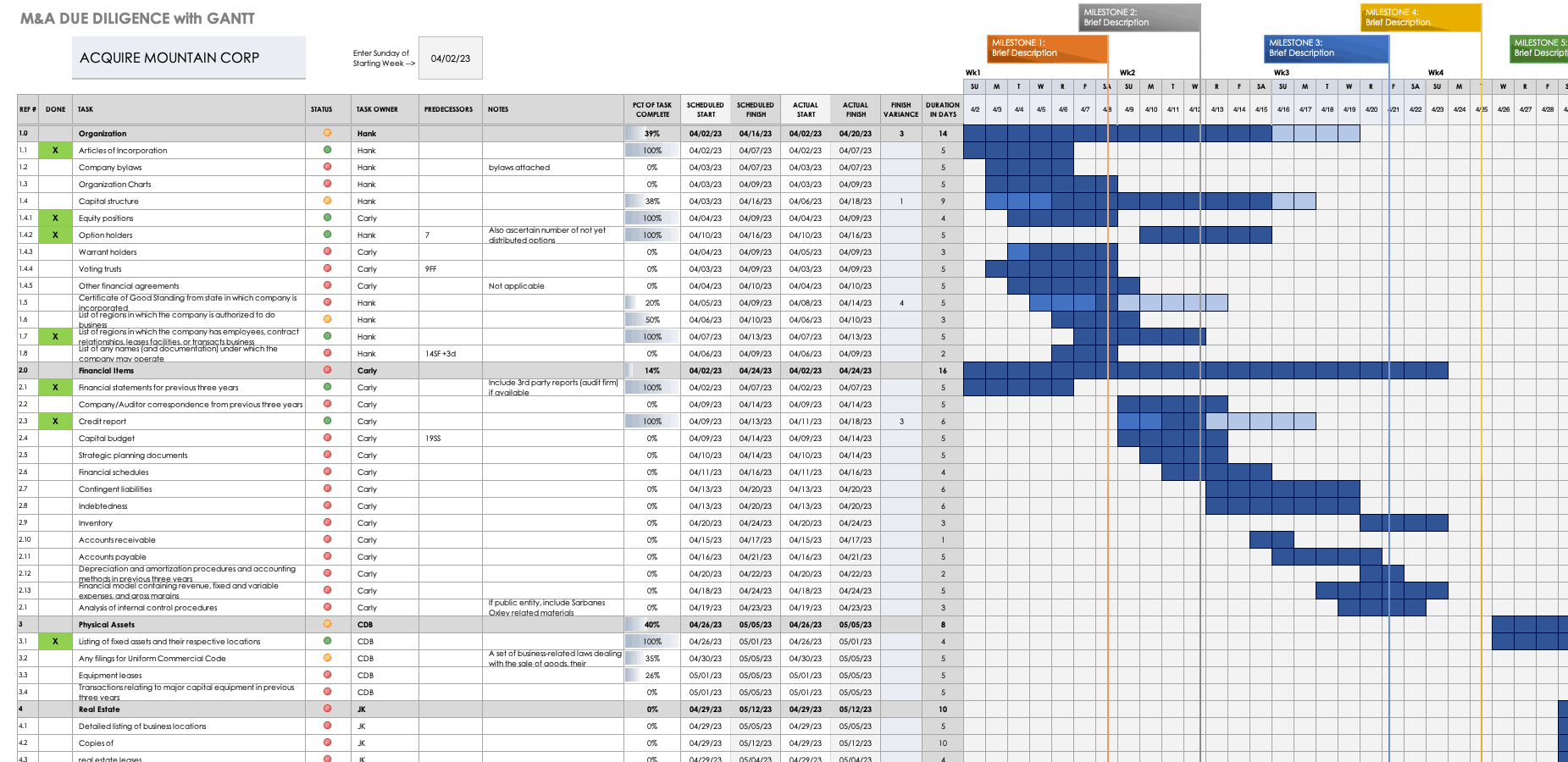

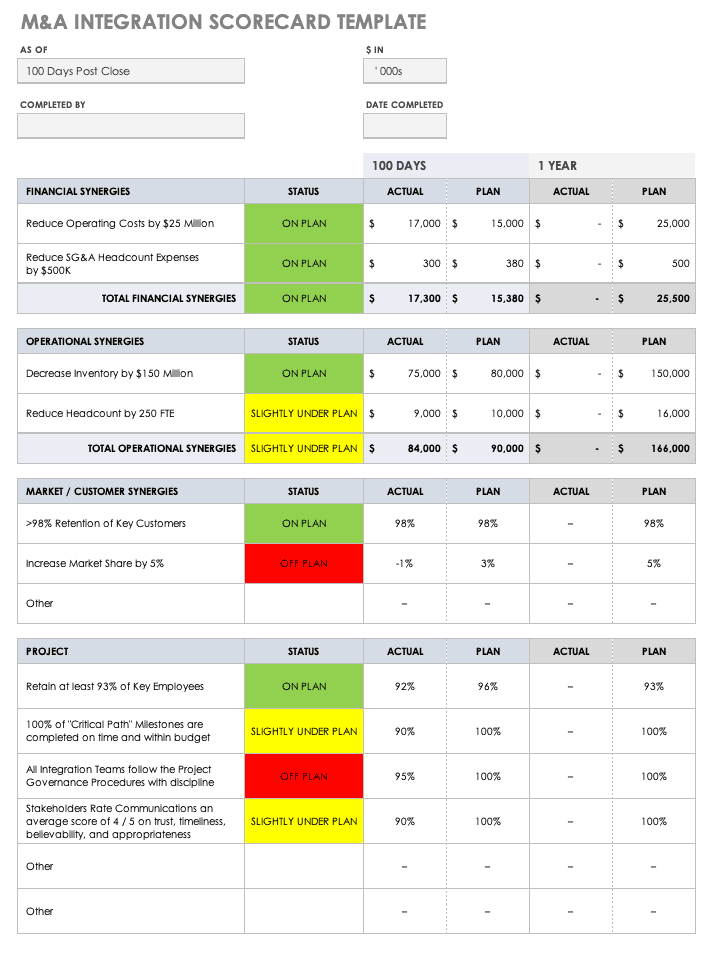

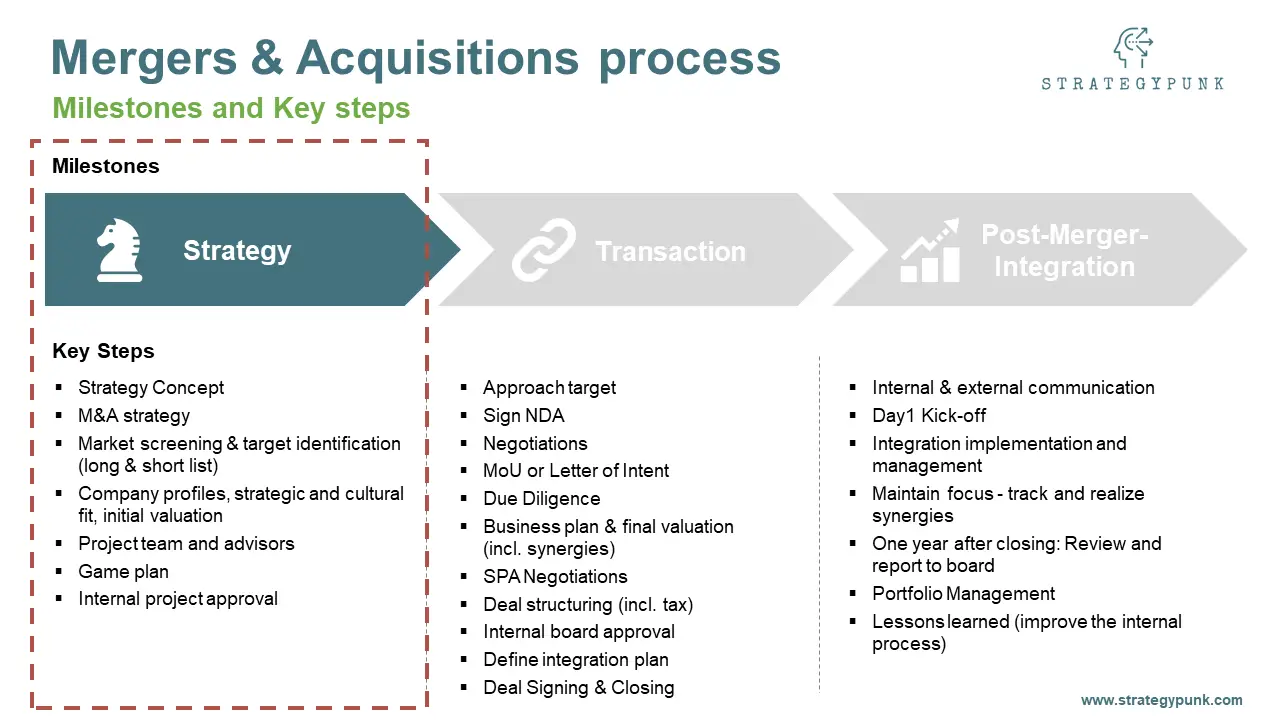

M&A Integration Plan Template - Web how to model synergies in m&a. With our m&a integration template, you can itemize tasks and take this process one step at a time! Web a typical m&a integration timeline should include the following nine phases: Web free due diligence & integration checklists / templates | agile m&a templates essential downloadable checklists & templates for m&a use these free m&a checklists to streamline your due diligence & integration process today. Most suitable during integration planning and execution for complex m&a transactions; The 100 day m&a plan example is in xls format. Web for its part, the market assessment acts as a “sense check” for business leaders, ensuring that the company’s m&a strategy capitalizes on the most recent and relevant trends, accounts for potential disruptions, and acknowledges competitors’ likely actions and reactions. The initial responsibility in an m&a integration is to define and determine the value drivers and guiding principles of the deal that supports the vision and integration strategy. The acquisition integration project plan tools and templates are organized in these categories: Web a typical m&a integration timeline can include the following nine phases: Web free due diligence & integration checklists / templates | agile m&a templates essential downloadable checklists & templates for m&a use these free m&a checklists to streamline your due diligence & integration process today. Web a typical m&a integration timeline can include the following nine phases: Acquisition / existing corporate strategy alignment b. This checklist provides a framework for integration. Web in order to ensure that the goals of the combined entities are captured, addressed and strategically planned for, you need an “m&a integration plan” that outlines exactly how and when complicated processes, resources, assets, and, most importantly, people of the acquiring and acquired companies will be combined. Business goals for the deal. Web a typical m&a integration timeline should. Web m&a tools & templates. Web free due diligence & integration checklists / templates | agile m&a templates essential downloadable checklists & templates for m&a use these free m&a checklists to streamline your due diligence & integration process today. With hr playing a leadership role from the beginning of the m&a process, it is more likely that the organization will. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Web synergy for the deal. Web this checklist is tailored specifically to assist practitioners accomplish it aspects of integration during an m&a transaction. Different types of integration checklists & areas 2. Today we. Web m&a tools & templates. The initial responsibility in an m&a integration is to define and determine the value drivers and guiding principles of the deal that supports the vision and integration strategy. Web a typical m&a integration timeline should include the following nine phases: Example of m&a presentation template that covers the 4 deal s’s: Treasury | sap integration. These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as pdf files. Web a typical m&a integration timeline should include the following nine phases: Different types of integration checklists & areas 2. Acquisition / existing corporate strategy alignment b. Agile m&a templates agile m&a templates traditional vs. Web in order to ensure that the goals of the combined entities are captured, addressed and strategically planned for, you need an “m&a integration plan” that outlines exactly how and when complicated processes, resources, assets, and, most importantly, people of the acquiring and acquired companies will be combined. Web synergy for the deal. Over the past few years, the rcp. Today we look at m&a integration playbooks, checklists, frameworks, planning, templates, and other integration methods. Hr leadership also can lead the organization’s efforts to identify potential business and human capital risks, and shape the strategy and integration plan. Acquisition / existing corporate strategy alignment b. This checklist provides a framework for integration tasks at 30, 60, and 100 day intervals,. Value delivery objectives and targets Example of m&a presentation template that covers the 4 deal s’s: Today we look at m&a integration playbooks, checklists, frameworks, planning, templates, and other integration methods. A process of rearranging business with the merger and acquisition of one company by another. Web how to model synergies in m&a. Example of m&a presentation template that covers the 4 deal s’s: With our m&a integration template, you can itemize tasks and take this process one step at a time! Business goals for the deal. Value delivery objectives and targets Acquisition / existing corporate strategy alignment b. Vision and mergers & acquisitions integration strategy. Value delivery objectives and targets The 100 day m&a plan example is in xls format. Web free due diligence & integration checklists / templates | agile m&a templates essential downloadable checklists & templates for m&a use these free m&a checklists to streamline your due diligence & integration process today. Treasury | sap integration | financial close | operational reporting | financial reporting | tax | inventory accounting | acquisition process | investor relations | synergy tracking | organization design Use this spreadsheet to log tasks and assign owners, as well as track their. Digital solutions to accelerate readiness. Why do you need one? 1) strategy for the deal 2) synergy for the companies 3) structure of the deal, and 4) steps for the m&a integration. Different types of integration checklists & areas 2. With our m&a integration template, you can itemize tasks and take this process one step at a time! Web synergy for the deal. Web in order to ensure that the goals of the combined entities are captured, addressed and strategically planned for, you need an “m&a integration plan” that outlines exactly how and when complicated processes, resources, assets, and, most importantly, people of the acquiring and acquired companies will be combined. Acquisition / existing corporate strategy alignment b. The initial responsibility in an m&a integration is to define and determine the value drivers and guiding principles of the deal that supports the vision and integration strategy. Business goals for the deal. A process of rearranging business with the merger and acquisition of one company by another. These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as pdf files. Web for its part, the market assessment acts as a “sense check” for business leaders, ensuring that the company’s m&a strategy capitalizes on the most recent and relevant trends, accounts for potential disruptions, and acknowledges competitors’ likely actions and reactions. Determine the value drivers that will guide the integration strategy.OnePager Pro M&A Integration Schedules Made Easy with Timeline Software

Download Free M&A Templates Smartsheet

M&A Integration PostMerger Integration Process Guide (2021)

Acquisition Integration Plan Template New Merger Integration Work How

M&A Integration PostMerger Integration Process Guide

PostMerger Integration M&A Integration Process Guide (2023)

Download Free M&A Templates Smartsheet

M&A Integration Logicore

M&A and Strategic Partnerships Free PowerPoint template

Mergers & Acquisitions Process Guide and free template

Related Post: