Npv Calculator Excel Template

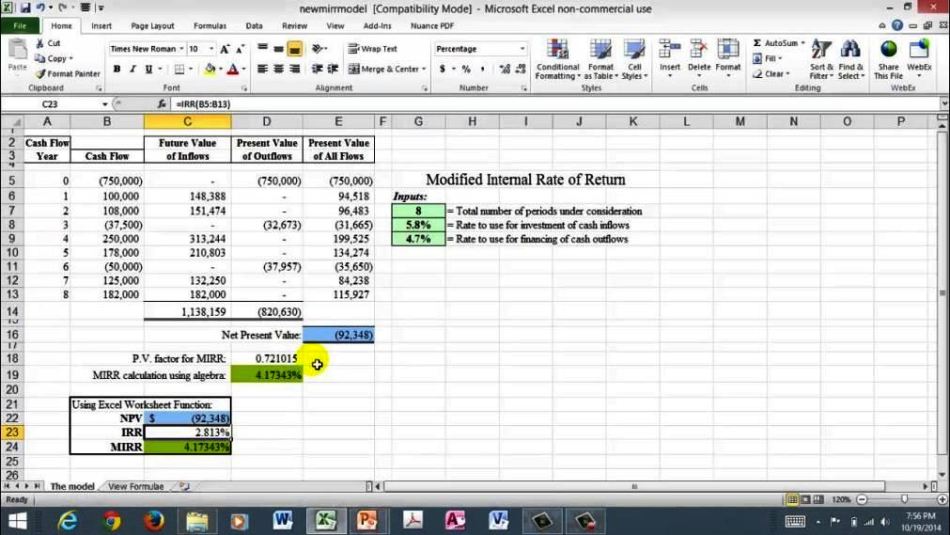

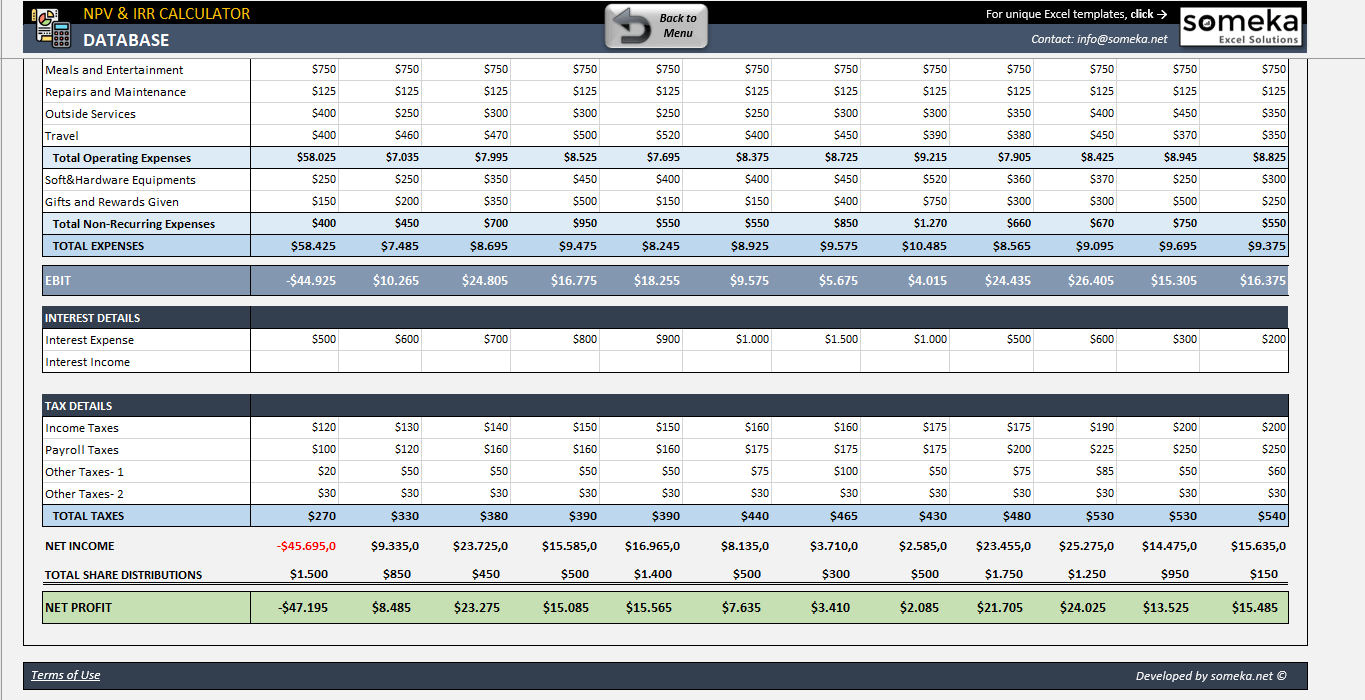

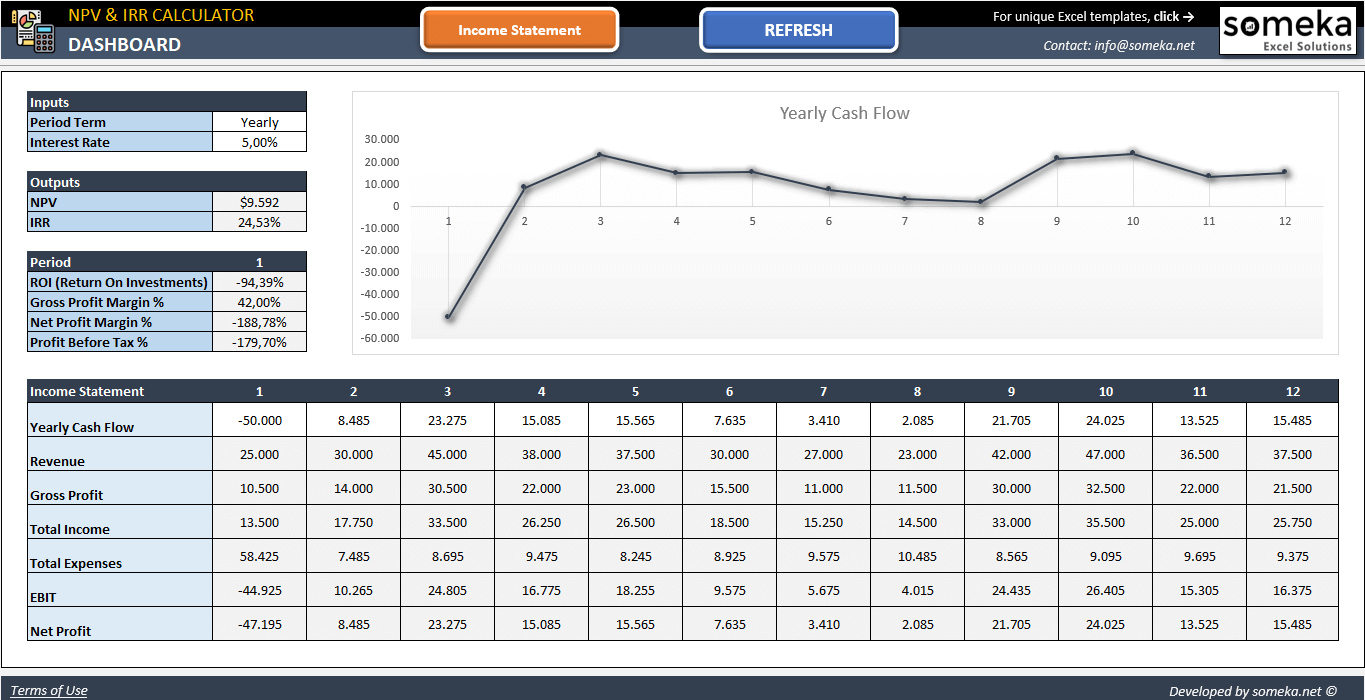

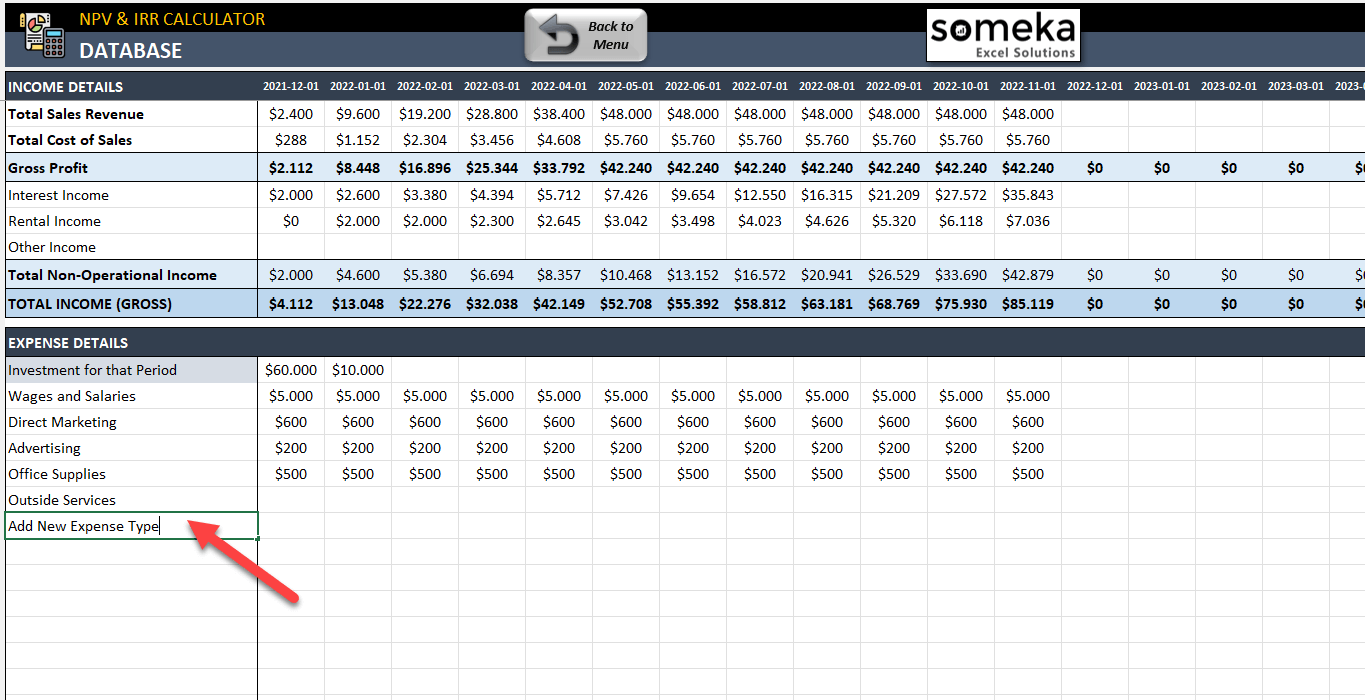

Npv Calculator Excel Template - Here is a screenshot of the net present. The calculation is performed to find. Let’s say that you have the following cash flow data (in column c). Web net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. Let’s calculate the net present value. Type “=npv (“ and select the discount rate “,”. Net present value is calculated using. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. And in this spreadsheet, this calculation is used to compare three different projects or. Web this gives you the total present value of expected cash flows. First, we have to calculate the present value the output will be: Obtain the npv of a new investment project quickly and freely with this npv. Establish a series of cash flows (must be in consecutive cells). Web microsoft excel already provide a tool to calculate this npv where you can use it directly. Here is a screenshot of the. Net present value is calculated using. Web this gives you the total present value of expected cash flows. Let’s say that you have the following cash flow data (in column c). Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. And in this spreadsheet, this calculation is used to. Let’s say that you have the following cash flow data (in column c). Type “=npv (“ and select the discount rate “,”. Description calculates the net present value of an investment by using a discount rate. First, we have to calculate the present value the output will be: Rate → the appropriate discount rate based on the riskiness and potential. Description calculates the net present value of an investment by using a discount rate. Let’s say that you have the following cash flow data (in column c). Web this gives you the total present value of expected cash flows. Calculate net present value of a project. Subtract the total present value of cash flows from the present value of the. In simple terms, npv can be defined as the. Obtain the npv of a new investment project quickly and freely with this npv. Web net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. Web this net present value template helps you calculate net present value. Web conveniently calculate net present value with our instant npv calculator. Npv (net present value) is a financial formula used to discount future cash flows. Web learn how to calculate npv (net present value) using excel. Here is a screenshot of the net present. Web =xnpv (rate, values, dates) where: In cells c3:c8, we have the future. Set a discount rate in a cell. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web the net present value of the business calculated through excel npv function is. Web learn how to calculate npv (net present. Web conveniently calculate net present value with our instant npv calculator. The calculation is performed to find. Similarly, we have to calculate it for other values. In cells c3:c8, we have the future. Set a discount rate in a cell. Obtain the npv of a new investment project quickly and freely with this npv. Description calculates the net present value of an investment by using a discount rate. Uniform (a) gradient (g) you can delete, copy,. And in this spreadsheet, this calculation is used to compare three different projects or. Rate → the appropriate discount rate based on the riskiness. Let’s calculate the net present value. And in this spreadsheet, this calculation is used to compare three different projects or. Use this online calculator to easily calculate the npv (net present value) of an investment based on the initial investment, discount rate and investment term. Similarly, we have to calculate it for other values. In cells c3:c8, we have the. Calculate net present value of a project. Web npv and irr calculator excel template rated 4.62 out of 5 based on 13 customer ratings 4.62 ( 13 reviews ) professional excel spreadsheet to calculate npv & irr. Web the net present value of the business calculated through excel npv function is. Subtract the total present value of cash flows from the present value of the initial investment. Rate → the appropriate discount rate based on the riskiness and potential returns of the cash flows values → the array of cash flows, with. Npv (net present value) is a financial formula used to discount future cash flows. Uniform (a) gradient (g) you can delete, copy,. Type “=npv (“ and select the discount rate “,”. In simple terms, npv can be defined as the. Web this article describes the formula syntax and usage of the npv function in microsoft excel. Here is a screenshot of the net present. Set a discount rate in a cell. Where n is the number of. Let’s calculate the net present value. Let’s say that you have the following cash flow data (in column c). Web this gives you the total present value of expected cash flows. Similarly, we have to calculate it for other values. Use this online calculator to easily calculate the npv (net present value) of an investment based on the initial investment, discount rate and investment term. Web learn how to calculate npv (net present value) using excel. Description calculates the net present value of an investment by using a discount rate.NPV Calculator Template Free NPV & IRR Calculator Excel Template

Professional Net Present Value Calculator Excel Template Excel TMP

Net Present Value Calculator Excel Templates

Npv Calculator Excel Template SampleTemplatess SampleTemplatess

NPV Calculator Template Free NPV & IRR Calculator Excel Template

8 Npv Calculator Excel Template Excel Templates

Download free Excel examples

NPV Calculator Template Free NPV & IRR Calculator Excel Template

NPV IRR Calculator Excel Template IRR Excel Spreadsheet

10 Npv Irr Excel Template Excel Templates

Related Post: