Real Estate Discounted Cash Flow Model Excel Template

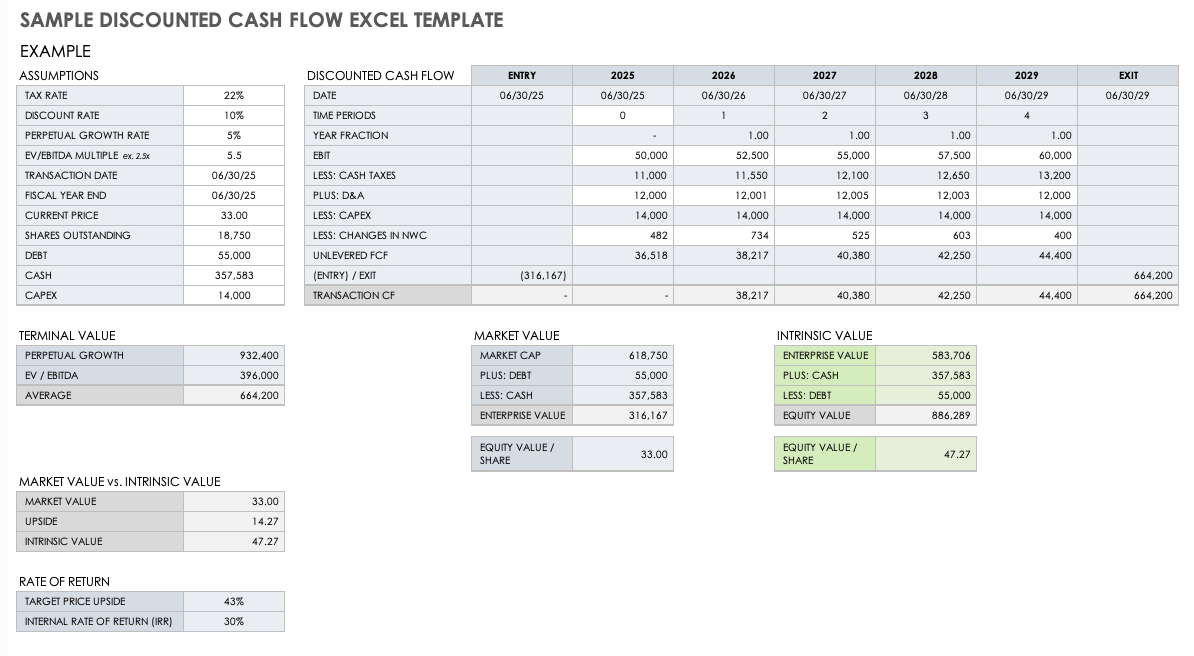

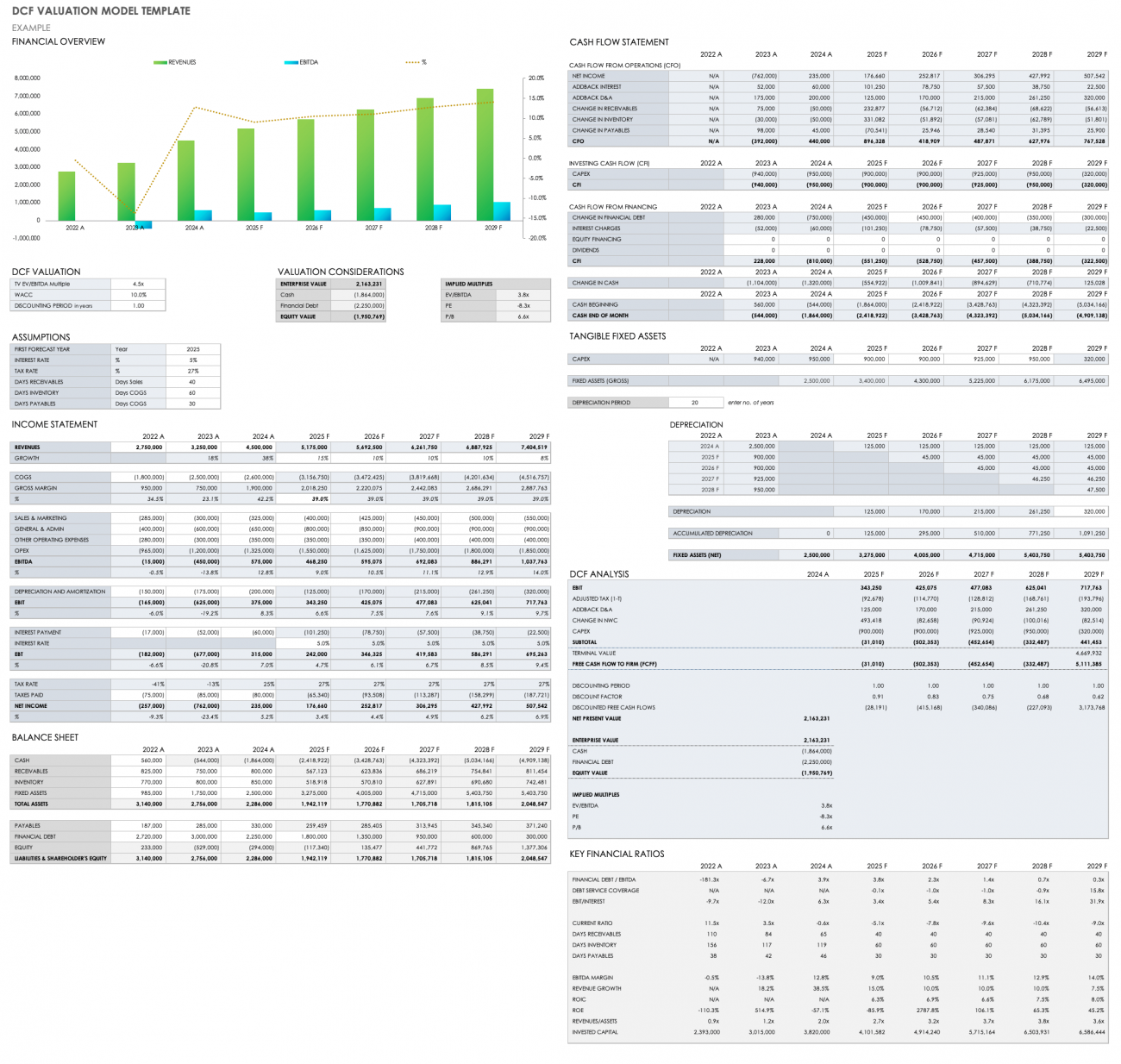

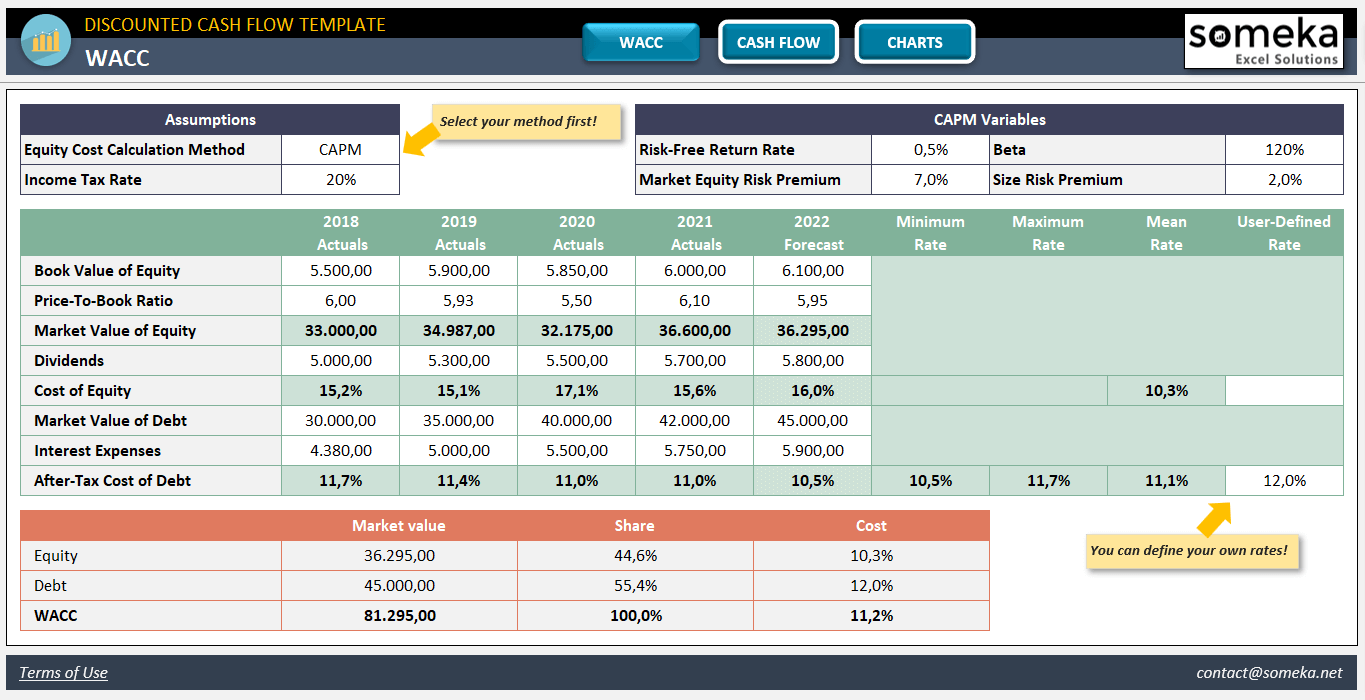

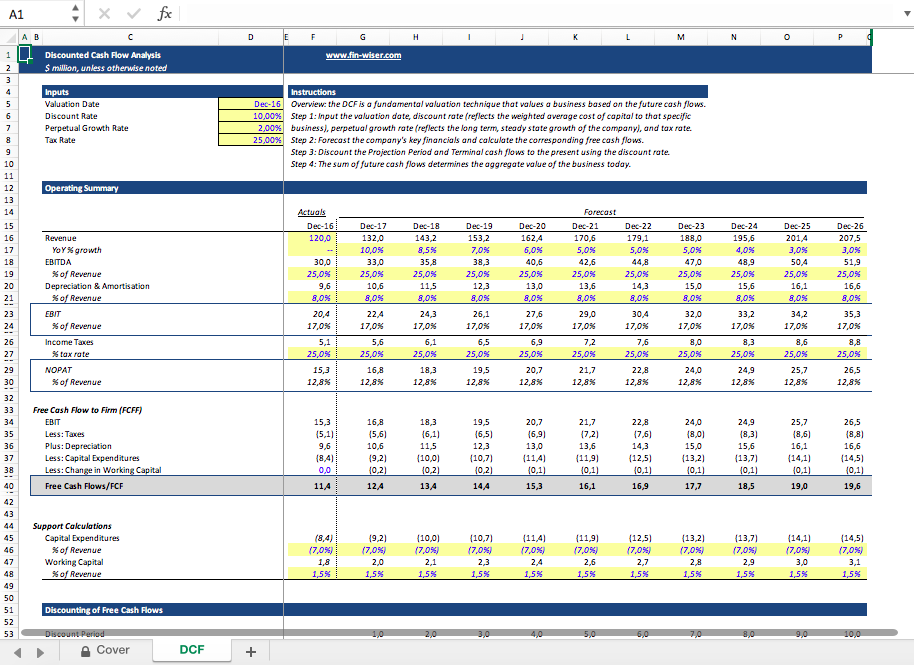

Real Estate Discounted Cash Flow Model Excel Template - Web discounted cash flow valuation model: Web all models are built in microsoft excel 2013 or newer. Dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called the net present value (npv). It comes complete with an example of a dcf model so even. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Download wso's free discounted cash flow (dcf) model template below! In the “year” column, list the years of the projected cash flows. What is discounted cash flow? Web washington real estate investment trust (wre) dcf excel template main parts of the financial model: Web our discounted cash flow template in excel will help you to determine the value of the investment and calculate how much it will be in the future. How do you calculate discounted cash flows?. It is basically based on methods that will determine how much money the. Admittedly, determining the discount rate —a. Web washington real estate investment trust (wre) dcf excel template main parts of the financial model: Web discounted cash flow valuation model: How do you calculate discounted cash flows?. Dcfs are widely used in both academia and in practice. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. It can guess the value of an investment based on expected cash flows.in other words, the dcf model tries to predict the value. The procedure is used for real estate valuation and consists of three steps: This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. It computes the perpetuity growth rate implied by the terminal multiple method and vice versa, and sensitizes the analysis over a range of assumed terminal multiples and. What is discounted cash flow? Below is a preview of the dcf model template: 5 year projected financial statements. Web a dcf model is a specific type of financial modeling tool used to value a business. We have built models for virtually every real estate property type (e.g. In the “year” column, list the years of the projected cash flows. Free support & projections review. It is basically based on methods that will determine how much money the. Web all models are built in microsoft excel 2013 or newer. “year”, “cash flow”, “discount rate”, “present value factor”, and “discounted cash flow”. Net present value (npv) the discounted cash flow ( dcf) is often mixed with the concept of net present value ( npv ). Web discounted cash flows allows you to value your holdings today based on cash flows to be generated over the future period. We have built models for virtually every real estate property type (e.g. Dcf stands for. Web discounted cash flow valuation model: This template allows you to build your own discounted cash flow model with different assumptions. These cash flows are then discounted using a discount rate, termed ‘cost of capital,’ to arrive at the present value of investment. It is basically based on methods that will determine how much money the. Below is a preview. Dcf stands for d iscounted c ash f low, so a dcf model is simply a forecast of a company’s unlevered free cash flow discounted back to today’s value, which is called the net present value (npv). Admittedly, determining the discount rate —a. Download wso's free discounted cash flow (dcf) model template below! Dcf models discount expected free cash flows. This template allows you to build your own discounted cash flow model with different assumptions. Web all models are built in microsoft excel 2013 or newer. In the “year” column, list the years of the projected cash flows. It is basically based on methods that will determine how much money the. Web the discounted cash flow model, or “dcf model”,. In brief, the time value of money concept assumes that one dollar in the future is worth less than today’s dollar. We have built models for virtually every real estate property type (e.g. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Net present value (npv) the discounted cash. I have 20 years of experience in project management and business development background, and with the help of my entrepreneurship skills i designed this. Web ms excel has two formulas that can be used to calculate discounted cash flow, which it terms as “npv.” regular npv formula: We have built models for virtually every real estate property type (e.g. The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date. This template allows you to build your own discounted cash flow model with different assumptions. “year”, “cash flow”, “discount rate”, “present value factor”, and “discounted cash flow”. =npv(discount rate, series of cash flows) this formula assumes that all cash flows received are spread over equal time periods, whether years, quarters, months, or otherwise. This dcf model training guide will teach you the basics, step. Admittedly, determining the discount rate —a. These cash flows are then discounted using a discount rate, termed ‘cost of capital,’ to arrive at the present value of investment. What is discounted cash flow? Start by creating a table with the following columns: The macabacus discounted cash flow template implements key concepts and best practices related to dcf modeling. In this article accounts payable template download accounts payable template excel | smartsheet Web discounted cash flow analysis is a technique used in finance and real estate to discount future cash flows back to the present. The discounted free cash flow (dcf) method is a widely accepted valuation method. Web discounted cash flows allows you to value your holdings today based on cash flows to be generated over the future period. Web a dcf model is a specific type of financial modeling tool used to value a business. It is basically based on methods that will determine how much money the. The reason behind discounting the cash flows is that the value of $1 to be earned in the.Free Discounted Cash Flow Templates Smartsheet

How To Use Excel To Calculate Discounted Cash Flow Rate Of Return

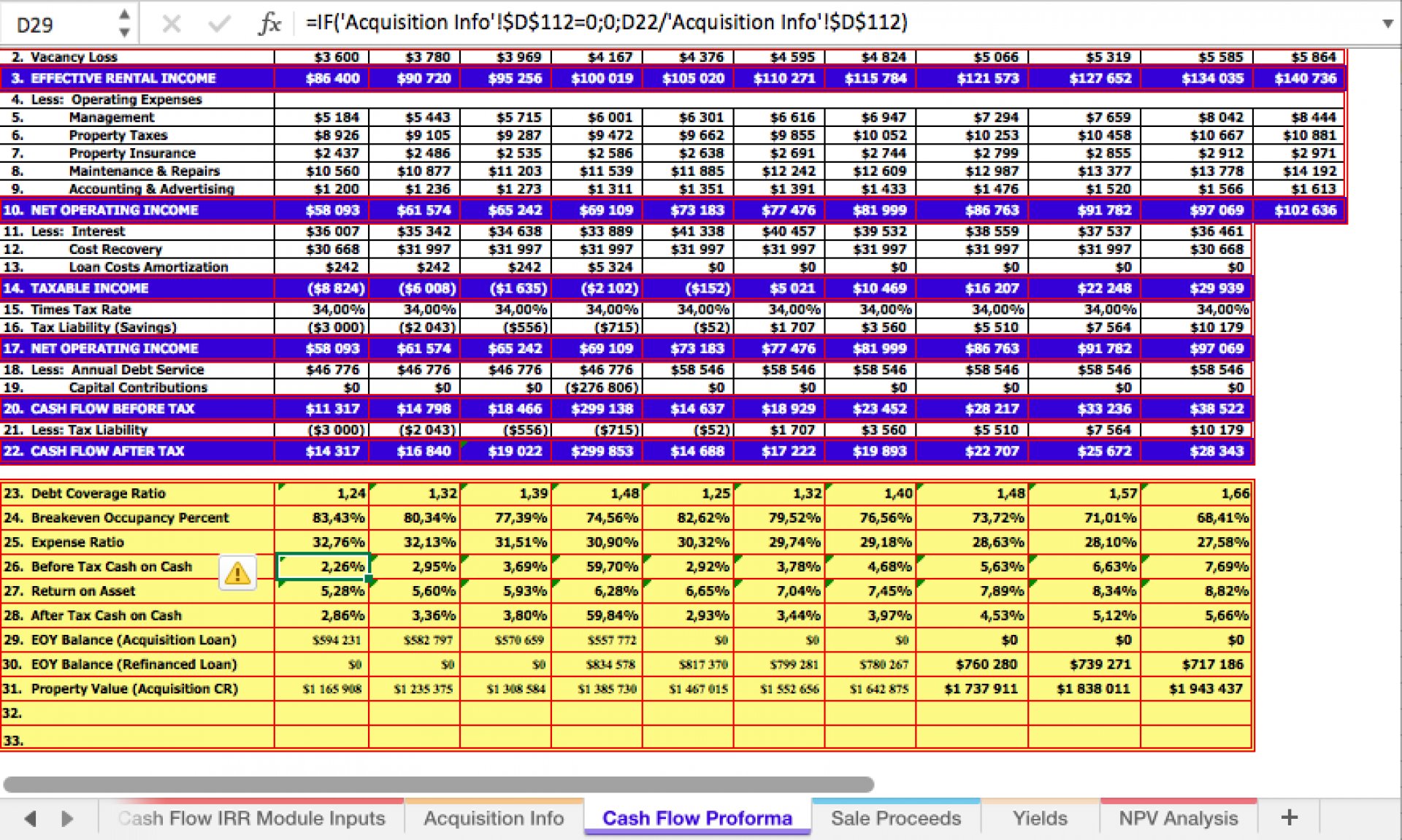

Real Estate Cash Flow Analysis Spreadsheet —

12 Discounted Cash Flow Template Excel Excel Templates Excel Templates

Discounted Cash Flow Excel Template DCF Valuation Template

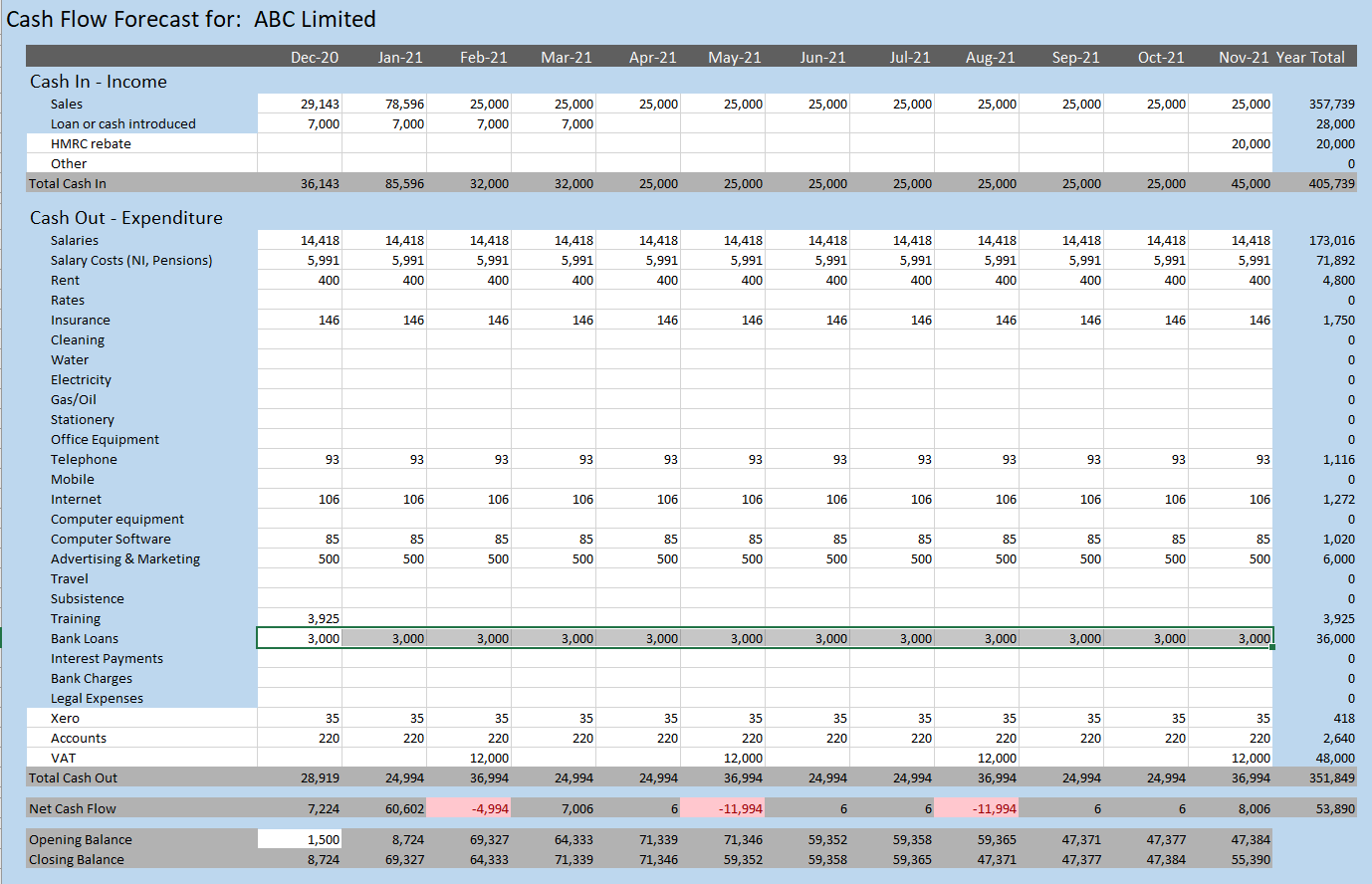

Cash Flow Excel Template Download from Xlteq

Single Sheet DCF (Discounted Cash Flow) Excel Template Eloquens

12 Discounted Cash Flow Template Excel Excel Templates Excel Templates

Excel Discounted Cash Flow (DCF) Analysis Model with IRR and NPV Eloquens

7 Cash Flow Analysis Template Excel Excel Templates

Related Post: